Stellar XLM Primed for $10 Surge as Mass Adoption Rally Accelerates

Stellar's native token XLM positions for explosive growth as institutional adoption reaches critical mass.

Market Momentum Builds

Network activity surges while cross-border payment integrations multiply—financial institutions increasingly bypass traditional settlement systems using Stellar's blockchain infrastructure. Transaction volumes hit unprecedented levels as corporate adoption spreads beyond pilot programs.

Technical Breakout Pattern

Chart analysis reveals consolidation near key resistance levels, suggesting imminent upward movement. Trading patterns mirror previous bull cycle formations that preceded major price appreciation phases.

Ecosystem Expansion

Developer activity reaches all-time highs as new smart contract capabilities attract decentralized application projects. The network's upgraded protocol handles increased throughput while maintaining minimal transaction costs—banks love efficiency almost as much as they love charging fees for basic services.

With traditional finance finally acknowledging blockchain's potential beyond speculative trading, Stellar's practical utility cases position XLM for sustained growth. The $10 target represents just another milestone in the protocol's inevitable march toward reshaping global finance—whether legacy banks are ready or not.

Following multiple years of consolidation, the coin’s chart structure indicates that the groundwork for a “mass adoption rally” could be forming, with projections hinting at a future surge toward the $10 mark by the next major market expansion.

Highlight Show Accumulation and Rally Phases

According to analyst X Finance Bull, Stellar’s market structure reflects a clear sequence of accumulation and rally phases. The chart highlights two distinct accumulation periods — the first tied to the early speculation cycle, and the second aligning with the current price behavior between 2022 and 2025. The buy zone, positioned around current levels, appears to be holding firm as the token consolidates.

Source: X

The analyst emphasized that once the current compression phase resolves, a breakout may occur without prior warning. This move could mark the transition from the ongoing second accumulation into what he terms a “mass adoption rally.” The long-term projection from the chart places the token’s potential target NEAR $10, signaling a major upward expansion phase if momentum aligns with historical cycles.

Market Metrics show liquidity at play

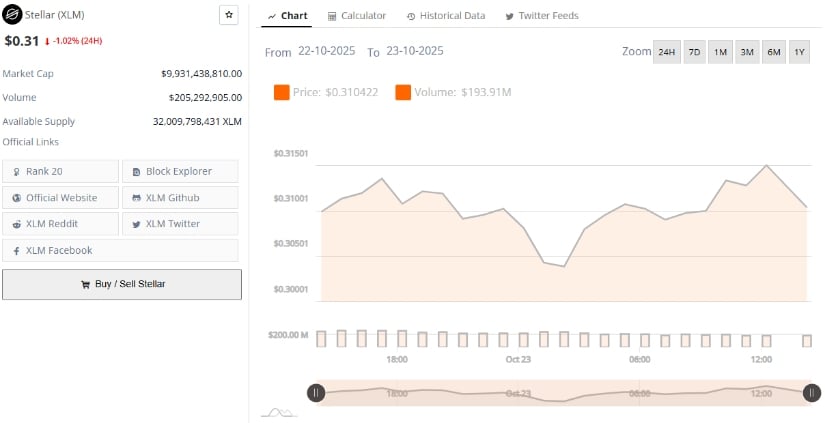

Additionally, Data from BraveNewCoin places Stellar’s market capitalization at $9.93 billion, with daily trading volumes near $205 million. Despite the token’s slight 1.02% decline in the last 24 hours, market activity remains relatively stable within the $0.30–$0.32 range. This steady turnover suggests that liquidity continues to support the token’s consolidation, even amid broader market uncertainty.

Source: BraveNewCoin

The circulating supply stands at over 32 billion XLM, placing the asset firmly among the top 20 cryptocurrencies by market capitalization. Such stability in ranking highlights continued engagement from long-term holders, a key element in maintaining structural integrity before a major price movement.

Technical Outlook: Show Price Consolidation

At press time, of writing, TradingView data shows that XLM/USDT has been trading around $0.3142, reflecting mild intraday gains of 1.98%. Despite prior volatility, recent price action suggests consolidation with potential for gradual accumulation. The BBPower indicator, currently reading –0.0289, denotes weakening bearish pressure, while the Chaikin Money FLOW (CMF) value of 0.05 signals modest capital inflow into the asset.

Source: TradingView

This combination suggests that while bearish momentum is waning, buyers are gradually regaining ground, potentially setting the stage for renewed upward pressure. If the asset sustains accumulation around this range, technical conditions could favor a breakout aligning with analyst projections of a long-term MOVE toward $10 by the 2026–2027 cycle.