🚀 XRP Price Alert: Double Bottom Reversal Signals Trillion-Dollar Crypto Boom – White House Backs the Bet

XRP's chart just flashed a classic bullish signal—and Washington's whispering about crypto markets growing bigger than Wall Street's wildest dreams.

Technical breakout or political pump? Let's dive in.

The Double Bottom That Could Reshape Crypto

XRP's 8-month price floor just formed a near-perfect W pattern—the kind that makes traders cancel weekend plans. Last time this happened in 2023, the coin ripped 300% in 90 days.

Trillions on the Horizon?

The White House's latest economic report casually dropped this bombshell: 'Digital assets could capture 10-15% of global financial flows by 2030.' That's a $12-18 trillion sandbox—if regulators don't bury it in paperwork first.

Funny how politicians discover blockchain's potential during election years.

What's Next for XRP?

Key resistance at $1.20 needs to break. Do that, and we're looking at a clear runway to retest all-time highs. Fail, and well... at least the SEC already took their best shot.

Remember folks: in crypto, every 'revolutionary breakthrough' is just a 20% dip waiting to happen.

At the same time, comments from a U.S. White House official forecasting “tens of trillions” in capital entering crypto have added fuel to the narrative around XRP’s role in real-world finance.

Double Bottom Reversal Pattern Strengthens XRP Outlook

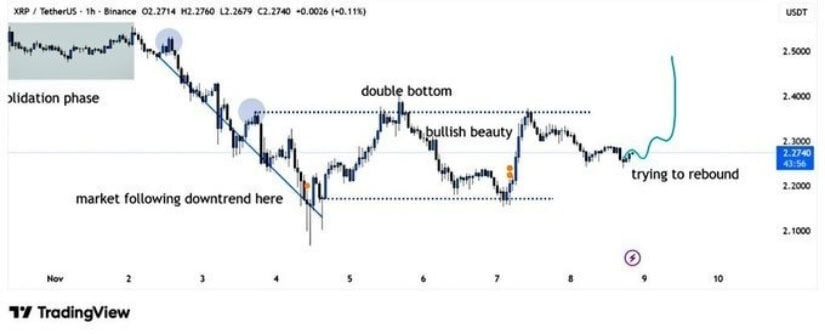

Technical analysts suggest XRP’s recent structure may mark the end of its corrective phase. After weeks of sideways movement, XRP has printed a W-shaped double bottom—a pattern that typically signals the exhaustion of selling pressure and the potential start of a new upward trend.

XRP forms a double bottom NEAR $2.20–$2.25, signaling easing selling pressure and a potential bullish reversal above $2.35. Source: @Maria_1Appe via X

A decisive breakout above the $2.32–$2.35 resistance range could confirm the reversal and target the next resistance levels near $2.60 and $3.00, where momentum traders expect increased buying interest.

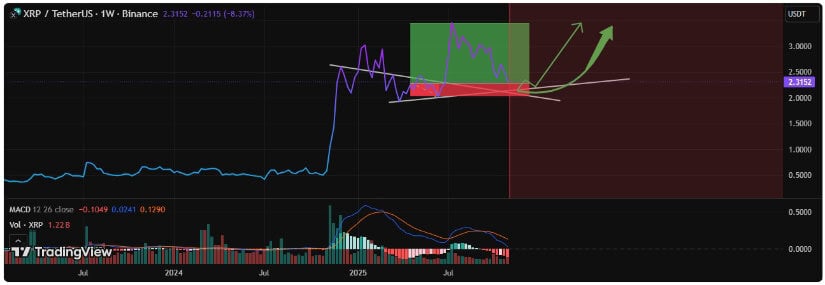

If validated, this structure would reinforce the broader XRP price prediction narrative calling for a midterm rally toward $5.00 and beyond.

White House Official Forecasts “tens of trillions” Flowing into Crypto

At Ripple Swell 2025, Patrick Witt, a U.S. White House representative, offered one of the most striking statements of the year regarding blockchain integration. “You’ll be looking at market caps in the tens of trillions—tied to platforms that integrate into real finance and unlock global efficiency,” he said.

White House official Patrick Witt predicts “tens of trillions” flowing into real-world crypto, spotlighting Ripple’s XRP Ledger at the center of global financial integration. Source: @Xfinancebull via X

While the comment did not specifically name Ripple, the community has pointed out that Ripple’s XRP Ledger (XRPL) is already building the type of real-world infrastructure described.The network is reportedly being integrated with institutional systems such as GTreasury, Hidden Road, Rail Payments Platform, Standard Custody & Trust, Palisade, and Metaco, covering everything from real-time treasury management to tokenized asset custody.

Ripple CEO Brad Garlinghouse echoed the sentiment, stating, “I’m reminding you all that XRP sits at the center of everything Ripple does. Lock in.”

Institutional Integration and Supply Dynamics Drive the Long-Term View

Ripple’s growing institutional partnerships could have far-reaching effects on XRP’s circulating supply. As financial institutions and corporate treasuries increasingly utilize XRPL for cross-border settlements and tokenized assets, analysts expect significant liquidity lockups.

Each transaction on the XRP Ledger incurs a small token burn, gradually reducing total supply over time. Combined with rising institutional usage, this dynamic could lead to what market observers describe as a potential “supply shock” scenario—where reduced availability meets accelerating demand.

Ripple’s strategic push for “custody-as-a-service” also reflects this trend. When banks custody XRP on their balance sheets rather than trade it, they effectively remove liquidity from circulation, reinforcing long-term price stability.

Market Risks Remain Despite the Bullish Structure

Despite the bullish momentum, risks remain. XRP continues to face market volatility and broader macroeconomic pressures impacting the crypto market. Furthermore, ongoing uncertainty surrounding the Ripple vs. SEC case and the potential for future regulatory developments could influence sentiment.

Ripple eyes $3 short-term and $10 long-term as institutional custody demand signals strong upside ahead. Source: leilizamanipour on TradingView

From a technical standpoint, failure to sustain momentum above $2.20 could invalidate the double bottom setup and push the xrp price back toward near-term supports at $2.05 or lower.

However, as long as the structure holds and volume continues to rise, the path of least resistance appears upward.

Final Thoughts

The next few sessions will be critical. A confirmed breakout above the $2.35 neckline could extend XRP’s short-term rally toward $3.00, while on-chain data showing increasing activity on XRPL may provide additional confirmation of network strength.

XRP was trading at around $2.31, up 2.28% in the last 24 hours at press time. Source: XRP price via Brave New Coin

With institutional adoption deepening and the macro narrative shifting toward crypto-based financial infrastructure, XRP’s technical and fundamental outlooks are beginning to align—a combination that could define the next phase of its market cycle.