UNI Surges Back: Open Interest Flashes Bullish Recovery Signals for Uniswap

Uniswap's native token UNI stages impressive comeback as derivatives data hints at sustained upward momentum.

The Rebound Catalyst

Open interest patterns reveal what seasoned traders call a textbook recovery setup—market positioning suggests this isn't just another dead-cat bounce. UNI's recent price action defied broader market sluggishness, proving once again that in crypto, fundamentals sometimes matter less than pure momentum.

Institutional Positioning

Futures markets tell the real story here. When open interest climbs alongside price, it signals fresh capital entering—not just short covering. That combination typically precedes sustained moves, though in this casino we call decentralized finance, nothing's guaranteed except volatility and occasional rug pulls.

Remember when traditional finance types said crypto derivatives would bring stability? Meanwhile, UNI's swinging 8% daily while Wall Street analysts still can't figure out whether to classify it as a security or a utility token.

The asset remains in a tight consolidation range, with sentiment appearing cautiously optimistic.

Buyers Regain Momentum as Open Interest Stabilizes

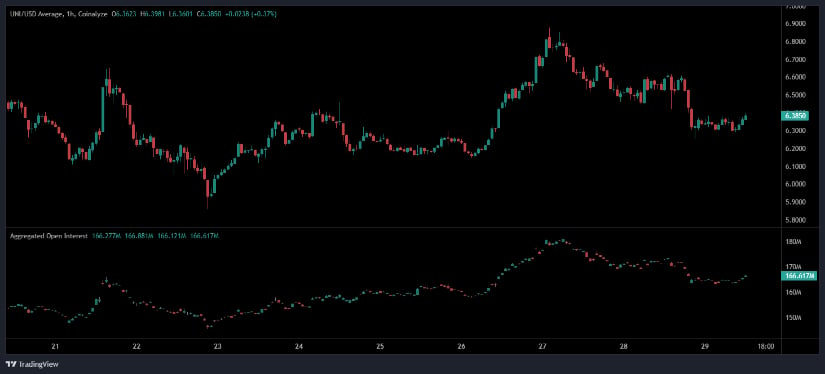

Uniswap Exchange is trading around $6.38, posting a mild rebound after briefly dipping below $6.30 earlier in the session. The short-term structure on the 1-hour chart highlights a recovery attempt following a correction from last week’s highs NEAR $6.90. Despite the pullback, the coin continues to consolidate within a narrow range, hinting at a potential directional breakout once volatility returns.

Source: Open Interest

The aggregated open interest (OI) currently stands near $166.6 million, recovering slightly after a decline from above $175 million earlier in the week. This drop indicates that a segment of Leveraged long positions was liquidated during the correction phase.

However, the stabilization in OI suggests renewed trader participation, with market participants gradually rebuilding exposure. Historically, such recoveries in open interest following liquidations often precede short-term relief rallies provided that the price sustains above key support areas.

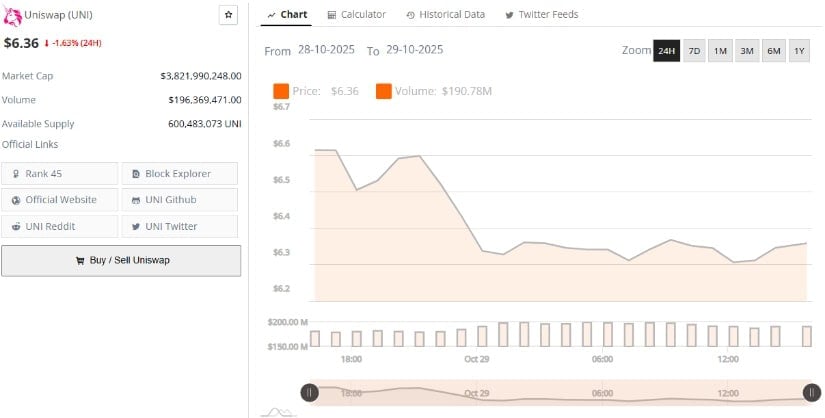

Market Overview Shows Controlled Trading Volumes

According to BraveNewCoin data, Uniswap exchange currently trades at $6.36, marking a 1.63% decline over the last 24 hours. The decentralized exchange token maintains a market capitalization of $3.82 billion, with a daily trading volume of approximately $196.37 million. The available circulating supply stands at 600,483,073tokens, placing the token at Rank 45 by global market cap.

Source: BraveNewCoin

The price performance chart over the past 24 hours shows relatively stable movement between $6.20 and $6.60, reflecting a phase of consolidation consistent with the observed open interest data. Trading activity remains moderate, suggesting that while large speculative inflows are absent, existing holders are maintaining confidence at current price levels.

Technical Indicators Hint at Building Bullish Momentum

At the time of writing, Uniswap crypto is trading near $6.39, up 0.84% in the past 24 hours, according to TradingView. The daily chart suggests a stabilization phase above $6.20, with recent candles forming a recovery pattern after a sharp correction. The neutral-to-bearish broader trend could shift if the token manages to reclaim and sustain above the $6.50 resistance area, aligning with the midpoint of October’s trading range.

Source: TradingView

The Relative Strength Index (RSI) is positioned at 43.08, with its moving average at 39.15, indicating early momentum recovery. Although still below neutral levels, the RSI’s upward curve signals potential bullish divergence, a pattern that often precedes short-term rallies when supported by increased trading volume.

Additionally, the MACD indicator is showing initial signs of convergence. The MACD line (-0.360) is approaching the signal line (-0.462), while the histogram has turned slightly positive at 0.102, suggesting weakening bearish pressure. If this momentum persists, the crypto could attempt a breakout toward $6.80–$7.00. Conversely, a failure to defend $6.20 WOULD expose the token to lower supports near $6.00.