Uniswap Price Prediction: UNI Plunges as Open Interest Craters - What’s Next for the DEX Giant?

Open interest in Uniswap's UNI token just fell off a cliff—and the price followed. Is this a temporary blip or a sign of deeper trouble for the decentralized exchange leader?

The Leverage Liquidation

Traders are bailing. A sharp drop in open interest signals one thing: leveraged positions are getting unwound fast. That's not just paper hands—it's a market reassessing conviction. When the smart money reduces exposure, retail often pays the price.

UNI's Uphill Battle

Without fresh catalysts, UNI faces headwinds. The DEX space is brutally competitive, and governance tokens need constant utility injections to hold value. Protocol revenue alone doesn't cut it when traders chase the next shiny object.

The DeFi Reality Check

Here's the cynical finance jab: in crypto, 'fundamentals' often just mean 'the narrative hasn't broken yet.' Uniswap builds real value, but the token trades on sentiment—and right now, that sentiment is looking for the exit.

Watch for a stabilization in open interest. That's the first sign the bleeding might stop. Until then, expect volatility—and maybe a lesson in why you don't confuse protocol success with token performance.

Market data shows weakening derivatives appetite, while spot metrics point to fading momentum as buyers reassess short-term expectations.

Open Interest Sees Rapid Decline

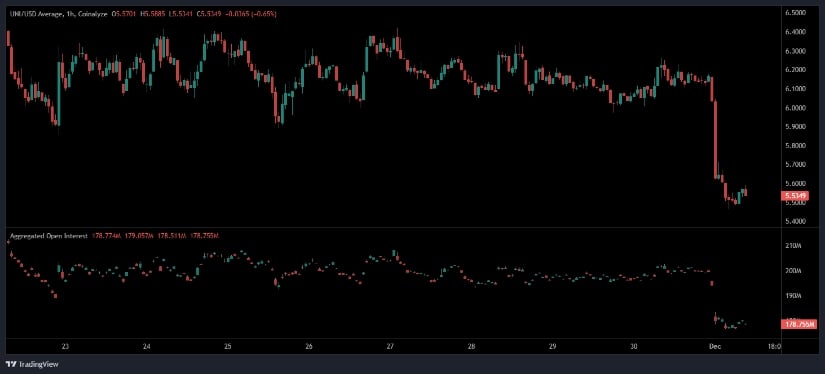

Open interest data across derivatives platforms shows a notable shift in market participation, with a visible contraction accompanying the latest coin price drop. The 1-hour chart indicates price sliding from above $6.20 to nearly $5.50, forming an aggressive sell-side candle that triggered a wave of liquidations.

This drop coincides with aggregated open interest falling toward the $178M region, reflecting reduced Leveraged exposure and signalling cautious sentiment from participants.

Source: Open Interest

The tightening pattern of open interest throughout the week suggested limited conviction ahead of this breakdown, and the sudden unwind confirms that buyers were unwilling to sustain higher positions.

As the coin stabilizes near $5.53 on the intraday timeframe, the muted open interest environment points to low speculative demand and indicates that the token may rely more heavily on spot-driven flows before attempting a recovery. This backdrop sets a restrained tone for the broader uniswap price prediction outlook.

Uniswap Faces Pressure as Data Shows Steady Decline

Market metrics from BraveNewCoin reinforce the cooling momentum surrounding the token. The coin currently trades at $5.51 after a 9.16% decline in the past 24 hours, bringing its market capitalization to USDT3.47B. Trading volume has surged above $424M, suggesting active repositioning from holders as the token enters a high-volatility phase. Despite the increased turnover, the persistent downward trend highlights ongoing supply-side pressure.

The circulating supply stands at 629.89M tokens, placing the token at Rank 43 globally. The price chart shows the token dipping back into a long-standing consolidation zone that previously served as a demand area during mid-year pullbacks.

This positioning creates an important test for the coin price prediction models, as the asset must maintain this region to avoid slipping toward deeper historical support. The corrective structure, paired with the recent volume spike, shows heightened sensitivity among market participants and underscores the importance of the next directional move.

TradingView Indicators Turn Bearish

On the daily chart, the crypto’s technical indicators show momentum weakening further at the time of writing. The MACD histogram has moved deeper into negative territory, with the MACD line below the signal line, an alignment that supports bearish continuation. This momentum loss reflects sustained downside pressure following weeks of lower highs and diminishing buying strength.

Source: TradingView

The Chaikin Money Flow (CMF) remains below zero at 0.31, revealing capital outflows as selling activity outweighs accumulation. Price action has also returned to a descending structure, with the asset struggling to reclaim the USDT6.00 region that once acted as a pivot level. The current candle sits NEAR $5.55, demonstrating limited rebound interest after the earlier sharp decline.

These combined readings paint a cautious technical picture for the Uniswap price prediction, with indicators signalling hesitation from buyers as broader sentiment cools.