TRON (TRX) Price Prediction: Bulls Charge as TRX Rebounds from Critical Support, Targeting $0.32 Breakout

TRX defies gravity with stunning support bounce

The cryptocurrency that just won't quit - TRON's native token TRX has staged a remarkable recovery from its key support level, leaving bears scrambling and setting the stage for what could be the most explosive move of the quarter.

Technical Breakout Imminent

Chart patterns scream bullish as TRX consolidates near resistance levels. The $0.32 target isn't just a number - it's the line in the sand that separates consolidation from full-blown momentum. Every dip gets bought, every sell-off gets absorbed. This isn't hope - it's pure technical mathematics playing out in real-time.

Market Sentiment Shifts

Traders who missed the initial bounce are now FOMO-ing into positions, creating the kind of demand pressure that fuels sustained rallies. The 'buy the dip' mentality has transformed into 'buy before it's too late' urgency.

Institutional Whispers

While retail traders chase headlines, smart money positions accumulate. The same Wall Street types who once dismissed crypto now quietly build TRX positions - because nothing gets bankers excited like a trend they can monetize.

Target Locked: $0.32 or Bust

The path forward is clear - break through current resistance and the road to $0.32 opens wide. Technical indicators align, momentum builds, and the market prepares for what could be TRX's most significant move since its last major rally.

Because in crypto, the only thing more predictable than volatility is Wall Street's ability to show up late to the party and claim they planned it all along.

After several days of volatility, TRX coin is showing signs of strength again as buyers step in NEAR key support. The TRON’s modest rebound from the $0.297 range has drawn attention back to its technical setup, with participants eyeing whether this renewed momentum can fuel a larger breakout.

TRX Coin Sees a Strong Bounce from Key Levels

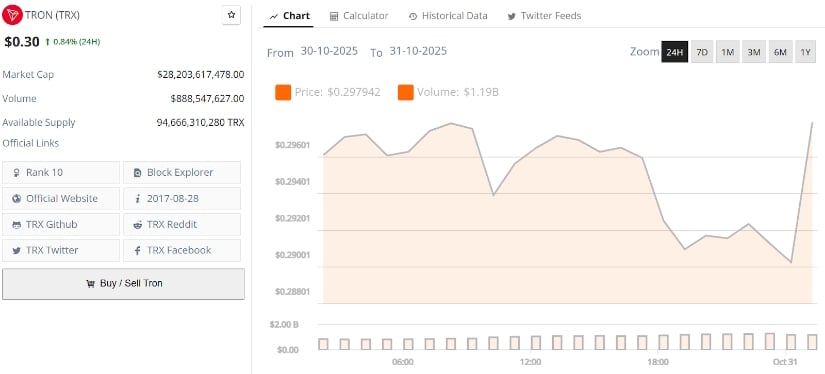

Data from Brave New Coin shows TRON TRX coin trading at $0.30, marking a modest 0.84% gain over the last 24 hours. The recovery follows a retest of the lower boundary of its short-term range near $0.297, where buyers stepped in to defend the structure. Volume spiked to $888 million, suggesting renewed activity.

TRON coin is trading at around $0.30, up 0.84% in the last 24 hours. Source: Brave New Coin

Technically, the current structure resembles a rebound phase inside a broader accumulation zone. The next critical resistance lies between $0.305 to $0.310, while support remains firm at $0.295. Sustaining above WOULD validate this short-term bounce, potentially targeting the upper channel near $0.32 if buying pressure continues.

Bullish Wedge Hints at Continuation Potential

ShangoTrades highlighted that TRX has broken out of a bullish falling wedge, a pattern that typically signals a shift in momentum. Price action confirms a strong rebound from the lower wedge boundary, with an immediate upside target around $0.3040.

TRX breaks out of a bullish falling wedge, signaling renewed momentum and potential continuation toward the $0.315 resistance zone. Source: ShangoTrades via X

The breakout aligns with increasing volume and short-term bullish divergence on momentum indicators, reinforcing the view that a continuation MOVE may follow. As long as TRX coin maintains structure above $0.297, the probability of an extension towards $0.310 to $0.315 remains high, supporting the broader bullish sentiment forming across the market.

