🚀 XRP Price Prediction: EZRP ETF Launch Sparks Bullish Rally—$2.40–$2.70 Target in Sight

XRP is flashing breakout signals as institutional interest surges with the EZRP ETF launch. Analysts see a clear path to $2.40–$2.70 if bulls hold momentum.

Key drivers:

- First XRP-focused ETF (EZRP) fuels market structure shift

- Whale accumulation patterns mirror 2021 bull run precursors

- Ripple's legal clarity acting as tailwind after years of uncertainty

Market skeptics warn ETF hype might be masking typical crypto volatility—remember when 'institutional adoption' was just a PowerPoint slide? But trading volumes don't lie: $XRP is back on the big boards.

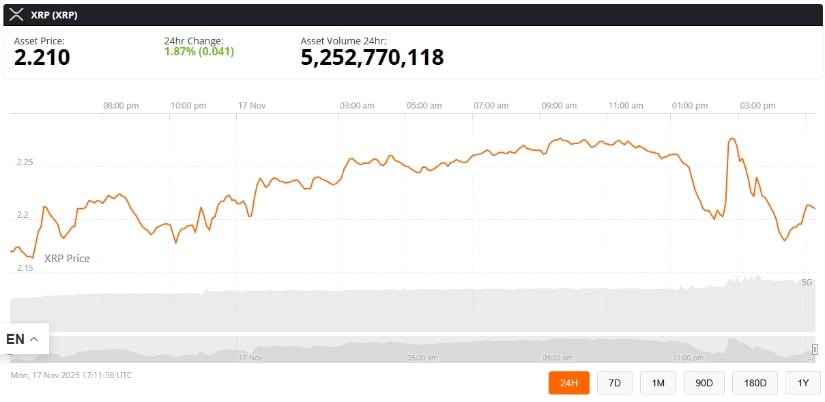

Trading around $2.21, the xrp price today is holding firmly above the critical $2.15 support level—an area analysts say could trigger a bullish continuation toward the $2.40–$2.70 range if defended. With multiple XRP ETFs rolling out, rising XRP Ledger activity, and renewed confidence following recent regulatory clarity, market sentiment is shifting toward a stronger medium-term outlook for Ripple’s native asset.

XRP Price Today: Market Overview

XRP is trading near $2.21, up 1.87% over the past 24 hours, with daily trading volume above $5.25 billion, according to the latest XRP price chart readings. The XRP market cap remains strong as the asset consolidates above key support zones, supported by institutional flows and rising activity on the XRP Ledger.

XRP’s $2.15 support level is crucial, with potential to climb to $2.40–$2.70 if maintained. Source: @ali_charts via X

Market analyst Ali (@ali_charts), known for on-chain technical assessments, highlighted the importance of the current support region, stating, “$2.15 is the line in the SAND for XRP. Hold it, and a move to $2.40–$2.70 becomes likely.”

His view is based on XRP’s repeated defense of the support range on the 1-hour chart, where price has stabilized during earlier periods of volatility. The XRP price today remains resilient following a 21% rally tied to the first XRP spot ETF launched on November 13, helping create a constructive short-term environment despite broader market pullbacks.

