Bitcoin (BTC) Price Prediction: 50-Week MA & Halving Model Signal $170K Rally—Is This the Start?

Bitcoin's 50-week moving average just crossed a critical threshold—and the halving model is flashing green. Traders are eyeing a potential $170K surge as technicals align.

Here's why the stars might be aligning for BTC:

- The 50-week MA has historically preceded major bull runs

- Halving-induced supply shock meets institutional demand

- On-chain data shows whales accumulating at current levels

Of course, Wall Street will claim they saw it coming—right after they finish shorting it. The real question: Will retail get trampled again when the 'smart money' decides to front-run the rally?

With Bitcoin stabilizing near the $104,000 mark after a volatile week, renewed Optimism is spreading among traders who believe the next leg of the bull market could already be forming.

Following a brief dip below $100,000 earlier this month, Bitcoin’s swift rebound has reignited confidence across the crypto sector. Market data shows rising accumulation near key moving averages, while long-term models forecast a potential surge toward $160,000–$170,000 in the coming year.

A New Bullish Setup Emerging

The price of Bitcoin (BTC) is capturing renewed attention as it hovers near the 50-week moving average—a technical milestone with a track record of sparking major upward moves. Simultaneously, a logarithmic cycle model tied to the cryptocurrency’s halving events projects a target zone between $160,000 and $170,000 for Bitcoin’s next major rally.

Bitcoin’s next projected target is between $160,000 and $170,000. Source: Trending bitcoin via X

The so-called “diminishing golden curves” model, referenced by analysts at CryptoCon, uses halving cycles and sine waves and has reportedly predicted past Bitcoin tops with approximately 88% accuracy. According to recent market commentary, the model now points to a zone of $160K–$170K by late 2025.

Why the 50-Week Moving Average Matters

The 50-week moving average for Bitcoin now sits in the vicinity of $100,000–$105,000. Analysts note that Bitcoin’s current position NEAR this long-term average suggests a potential strategic buying opportunity for investors who favor trend-based entries.

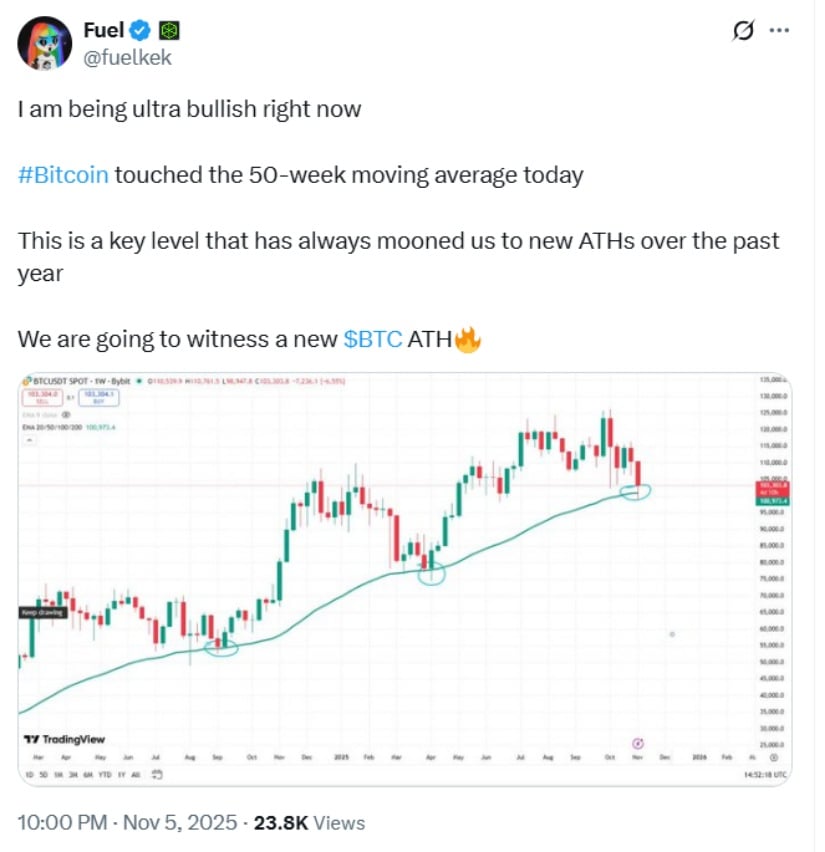

A prominent trader expressed strong bullish sentiment, noting that Bitcoin’s recent touch of the 50-week moving average—a historically significant level—could signal a potential new all-time high. Source: Fuel via X

A prominent crypto analyst with a large following noted that Bitcoin recently touched the 50-week moving average, a historically significant level that has often preceded new all-time highs.

That observation highlighted past instances where Bitcoin retouched this indicator and soon surged to new all-time highs. While no guarantee exists, the combination of a historical support marker and a broader cycle model has drawn attention from bullish participants.

The Halving Model: Projecting $160K-$170K

Halving events—when Bitcoin mining rewards are cut in half—have historically preceded parabolic rallies in the BTC price. The diminishing golden curves model combines those halving effects with sine-wave dynamics and Fibonacci extensions to estimate future price peaks.

In its latest projection, the model targets the $160K–$170K range for Bitcoin, aligning with long-term bullish forecasts and bolstering the broader narrative of cyclical appreciation. With an 88% historical accuracy rate, this model remains influential among traders studying long-term Bitcoin price prediction trends.

Watch These Key Price Thresholds

The support zone near the 50-week moving average, around $100K–$105K, has become a crucial pivot for Bitcoin. Holding above this level WOULD reinforce the ongoing bullish outlook and confirm the strength of market demand.

Bitcoin bounced off $106K support, eyeing $115K–$116K resistance within a rising channel. Source: ClassicallegendFx on TradingView

The resistance zone lies between $115K and $116K, where previous rallies have faced selling pressure. Bitcoin’s current chart pattern, moving within a rising parallel channel, suggests this area could serve as the next breakout point.

Looking ahead, the target zone of $160K–$170K remains the broader goal if bullish momentum persists, aligning with long-term halving-based projections.

However, a risk bookmark is essential—a sustained drop below $100K could weaken sentiment, potentially invalidating the bullish thesis and signaling a period of consolidation or correction before the next leg upward.

Context & Risks to Consider

Despite increasing optimism, some analysts caution that Bitcoin’s current rebound may face headwinds. On-chain data shows reduced accumulation from large holders and mixed BTC liquidity signals, while volatility metrics suggest ongoing uncertainty.

Recent pullbacks have also tested key moving averages, showing that momentum remains fragile. Macroeconomic factors—such as tightening liquidity conditions and fluctuating institutional flows from Bitcoin ETF products—continue to play a major role in shaping price direction.

A market analyst observed that the setup for Bitcoin is in place, but the market has yet to provide a clear trigger for the next move.

Final Thoughts

The convergence of the 50-week moving average and the halving-cycle projection suggests a potentially strong setup for Bitcoin’s next major move. If the Bitcoin price today can hold steady above the $100K–$105K support zone, it could open the path for a rally toward the $160K–$170K target range.

Bitcoin was trading at around 103,636.41, up 1.65% in the last 24 hours at press time. Source: Brave New Coin

Still, caution is advised. The continuation of buying momentum, market liquidity, and broader economic stability will be crucial to determining whether Bitcoin can sustain this bullish trajectory. While technical models and forecasts provide valuable guidance, the outcome will depend on real market confidence and investor behavior in the months ahead.