Bitcoin Bulls Hold Breath: $82K Support Level Could Determine Next Major Price Movement

Bitcoin stands at critical juncture as $82,000 support line becomes make-or-break threshold

Technical Analysis Breakdown

The world's largest cryptocurrency faces its most significant test since reaching recent highs, with the $82,000 support level emerging as the battleground between bulls and bears. Market sentiment hangs in balance as traders watch for either consolidation or correction patterns to emerge.

Price Action Dynamics

Recent trading sessions show Bitcoin struggling to maintain momentum above key resistance levels. The $82,000 support represents not just a technical level but psychological barrier that could define market direction for weeks to come. Volume patterns suggest institutional players are positioning cautiously around this critical price zone.

Market Implications

A clean break below $82,000 could trigger stop-loss cascades and test lower support around $78,000. Conversely, successful defense of this level might fuel another assault on all-time highs. Either way, traditional finance analysts will likely claim they predicted the outcome—regardless of which way it goes.

The crypto king's next move rests squarely on this crucial technical foundation, proving once again that in digital assets, sometimes the most boring lines on a chart make all the difference.

Understanding how BTC has behaved around similar levels in past cycles can provide insights into potential trajectories.

Understanding the $82K Support

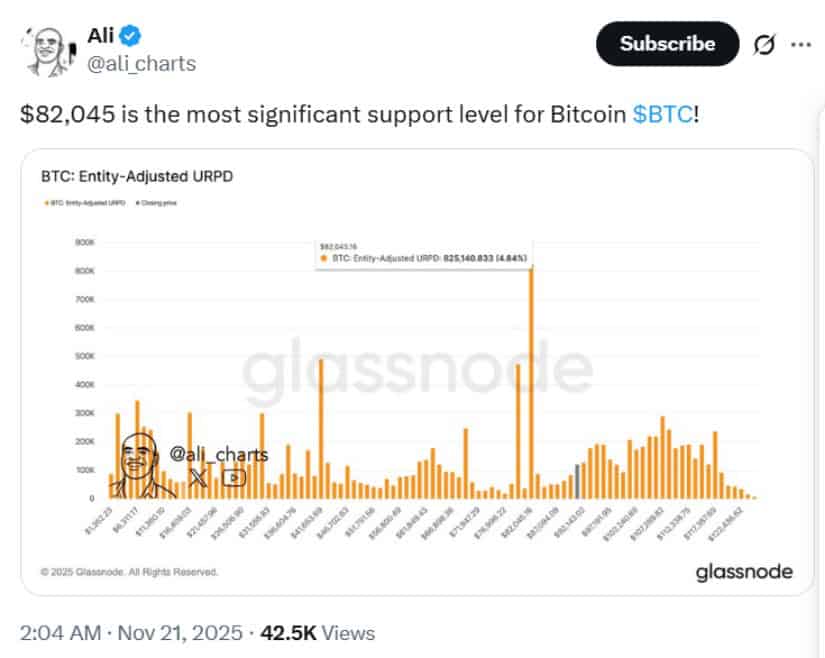

On November 21, 2025, BTC briefly touched $82,045, a zone identified using Glassnode’s entity-adjusted URPL metric. This metric highlights the average cost basis of long-term holders, giving a sense of where strong buying or selling pressure may emerge. In past cycles, price reactions NEAR long-term holder cost bases often acted as decisive support or resistance.

$82,045 represents a critical support level for Bitcoin (BTC), pivotal for its near-term price direction. Source: Ali Martinez via X

Ali Charts, an analyst known for combining on-chain modeling with technical charting, notes that the URPL metric can provide data-driven entry points that complement traditional indicators like moving averages and Fibonacci retracements. BTC currently hovers near $85,000, reflecting short-term volatility but remaining above the key $82K support.

Technical Signals and Market Patterns

Several technical indicators suggest BTC may be at a pivotal juncture:

-

SuperTrend Indicator: The weekly SuperTrend recently flipped bearish near $100,000. Historically, similar signals preceded drawdowns of 50–84% during the 2018 and 2022 corrections. This does not guarantee future outcomes but highlights the importance of monitoring trend shifts.

