Uniswap Defies Market Volatility: Price Holds Critical Range as $150M Open Interest Signals Strong Trader Conviction

Uniswap's price stability becomes the market's quiet anchor while traders place $150 million bets on its next move.

The Range That Refuses to Break

While other DeFi tokens swing wildly, UNI maintains its crucial trading zone—proving some things in crypto actually hold value beyond hype. The steady $150 million open interest suggests traders aren't just watching, they're building positions for what comes next.

Institutional Money Stays Put

That massive open interest figure tells a story of conviction. Unlike retail traders chasing the next shiny token, serious money appears committed to UNI's current range—because apparently even in DeFi, sometimes patience beats panic.

When the market's throwing tantrums, sometimes the smartest trade is holding steady—a concept Wall Street still struggles to grasp between their quarterly earnings panic attacks.

After recent volatility, the token’s momentum appears muted, with indicators suggesting a neutral stance ahead of a potential trend shift.

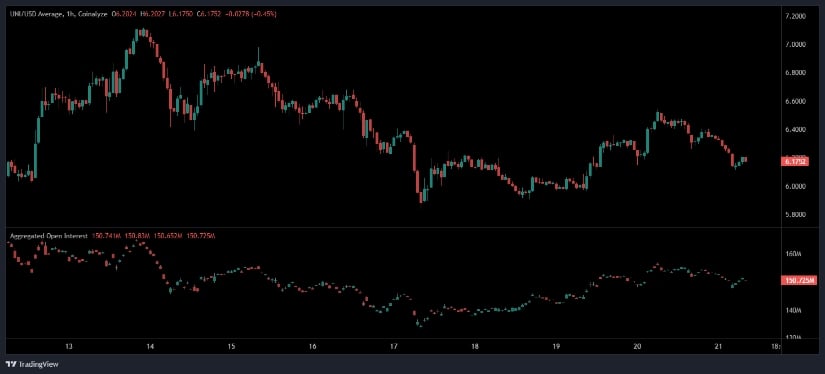

Open Interest Remains Flat, Reflecting Trader Indecision

Recent Open Interest market data reveals that Uniswap’s aggregated open interest sits NEAR 150.7 million, signaling balanced positioning between long and short holders. This flattening of open interest often reflects uncertainty, as traders await a decisive price move before entering new positions.

The lack of a sharp increase or decrease in derivatives exposure indicates that market participants are not yet committed to a directional bias, a common feature during consolidation phases.

Source: Open Interest

If open interest begins to rise alongside an uptick in volume, it could signal the start of renewed volatility and a possible directional move. However, for now, the crypto’s derivative data supports the view that the market is in a holding pattern after an extended decline.

Market Metrics Show Weak Momentum but Stable Participation

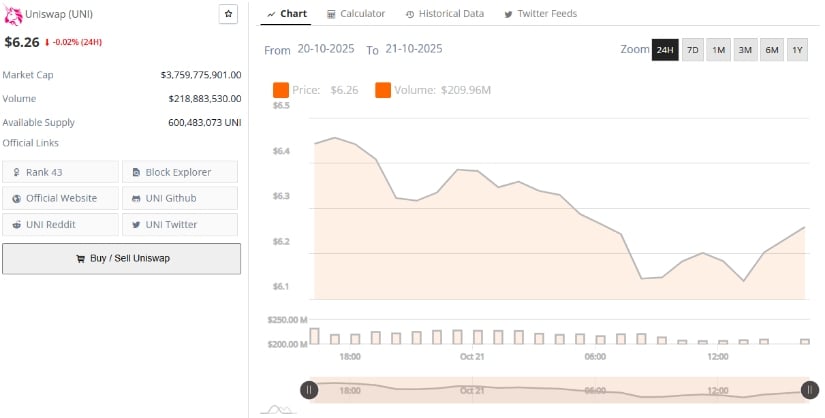

According to BraveNewCoin data, Uniswap holds a market capitalization of 3.75 billion, ranking 43rd among cryptocurrencies. Daily trading volume stands near 218.8 million, while the token’s circulating supply remains at 600.48 million tokens. The latest data points to a minor 0.02% daily decline, reflecting subdued market interest following weeks of corrective action.

Source: BraveNewCoin

Despite limited price movement, liquidity across major exchanges remains consistent, showing that the coin’s ecosystem continues to attract steady activity even in a risk-off environment. This balance of participation without strong trend development reinforces the broader picture of market consolidation.

Technical Indicators Highlight Narrow Range Trading

At the time of writing, UNI/USDT trades within a confined zone on the daily chart, with neither bulls nor bears gaining clear control. The Bulls and Bears Power (BBPower) indicator records a negative reading of -0.727, confirming short-term bearish momentum. Meanwhile, the Chaikin Money FLOW (CMF) remains slightly positive at 0.10, suggesting mild accumulation but insufficient to trigger a breakout.

Source: TradingView

Price action continues to hover between 6.17 and 6.30, with decreasing volatility indicating a potential squeeze setup before the next move. If CMF maintains positive territory and open interest starts to expand, a short-term rebound toward the 7.00–7.20 range could develop. Conversely, failure to hold current support may expose the asset to retesting the 5.80 zone in the coming sessions.

The coin’s current technical landscape points to a neutral-to-cautious market state. Traders appear to be waiting for clearer confirmation either through volume expansion or a break above range resistance before committing to the next directional play.