XRP Price Alert: Will November 2025 Be the Month It Crashes Below $2 or Skyrockets to New ATH?

XRP stands at a critical juncture—bullish momentum could send it soaring, while bearish pressure threatens a plunge below $2.

The crypto’s recent volatility has traders on edge, with some betting on a breakout and others bracing for a collapse.

Will institutional interest push XRP to new heights, or will it become another casualty of crypto’s infamous boom-bust cycle? Only time will tell—but one thing’s certain: the market never fails to keep things 'interesting' for bagholders.

Market watchers are debating whether XRP will stabilize above $2 or suffer a deeper correction before resuming its upward trend.

XRP Price Chart Today: Testing Key Support

After rallying from lows near $0.60 earlier this year, XRP has seen significant gains, climbing above $2.30. On-chain data indicate strong accumulation, including over 21,000 new wallets created in the last 48 hours, signaling growing investor interest. However, the cryptocurrency faces resistance around $2.55–$2.70, where overbought conditions could trigger short-term pullbacks.

The $1.90–$2 range is a key support level for XRP, drawing price stability and possible upward moves. Source: @ali_charts via X

Crypto analyst Ali (@ali_charts) notes, “$1.90–$2 looks like a magnet for XRP. This zone has repeatedly acted as support and could hold during the current pullback.” On the flip side, a breach below $2 could expose XRP to $1.80–$1.90 levels amid broader market weakness.

Whale Activity and Market Sentiment

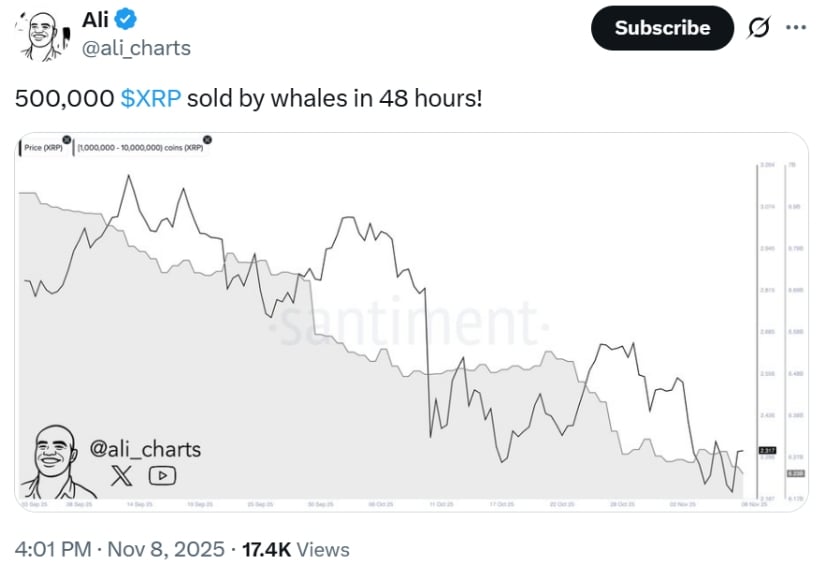

Recent on-chain data show whales distributed 500,000 XRP (~$1.1 million) over 48 hours, coinciding with a temporary 13% drop from $2.7. While some community members dismiss this as minor, it reflects heightened short-term volatility. Despite this, the overall circulating supply remains stable, suggesting potential stabilization above $2.10.

Could xrp price Hit a New All-Time High (ATH) Before the End of the Month? Source: @amonbuy via X

Amonyx (@amonbuy) highlighted the upside potential, posting, “If XRP maintains momentum, a new all-time high above $3.65 could be achievable by November 30.” Analysts warn, though, that resistance at $2.55 and RSI overbought levels could create a 20–30% pullback risk before any major breakout.

Institutional and Regulatory Drivers

Institutional interest remains a key catalyst for XRP. Ripple’s recent strategic moves, including a $500M funding round at a $40B valuation, bolster confidence in the token’s utility for stablecoin custody and payment services. Meanwhile, ETF filings and Ripple-backed initiatives continue to support XRP’s adoption.

Whales Sell 500,000 XRP in 48 Hours, Impacting XRP price and Market Sentiment. Source: @ali_charts via X

However, regulatory outcomes—particularly in the ongoing SEC vs. Ripple case—remain a major uncertainty. A favorable ruling or positive developments could act as a bullish trigger, while setbacks may increase downside pressure.

XRP Price Prediction 2025: Next Moves

If XRP maintains support and benefits from ongoing institutional momentum, analysts suggest it could test $2.80–$3.00+ by year-end. Conversely, a breakdown below key support might see XRP revisiting sub-$2 territory, potentially dropping to $1.70–$1.80.

Traders should watch volume trends, whale activity, and ETF-related announcements closely. Market dynamics over the next few days could decide whether XRP crashes below $2 or soars toward a new all-time high.

Support and Resistance Levels

-

Support: $2.10–$2.20—crucial accumulation zone

-

Resistance: $2.50–$2.70—key technical band with EMA convergence

-

Bearish risk: A drop below $2.10 could target $1.80–$1.90

-

Bullish trigger: Sustained move above $2.75–$2.80 could open the path to $3+

Final Thoughts

For XRP investors, the current market action represents a critical make-or-break moment. The $2.10–$2.20 support zone is key to maintaining bullish momentum, as holding this level could prevent a deeper correction. Traders are closely monitoring XRP price today, XRP chart trends, and whale activity, all of which influence short-term market sentiment. With Ripple’s expanding ecosystem and ongoing institutional interest, XRP continues to be one of the most closely watched altcoins in 2025.

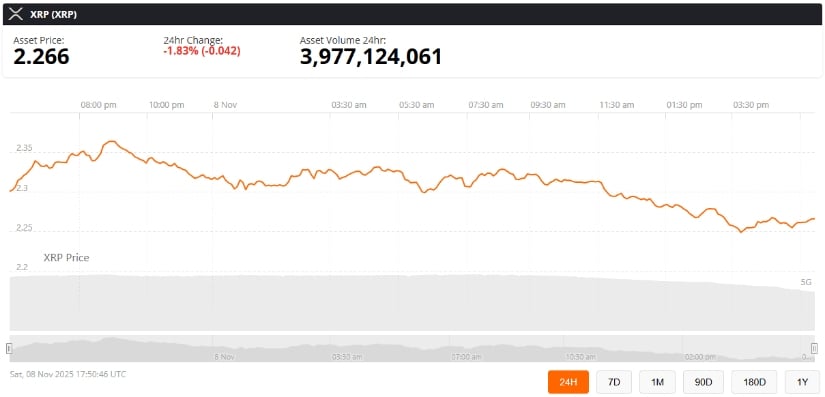

XRP was trading at around $2.26, down 1.83% in the last 24 hours at press time. Source: XRP price via Brave New Coin

Clearing resistance near $2.75–$2.80 could reignite the ongoing rally, paving the way for a potential push toward XRP’s next highs. Analysts note that regulatory updates, ETF filings, and on-chain accumulation will play a crucial role in determining XRP’s trajectory. For those tracking XRP crypto news, the combination of technical support, institutional adoption, and market momentum makes this a pivotal period for forecasting whether XRP will soar to a new all-time high or face further downside.