Dogecoin Price Prediction: DOGE Defends $16 Support – Breakout Imminent?

Dogecoin bulls dig in as DOGE holds critical $16 support level. Chart patterns suggest a potential explosive move—but will the 'people's crypto' deliver?

Technical analysts point to a tightening wedge formation, historically a precursor to volatility. Meanwhile, traders watch Bitcoin's momentum for cues—because in crypto-land, even meme coins follow the king.

Remember: This is the same asset that turned 'to the moon' from a joke into a $88B market cap. Now institutional wallets are accumulating DOGE—proving Wall Street will monetize even the dankest memes.

Despite trading well below its May 2021 peak of $0.73, DOGE sits at a critical juncture where market structure, volume patterns, and broader crypto sentiment could determine whether the coin resumes an upward trajectory or continues its consolidation phase. This analysis explores near-term technical indicators, medium-term forecasts, and contextual factors influencing DOGE’s outlook.

Technical Overview: DOGE Approaches a Critical Inflection Level

Based on data from TradingView (as of the latest daily close), Dogecoin trades near $0.16, resting just below a cluster of short- and medium-term resistance levels. These are the primary indicators shaping market sentiment:

-

SMA 20: $0.17 — near-term resistance.

-

SMA 50: $0.20 — medium-term resistance.

-

SMA 200: $0.21 — long-term trend marker.

-

RSI: 38.71 — neutral-to-weak momentum positioning.

-

MACD histogram: 0.0000 — early bullish inflection attempt.

-

24-hour volume: ~$179.6 million—consistent with typical liquidity conditions.

From an experience perspective, Doge has historically shown stronger reactions to volume expansion and retail-driven momentum than to gradual trend-line shifts. This is why analysts closely monitor breaks above short-term moving averages: in previous cycles, DOGE often required both price confirmation and sentiment acceleration before sustaining rallies.

Dogecoin is expected to remain in a downtrend next month, potentially targeting $0.039 before any meaningful bullish reversal. Source: mpd on TradingView

Bollinger Bands currently place DOGE in the lower range of its volatility envelope—an area that has commonly preceded short-term rebounds, though historically these rebounds only sustained when Bitcoin’s trend structure was supportive.

A decisive break above $0.17 remains the primary trigger for a continuation signal. Conversely, losing $0.15 WOULD weaken the structure and expose DOGE to deeper liquidity pockets near $0.10.

Bullish Setup: What a Structured Recovery Would Require

A bullish scenario remains plausible, yet it requires validation rather than assumption. A structured upside MOVE would typically unfold in phases:

Break above $0.17: Historically necessary for triggering momentum algorithms and retail inflows.

Advance toward $0.185: Aligns with algorithmic price projections and represents the first mid-range target.

Test and break the $0.20–$0.25 zone: This region includes major moving averages and liquidity resistance. A close above this zone would signal a broader trend shift.

Technical confirmation for sustained upside would require:

-

RSI moving above 50.

-

MACD turning positive.

-

Increasing volume, especially during green candles—something DOGE requires more than most altcoins due to its high supply and sentiment-driven trading patterns.

Dogecoin has undergone an unusually long four-year contraction since 2020, with analysts projecting that the altcoin’s expansion phase is likely to begin in early 2026. Source: EquityGiant on TradingView

Bearish Risks: Scenarios That Could Invalidate the Bullish Thesis

An equally probable risk scenario must be acknowledged. A failure to hold $0.15 would reflect weakening market participation. Historically, such breakdowns often coincide with:

-

Bitcoin is losing key support.

-

Liquidity is thinning across meme-coin markets.

-

RSI dipping into oversold territory.

-

Divergence between MACD momentum and price action.

Under these conditions, DOGE could revisit $0.10, a level reinforced by previous consolidation phases and long-standing demand zones.

Long-Term Perspective: 2025 and Beyond

DOGE has been in a multi-year contraction phase since 2021, a common pattern among high-volatility altcoins. Many analysts believe 2025 could mark the final compression year before a broader liquidity expansion cycle potentially begins in 2026.