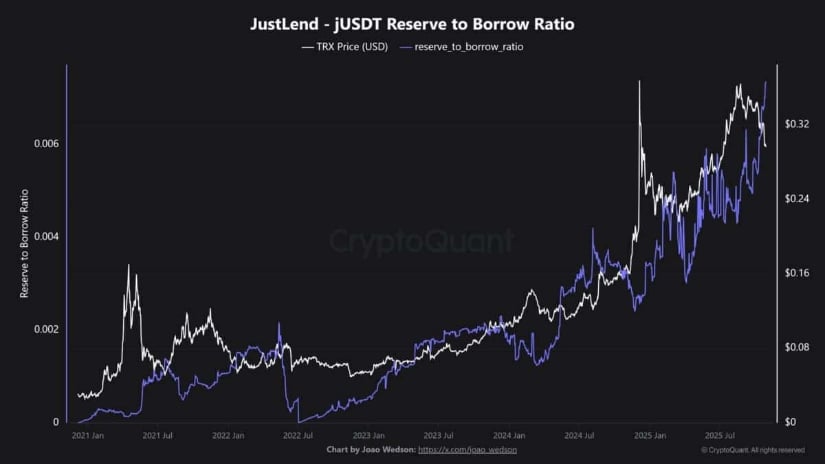

On-Chain Flows Support Accumulation and Strength

TRX on-chain signals are increasingly aligning with price strength. Rising reserves and accumulation trends indicate growing confidence among long-term holders. The data suggests TRX could target $0.32–$0.37 once resistance is cleared, with funding and open interest metrics stabilizing. The inflow of stablecoins into TRON’s ecosystem further bolsters liquidity, signaling a healthy environment for potential upside continuation. On-chain momentum remains one of the stronger supporting factors for TRX’s medium-term outlook.

TRON’s on-chain data shows rising accumulation and stable funding, highlighting strong holder confidence and growing liquidity across its ecosystem. Source: Davide via X

Technical Breakout Targets Align with Bullish Reversal

Jack’s analysis shows TRX stabilizing within a descending channel after months of corrective movement. A breakout above the upper trendline resistance would shift the market structure from neutral to bullish. The key confirmation zone sits between $0.308 to $0.315; clearing this level could drive an impulsive move towards $0.32 to $0.37.

TRX coin consolidates within a descending channel, with a breakout above $0.315 likely confirming a bullish reversal toward the $0.37 zone. Source: Jack via X

Momentum indicators show reserves rising and leverage cooling off, both typical of accumulation phases before breakout rallies. As long as the price holds above the $0.295 base, the structure favors an upward continuation. The phrase “quiet momentum, loud potential” fits perfectly as TRX builds strength quietly before a possible push towards higher resistances.

Contrary View: TRX Coin Faces Technical Weakness Below 200D SMA

While Optimism grows, Umair Crypto presents a cautious perspective. TRX has dipped below its 200-day SMA, signaling that the broader uptrend remains unconfirmed. The chart also shows price slipping under its previous swing low, a sign of structural weakness that could lead to additional short-term pressure.

TRON remains below its 200-day SMA, showing short-term weakness despite bullish divergence signals hinting at a possible rebound. Source: Umair crypto via X

However, a minor bullish divergence on RSI offers a glimmer of hope. If the divergence holds, a rebound towards $0.31 may materialize, but failure to reclaim the moving average would keep TRX coin exposed to further downside, possibly towards $0.285 to $0.280. This contrary view highlights that while momentum is improving, bulls still need a confirmed reclaim of major averages to solidify control.

Final Thoughts: TRX Eyes $0.32 with Broader Market Support

TRON’s latest rebound shows both technical and on-chain confluence, accumulation is rising, liquidity is improving, and structure is tightening towards a potential breakout.

If the bullish wedge breakout continues and on-chain strength persists, TRX coin could retest the $0.32 to $0.37 zone in the near term. However, reclaiming the 200-day SMA remains the key trigger for a sustained mid-term trend reversal. For now, the setup leans bullish but demands confirmation through volume expansion and follow-through above resistance.