XRP SuperTrend Flashes Historic Buy Signal - $27 Price Target Now in Play

XRP's technical setup just triggered a pattern that previously preceded massive rallies - and this time the charts are pointing toward a potential $27 target.

The SuperTrend Indicator Awakens

That flashing green signal on the weekly chart? It's the same configuration that launched XRP's most legendary runs. The SuperTrend indicator - which filters out market noise to identify momentum direction - just flipped bullish in a way that mirrors the asset's historic breakout patterns.

Market Structure Shifts Gear

Traders are watching open interest build while key resistance levels crumble. The $27 target isn't just hopeful thinking - it aligns with Fibonacci extensions from previous cycle highs. Though let's be honest, in crypto, technical analysis sometimes feels like reading tea leaves while riding a rollercoaster.

Institutional money continues circling the digital asset space while retail traders chase the next moonshot. Whether XRP actually hits that ambitious target remains to be seen, but the setup suggests we're in for significant volatility ahead - buckle up.

Analysts say the alignment of historical Supertrend patterns, ETF momentum, and strengthening institutional interest could position Ripple XRP for one of its most significant rallies to date. While speculative, the setup is drawing widespread attention across the crypto market as traders closely watch how the price reacts to critical resistance levels.

Supertrend Confluence Signals a Major Upside

Technical analyst ChartNerdTA recently shared a monthly XRP/USD chart, highlighting a rare Supertrend confluence with a $27 Fibonacci extension level. Historically, similar setups have preceded explosive rallies in previous market cycles. The analysis traces this pattern back to 2014, when breaks above major resistances led to multi-fold gains.

A monthly XRP/USD Supertrend chart shows a key confluence with the $27 Fibonacci extension, echoing past breakout patterns and signaling strong upside potential from current levels. Source: ChartNerd via X

The Supertrend signal aligning with the Fibonacci extension has historically marked key inflection points for XRP in past bull markets, and if this pattern repeats, it could signal a major breakout phase ahead.

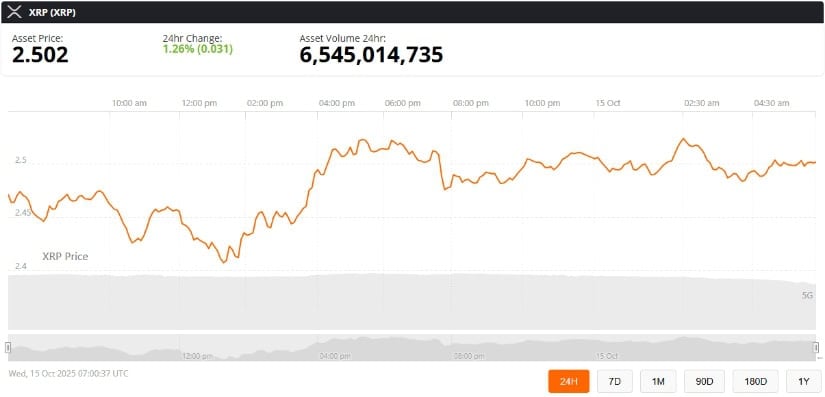

As of October 15, 2025, the current xrp price hovers near $2.50 after recovering from a sharp mid-month sell-off. Analysts view this confluence as a potential springboard for a long-term rally, though they caution that fundamentals will need to support such ambitious price targets.

ETF Momentum Could Fuel Institutional Demand

A major narrative driving Optimism in Ripple XRP news today is the increasing likelihood of Grayscale and other firms launching spot XRP ETFs. Since the landmark legal victory against the SEC in 2023, over a dozen ETF applications have been filed, with futures-based products already trading and spot ETF approvals expected between October 18–25.

Ripple’s legal victory has brought regulatory clarity to XRP, fueling institutional interest, ETF momentum, and heightened Wall Street attention. Source: @stedas via X

“Ripple’s legal win gave XRP clarity. Now institutions are coming, ETFs are heating up, and Wall Street’s watching,” noted XRP_Cro. Analysts project that successful ETF launches could trigger inflows 2–3 times greater than what was seen during Bitcoin’s ETF debut. Such capital movements could help propel the price of XRP toward the $4–$6 range by the end of the year, potentially laying the groundwork for longer-term moves toward $27.

Broader Outlook: From Consolidation to Potential Breakout

The XRP price forecast hinges on whether bulls can regain momentum at critical resistance zones. Consolidation between $2 and $2.72 may create a stronger base for future rallies, but a failure to defend $2 support could lead to deeper corrections.

XRP’s recent breakout from dual triangle patterns, combined with ETF momentum and Ripple’s rapid expansion, suggests a bullish setup with strong support and upside potential toward $15. Source: CryptoColugo on TradingView

At the same time, macroeconomic trends—such as expected Fed rate cuts and increasing institutional involvement—are shaping a favorable backdrop for the crypto market. Combined with the upcoming ETF decision timeline and Ripple’s expanding global footprint, many analysts view this as a potential turning point for XRP.

Final Thoughts

XRP’s current structure mirrors several technical conditions seen during its past breakout phases. While a $27 price target remains speculative, the alignment of technical indicators, growing ETF momentum, and a favorable macro environment gives the XRP price prediction 2025 a bullish edge.

XRP was trading at around $2.50, up 1.26% in the last 24 hours at press time. Source: XRP price via Brave New Coin

For now, all eyes remain on the 200-day moving average and the pending spot ETF decision. A breakout above $2.72 could spark the next leg higher for XRP, while failure to hold support may delay the anticipated rally.

As the crypto market heads deeper into 2025’s bull cycle, XRP is once again positioning itself at the center of institutional and retail attention—making the coming weeks pivotal for its long-term trajectory.