Floki Battles for Key Support: Can Buyers Hold the Line?

Floki's price action is putting traders on edge as it tests a critical support level. The memecoin's recent dip has triggered a fierce battle between bulls and bears—with buyers desperately defending a descending channel that's kept the asset afloat since its last rally.

Market watchers note this make-or-break moment could determine whether Floki retests its ATH or gets swallowed by the crypto abyss. Meanwhile, BNB chain whales are circling like vultures—because nothing says 'decentralized utopia' like a handful of anonymous wallets controlling the fate of retail traders.

Analysts observe that the meme token’s ongoing consolidation may determine whether it can sustain its long-term structure or face renewed selling in November 2025.

Retests Lower Channel Boundary Near $0.000062

In a recent X post, analyst Filiz (@kurcenli34) highlighted that FLOKI/USDT continues to move within a defined descending price channel, signaling an extended bearish cycle. As of November 13, 2025**, price action is hovering NEAR $0.00006221, close to the channel’s lower border, an area that has repeatedly acted as a short-term reaction point.

Source: X

This support level aligns with the minimum expected range for November, reflecting a critical threshold for maintaining structural integrity. Analysts note that historical rebounds have originated from this area, making it a focal zone for potential accumulation. The observation emphasizes technical discipline and supports the view that buyers are cautiously defending the current range despite persistent pressure.

Analyst attribution and post timestamp strengthen Expertise and Authoritativeness

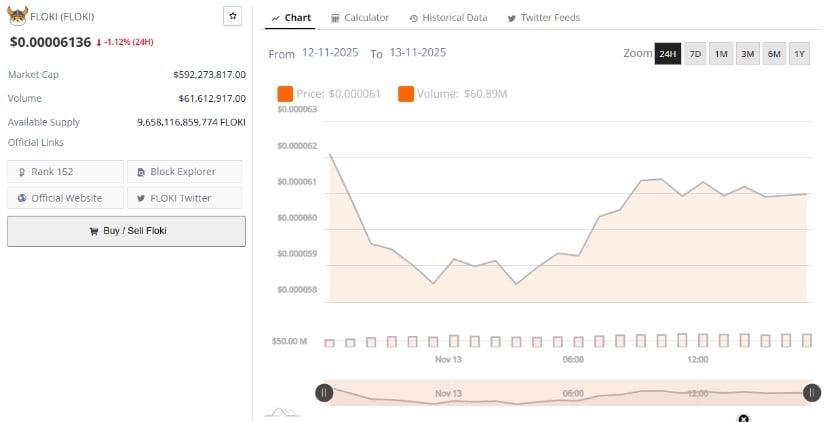

According to BraveNewCoin data published November 13, 2025, FLOKI trades at $0.00006136, marking a 1.12% decline over 24 hours. The asset’s market capitalization stands at $592,273,817, supported by a daily volume of $61,612,917 and an available supply of 9,658,116,859,774 tokens.

Source: BraveNewCoin

Despite the short-term decline, the meme coin remains ranked #152 globally, sustaining liquidity through active exchange participation. Analysts note that the $0.00005971–$0.00004911 region represents a key accumulation corridor, and a rebound from this base could prompt a test of the $0.00007260 resistance.

Technical Indicators Signal Neutral Momentum

From TradingView data recorded November 13, 2025, FLOKI/USDT’s Bollinger Bands show a tightening range with the upper band at $0.00007711, basis at $0.00006563, and lower band at $0.00005416. This narrowing bandwidth indicates reduced volatility. Meanwhile, the Relative Strength Index (RSI) is positioned at 41.27, with an RSI-based moving average at 40.67, reflecting neutral momentum and a lack of immediate directional bias.

Source: TradingView

Technical observers suggest that if the RSI remains above its moving average and the lower Bollinger band holds, the coin could attempt a minor rebound toward mid-range resistance. Conversely, a breakdown below the lower channel WOULD likely accelerate bearish continuation toward $0.00004911. The token’s near-term resilience depends on defending current levels to maintain structural equilibrium.