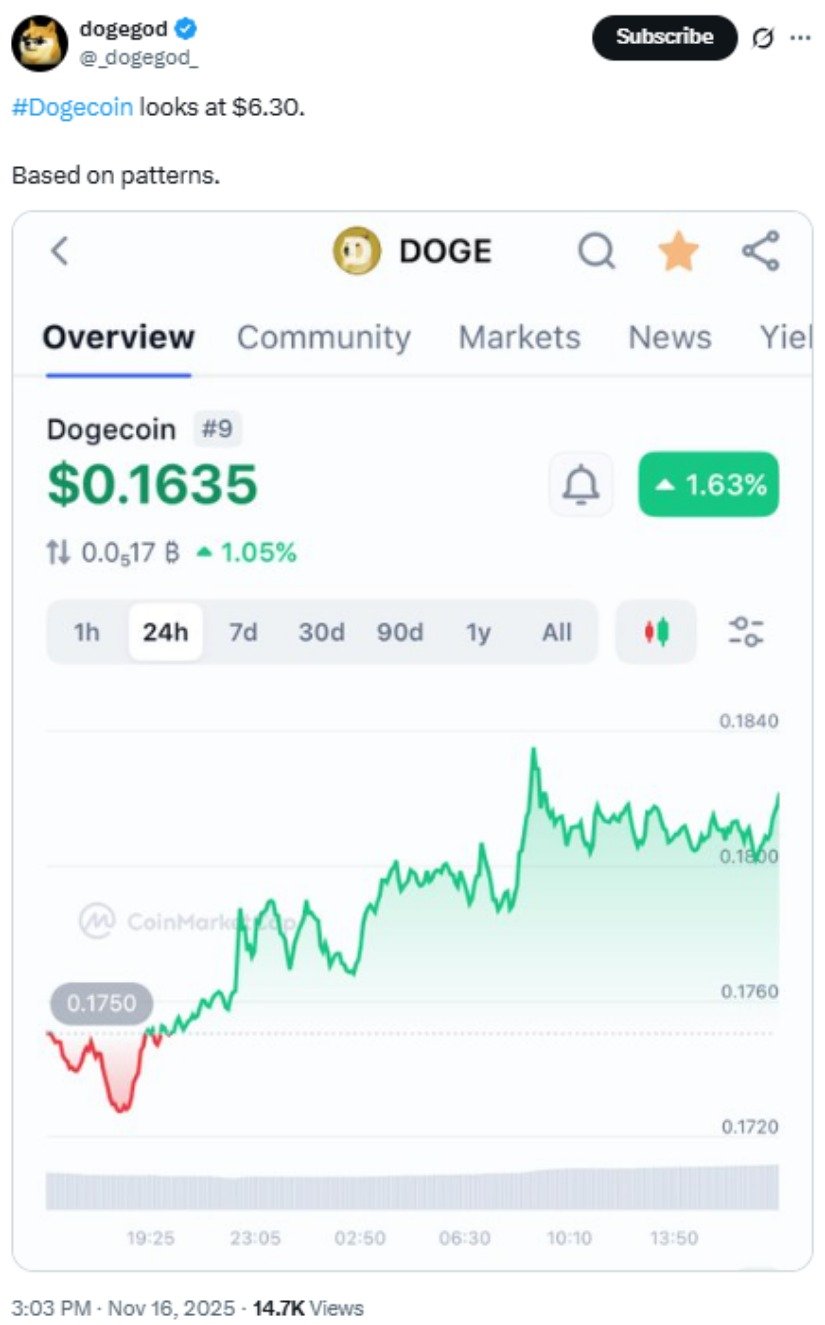

Based on chart patterns, dogecoin is being eyed for a potential target of $6.30. Source: @_dogegod_ via X

Highly speculative claims—especially multi-dollar meme-coin forecasts—should be treated cautiously. These projections carry significant uncertainty, relying heavily on macro risk appetite, liquidity cycles, and DOGE’s unique dependency on community engagement.

Final Thoughts

Dogecoin’s near-term outlook remains cautiously optimistic, with technical indicators hinting at a possible bullish shift if key resistance levels are overcome. A confirmed move above $0.17 would strengthen the case for an advance toward $0.185–$0.25, though broader market conditions—particularly Bitcoin’s direction—will play a major role.

At the same time, risks remain significant. Losing $0.15 could shift momentum toward the deeper support zone around $0.10.

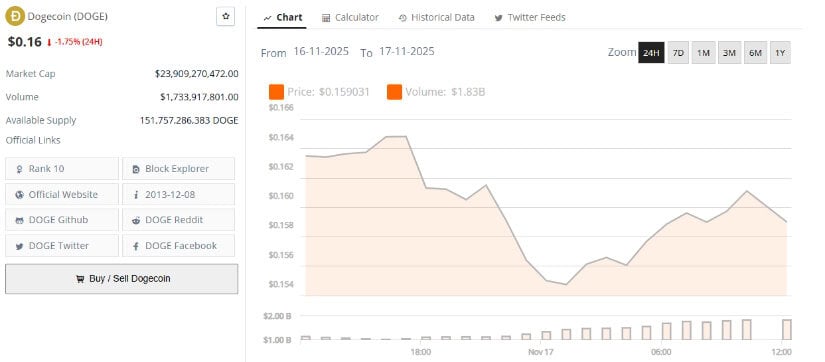

Doge was trading at around $0.16, down 1.75% in the last 24 hours. Source: Brave New Coin

As always, market participants should monitor RSI, MACD, volume behavior, and correlation with Bitcoin to evaluate whether a breakout is developing or whether the structure is weakening. With sentiment-driven assets like DOGE, both upside potential and downside risk can emerge quickly, making transparency and cautious interpretation essential.