Ethereum’s Fusaka Upgrade Gets Final Date - ’It’s a Really Big Deal’

Ethereum developers just dropped the calendar bomb everyone's been waiting for.

The Final Countdown Begins

Mark your calendars and clear your schedules - the Fusaka upgrade now has an official launch date. After months of speculation and development chatter, the core team has locked in the deployment timeline that could reshape Ethereum's entire ecosystem.

Why This Upgrade Matters

This isn't just another routine update. Fusaka represents one of the most significant network enhancements since The Merge, addressing critical scalability and efficiency challenges that have been plaguing the blockchain. Developers are calling it a game-changer for transaction processing and network throughput.

The Market Impact

While traders scramble to position themselves ahead of the upgrade, institutional players are taking notes. The timing couldn't be more crucial as Ethereum battles for dominance against a growing field of competitors. Though let's be honest - half the 'institutional interest' is just hedge funds trying to sound smarter than they actually are about blockchain technology.

Get ready for the mainnet moment that could either launch Ethereum into its next growth phase or become another overhyped crypto event that underdelivers. Either way, the countdown is officially on.

Despite market uncertainty, LINK shows resilience, strong accumulation, and rising volume, signaling investor anticipation of major developments that could reinforce its dominance in DeFi and bridge decentralized networks with global financial systems.

LINK Maintains Strength Above Key Support Zone

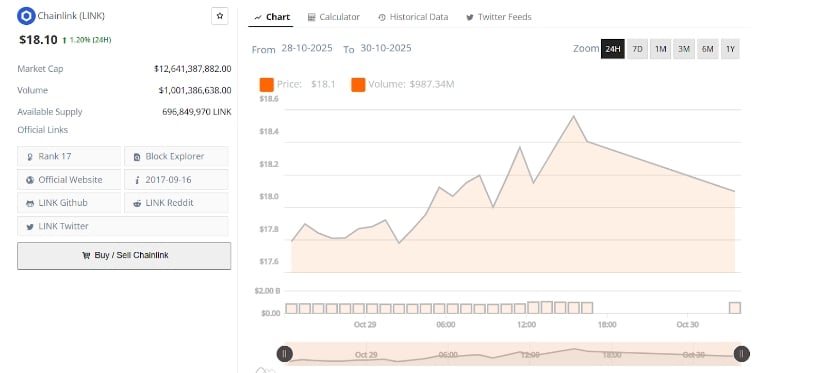

Chainlink has maintained strong performance in recent sessions, trading around the $18 level. The price region has acted as an important pivot point in recent months, serving as both support and resistance during different phases of market activity. As of the latest update, the token trades NEAR $18.10, marking a 1.20% gain in the past 24 hours.

LINKUSD 24-Hr Chart | Source: BraveNewCoin

Market data indicates a capitalization of approximately $12.64 billion, with trading volumes surpassing $1 billion. The available circulating supply remains steady at around 696.8 million tokens, suggesting that holders are showing patience rather than engaging in large-scale profit-taking. The pattern of moderate gains and consistent volume reflects stability in the asset’s positioning despite broader market uncertainty.

Analyst Cites Cautious Optimism

Crypto analyst Pentoshi shared on X that the token’s chart structure shows renewed bullish strength, with the price maintaining higher lows and building a potential base for a breakout. The analyst described the asset’s resilience amid overall market weakness as an encouraging signal, suggesting that the altcoin may be developing a degree of independence from broader crypto trends.

LINKUSD Chart | Source:x

Pentoshi mentioned that while there is a possible catalyst expected next week, its direct effect on price remains uncertain. He added that the decision to take a small position reflects confidence in its technical setup, paired with caution due to the unpredictable nature of the wider market.

The price currently consolidates above the $17–$17.5 range, which forms a strong support zone. A sustained MOVE above $19 could open the path toward $22, while a drop below $17 may trigger a short-term retest near $15.5.

Growing Speculation About Institutional-Level Developments

Another analyst, Gammichan, suggested that the asset’s recent movement mirrors a market anticipating institutional-level developments. The analysis implies that traders may be pricing in a potential announcement involving enterprise partnerships or cross-sector integrations that could elevate Chainlink’s presence in decentralized finance and traditional banking infrastructure.

LINKUSDT Chart | Source:x

The chart displays a sharp breakout from prior consolidation, showing accumulation patterns that often precede large-scale developments. This interpretation has attracted speculative interest among traders expecting fundamental news. Analysts following this pattern note that previous similar breakouts in its history often coincided with major project announcements related to network integrations and cross-chain adoption.

Market Sentiment Aligns With Technical Setup

The recent market structure indicates that the asset is consolidating above previous support and testing new resistance levels around $18.50. Short-term fluctuations have been attributed to traders locking in profits after brief intraday rallies, yet the broader technical structure remains intact. The price continues to hover within a narrow range, positioning for a potential breakout as market volatility returns.

If the altcoin maintains stability above $18, buyers may attempt to push the price toward $19 and $22 in the coming sessions. On the contrary, a breakdown below $17 could invite further testing of lower zones. Market participants are closely monitoring next week’s anticipated event to determine whether it could catalyze sustained upside momentum.

The overall trend portrays a balanced market posture, where investor confidence appears to be growing in anticipation of Chainlink’s upcoming developments. The combination of stable volume, defined support levels, and renewed trading activity positions it as one of the closely observed assets leading into next week’s event.