Cardano Price Prediction: ADA Primed for Explosive Rally as $0.50 Support Holds Strong

Cardano (ADA) traders are betting big on a trend reversal as the cryptocurrency finds solid footing above $0.50—a level that's now sparking bullish momentum across derivatives markets.

Why this support matters: The $0.50 psychological barrier has flipped from resistance to support three times this quarter, creating a textbook springboard for upside. Whale accumulation patterns suggest institutional players are positioning for a breakout.

Market irony alert: While retail traders panic-sold during last week's 12% dip, hedge funds quietly loaded up on ADA futures—proving once again that the 'dumb money' often feeds the smart money's profits.

Technical outlook: A decisive close above $0.55 would confirm the reversal, potentially triggering a 30-40% surge toward Q4 targets. But with Bitcoin's dominance wavering, ADA might just become the altcoin leader this cycle deserves.

A surge of quiet accumulation is starting to surface around Cardano’s $0.50 zone, where price action has repeatedly attracted long-term holders. The stability at this level is drawing fresh optimism, with several participants noting early signs of reversal momentum.

Cardano Price Attempts Reversal Around the $0.50 Support

Cardano appears to be approaching a potential bullish reversal as price tests the descending trendline that has capped every rally since early 2024. The chart shared by Rand shows ADA Cardano price is forming a possible base around the $0.50 region. A confirmed push above resistance could now flip market sentiment from bearish to bullish.

ADA holds steady NEAR the $0.50 zone, signaling potential accumulation as traders watch for a breakout confirmation. Source: Rand via X

The key support remains around $0.53 to $0.50, a region that has repeatedly held through prior shakeouts. If the structure holds and volume begins to expand, cardano price could be gearing up for a mid-cycle reversal, setting the stage for higher highs over the coming days.

ADA Targets Point Towards a Larger Upside Setup

Waleed Ahmed’s broader timeframe analysis suggests that ADA’s long-term structure remains intact within a massive accumulation box. The range between $0.59 and $0.62 continues to serve as a consolidation base, while the upper boundary near $3.10 represents the major cycle top where price could head next.

Cardano price continues to trade within a broad accumulation range, hinting at a potential long-term breakout towards the $3.00 cycle top. Source: Waleed Ahmed via X

If ADA can hold its mid-range support and break above $0.80–$1.00, it could initiate a multi-month rally similar to past expansion cycles. This accumulation behavior, visible in the weekly structure, implies that Cardano price may be preparing for a strong macro move if broader market momentum aligns.

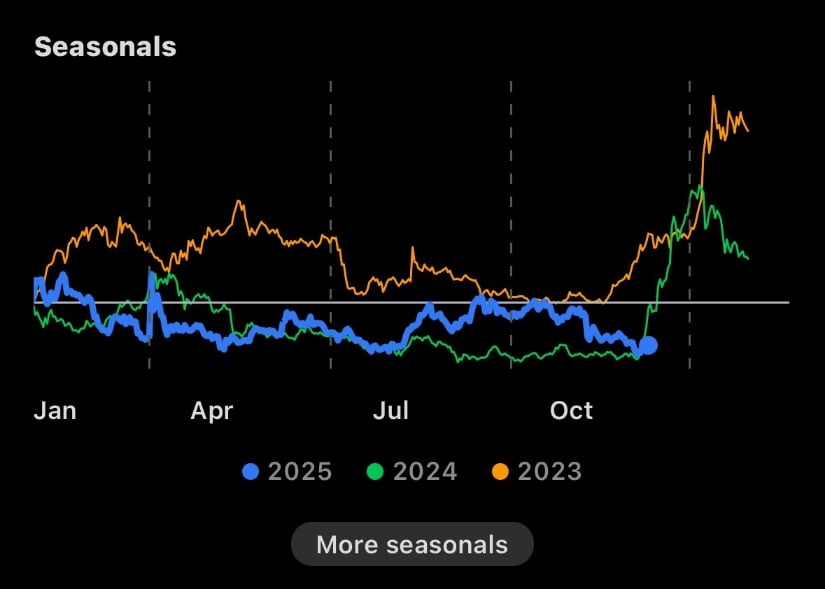

Seasonal Trends Hint at Breakout Potential

The DApp Analyst’s seasonal data adds weight to the bullish outlook, showing that ADA has spent nearly a year consolidating within the $0.50–$1.30 range. Historically, such long periods of compression have preceded strong expansions in prior cycles.

ADA nears a Q4 breakout as seasonal data signals a potential end to its year-long consolidation. Source: The DApp Analyst via X

As seasonal trends align, the historical performance charts for 2023 and 2024 suggest that ADA typically sees acceleration in late Q4, followed by sustained strength through Q1. If this pattern repeats, ADA could soon see the long-awaited breakout, positioning it for a more decisive trend shift into 2026.

Short-Term View: Indicators Turning Bullish

Cardano is currently testing the lower boundary of its trading band as noted by Trend Rider’s setup. The chart highlights a key threshold at $0.70, which needs to be reclaimed to confirm short-term trend reversal. ADA is hovering near the 0.59 support, resting on the lower edge of the RiderAlgo band, a level that has previously triggered bullish rebounds.

Cardano price tests key support near $0.59, with indicators hinting at a possible short-term bullish reversal. Source: Trend Rider via X

Momentum indicators show exhaustion among sellers, while price remains compressed under the VWAP and EMA cluster. A breakout above $0.64 to $0.70 could flip local structure back to bullish, targeting the $0.85 to $0.90 zone in the near term.

Final Thoughts

Cardano’s chart structure continues to mature as price repeatedly defends its key supports while forming higher lows on longer timeframes. Technical alignment across multiple market watchers pointing towards a growing possibility of reversal, with confluence around the $0.65–$0.70 zone acting as the pivot for confirmation.

If ADA sustains momentum above that resistance, the path toward $1.00 and beyond becomes clearer. With seasonal strength approaching and structural compression nearly complete, the next few weeks could be bullish for cardano Price Prediction.