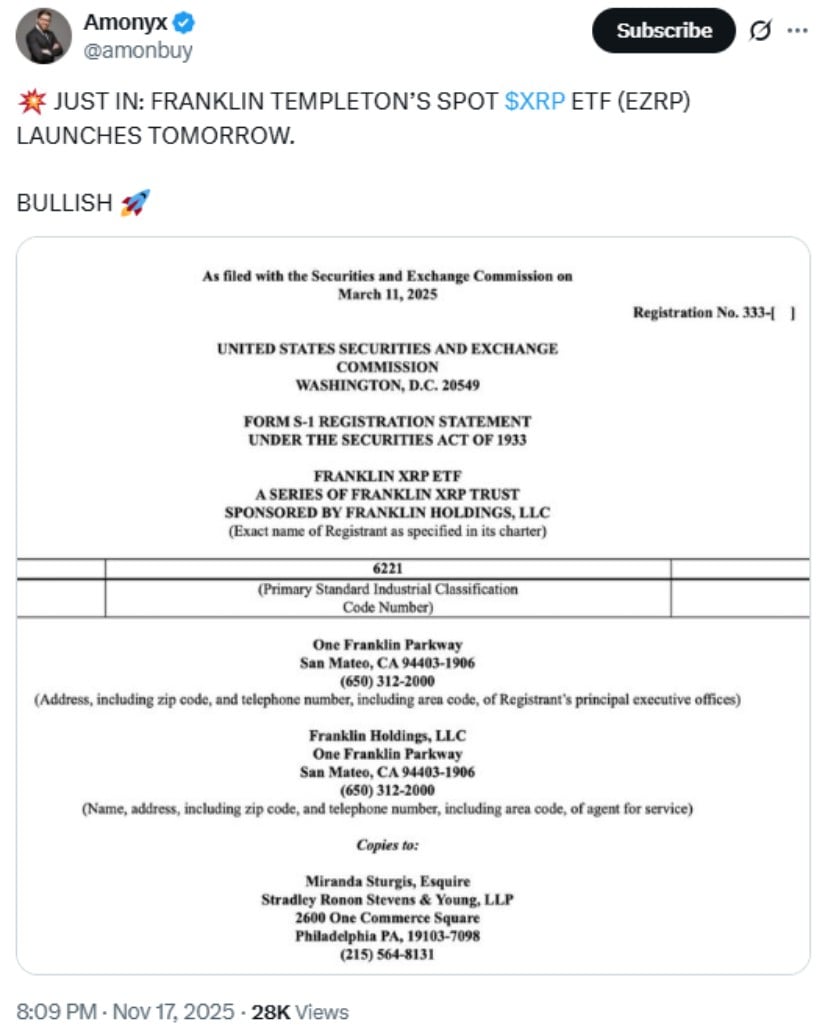

XRP ETF Inflows Impact

Attention is now turning to the upcoming launch of Franklin Templeton’s Spot XRP ETF (EZRP) on November 18, 2025. Analyst Amonyx (@amonbuy) shared the scheduled launch publicly, observing that Franklin Templeton’s involvement adds legitimacy due to the firm’s long institutional track record.

Franklin Templeton’s Spot XRP ETF (EZRP) is set to launch tomorrow, signaling bullish momentum. Source: @amonbuy via X

This follows Canary Capital’s XRP ETF debut on November 13, marking two XRP-focused ETFs within a single week. Community projections on X suggest the EZRP rollout may generate strong inflows, but these early estimates are speculative rather than based on formal modeling. Historically, inflows into new digital-asset ETFs depend heavily on liquidity conditions, macro sentiment, and overall market risk appetite.

As of November 17, XRP trades around $2.20, reflecting a 7% cooling from recent highs. Analysts note that ETF-driven accumulation may help stabilize price, but short-term risks remain—such as periodic whale distribution, varying liquidity depending on session hours, and the arrival of more ETF products from Bitwise, 21Shares, and others through November 25.

Meanwhile, the Ripple vs. SEC legal backdrop still influences investor expectations. Although no new filings emerged this week, earlier rulings—especially Judge Torres’ clarification differentiating institutional versus secondary-market XRP transactions—continue to shape the regulatory narrative.

Ripple SEC Case Update

The Ripple–SEC case saw no major developments this week, yet it remains relevant to XRP news today. Regulatory clarity matters even more as XRP enters deeper institutional territory with additional ETF approvals underway. Analysts note that smooth ETF progression signals improved comfort among regulators with XRP’s market behavior, but unresolved aspects of the lawsuit mean further volatility cannot be ruled out.

Ripple’s partnerships and rising XRP Ledger transaction volume continue to strengthen underlying fundamentals. Still, any new motions or rulings could influence the medium-term XRP price prediction outlook.

Technical Analysis: Key Support and Resistance Levels

Technical analyst TradeCityPro, known for volume-profile and liquidity-structure studies, highlights XRP’s strong position as the 4th largest crypto, with a market cap of roughly $136.74 billion.

XRP tests key $2.1843 support, with potential resistance at $2.34–$2.67 as volume remains low. Source: tradecitypro on TradingView

On the 4-hour chart, XRP is testing a critical support zone at $2.1843, a level aligned with high-volume nodes. He identifies the following levels:

-

Resistance: $2.3404

-

Next resistance: $2.5508

-

Trend confirmation zone: $2.6718

-

Primary support: $2.1843

-

Deeper support: $2.0013

Breakouts historically require a clear rise in buy-side volume. A failure to defend $2.18 could invite additional correction.

Final Thoughts

XRP is approaching a pivotal point with the launch of Franklin Templeton’s EZRP spot ETF, a development that stands to influence both liquidity and institutional participation. Maintaining the $2.15–$2.18 support area remains critical for keeping momentum toward the $2.40–$2.70 target identified by several technical analysts.

XRP was trading at around 2.21, up 1.87% in the last 24 hours at press time. Source: XRP price via Brave New Coin

While the broader outlook appears more constructive than in recent months—due to ETF demand, Ripple’s expanding ecosystem, and growing on-chain activity—analysts emphasize the importance of balancing Optimism with realistic risk evaluation. Factors such as liquidity shifts, regulatory updates, and asset-specific volatility remain central considerations.