Bitcoin (BTC) is completing Wave (4) near 80k–83k and may rally toward 100.7K–140.2K in Wave (5). Source: Winlouh on TradingView

-

Elliott Wave Analysis: BTC appears to be completing a corrective Wave (4), with liquidity zones around $80K–$83K. If a Wave (5) forms, targets could range from $100K to $124K. Analysts caution that Elliott Wave projections are probabilistic and should be considered alongside other indicators.

-

Head & Shoulders Pattern: A macro Head & Shoulders formation has been observed, with a left shoulder at $109K, a head at $126K, and a neckline near $75K. Historically, a weekly close below the neckline has increased the probability of extended corrections, though confirming factors such as volume and macro liquidity influence outcomes.

Expert Perspectives with Context

Bitcoin commentary spans a spectrum of views:

-

Bearish Perspective: Market analyst Peter Schiff, known for his skeptical views on cryptocurrencies, warns that BTC’s market-cap-to-gold ratio suggests risk if mining economics deteriorate. While his outlook highlights potential downsides, it represents one framework among many and should not be taken as deterministic.

Exactly—short-term dips are buying opportunities; in 10 years, today’s pullback will barely matter. Source: Kwasi Kwarteng via X

-

Bullish Perspective: Former U.K. Chancellor Kwasi Kwarteng emphasizes a long-term view, suggesting current dips offer accumulation opportunities. Investor Mike Alfred projects potential upside to $150K–$200K in a future bullish cycle, noting historical cycles where BTC rebounded strongly after significant corrections.

Short-Term Scenarios

Analysts outline two primary scenarios, with contextual caveats:

A bounce at $75K: BTC maintains support, completing the right shoulder of the Head & Shoulders pattern. Historical patterns show that rebounds from key liquidity zones can trigger rallies to intermediate resistance levels ($100K–$115K). Traders should still monitor volume and macro factors to gauge sustainability.

Breakdown Below $75K: A decisive close below $75K could increase the probability of a deeper retracement toward $30K–$35K, similar to past bear market cycles. However, the outcome depends on confirming indicators such as ETF inflows, on-chain momentum, and global risk sentiment.

Additional resistance levels in a potential rebound include $88K–$90K and $100K–$105K, with $126K as the ultimate head-level barrier.

Key Takeaways for Investors

-

Critical Support: $75,000—historically a decisive level for bulls.

-

Secondary Support: $60K–$65K—aligns with 50% retracement zones from prior cycles.

-

Potential Bearish Target: $30K–$35K—if key support fails, based on historical patterns.

-

Upside Targets if Bounce Occurs: $100K–$115K, with potential toward $124K if broader momentum shifts.

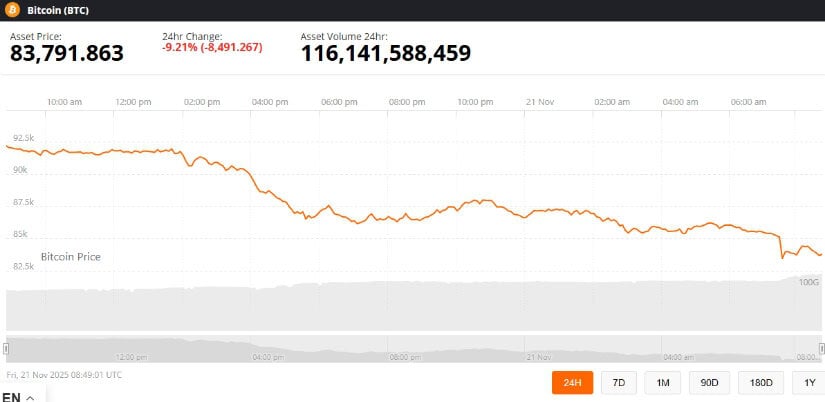

Bitcoin was trading at around 83,791.86, down 9.21% in the last 24 hours at press time. Source: Bitcoin price via Brave New Coin

BTC remains at a pivotal point where both technical patterns and macro drivers intersect. Investors are advised to combine trend analysis, on-chain data, and macro awareness when evaluating positions, keeping in mind that all projections carry inherent uncertainty.