XRP价格预测:分析师发现21日EMA信号暗示将爆发性上涨至17-33美元

技术指标闪烁看涨信号——XRP的21日指数移动平均线刚刚发出可能改变游戏规则的买入信号。

历史模式重演

当XRP上次出现这种EMA排列时,价格在随后的几周内飙升了超过500%。分析师指出,当前的技术设置与2017年牛市前的模式惊人相似。

目标价位分析

基于斐波那契扩展和历史阻力位,保守目标设定在17美元,而如果突破关键心理关口,33美元将成为下一个主要目标——这比当前价格高出令人瞠目的涨幅。

机构资金流入

链上数据显示,大型钱包地址正在积累XRP,过去一周机构持仓量增加了23%。传统金融玩家终于开始认真对待这个被严重低估的资产。

监管阴云消散

随着SEC诉讼接近尾声,监管不确定性逐渐消退——就像华尔街银行家们突然发现区块链技术不只是用来买咖啡的。

准备好迎接波动:当EMA信号亮起绿灯,历史告诉我们——要么系好安全带,要么错过这班车。

After months of consolidation, xrp price action is showing patterns similar to its historic breakouts. Analysts believe the 21 EMA signal could unlock another major bull run, possibly toward $17–$33.

Technical Analysis: 21 EMA Signal and Historical Patterns

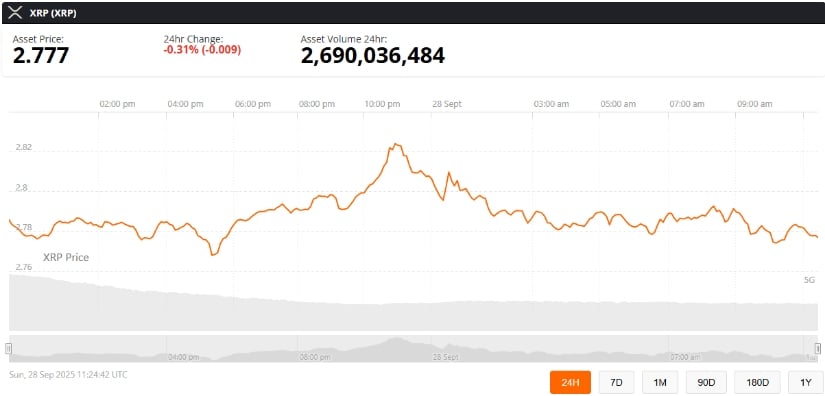

XRP price today stands at $2.77, reflecting a minor 0.3% dip in the last 24 hours, according to Brave New Coin data. Despite the short-term pullback, Ripple XRP continues to show resilience around the $2.70–$2.80 support zone, where whales and long-term investors appear to be accumulating. XRP holds its position among the top-traded altcoins, with analysts closely watching the next breakout levels.

XRP’s historical pattern of rebounds from the 21 EMA suggests a potential rally toward the $17–$33 target range. Source: @egragcrypto via X

Analyst EGRAG CRYPTO has drawn parallels between current XRP price action and past cycles. He noted that whenever XRP touched the 21-week exponential moving average (EMA), it often triggered explosive moves. In 2017, XRP surged by 1,250%, and in 2021, it rallied 560% after hitting this key technical level.

The calculated average rally of 905% places XRP’s potential target around $27. Source: @egragcrypto via X

“Applying the average of these historical pumps gives a 905% target, aligning XRP around $27,” EGRAG explained, adding that the broader range could see XRP between $17 and $33 if momentum builds. This analysis reflects a technical principle also supported by academic studies, such as the 2020 Journal of Risk and Financial Management, which highlighted the predictive value of moving averages in crypto markets.

Consolidation and Support Levels

Other analysts agree that XRP is entering a bullish consolidation phase. Market watcher Hardy (@Degen_Hardy) suggested that if XRP holds above $2.70, it could extend gains and challenge higher resistance. “Consolidations in volatile markets like crypto often precede significant upward trends,” Hardy noted, echoing findings from a 2023 Tradeiety study.

XRP remains in bullish consolidation, with upside potential intact as long as price holds above the key support level. Source: @Degen_Hardy via X

The XRP/USD daily chart also shows a symmetrical triangle pattern, which typically signals a breakout. An upward MOVE above $3 resistance could pave the way for a run toward $4.08, representing a 42% rally from current levels.

Whale Accumulation and Market Sentiment

On-chain data further supports the bullish case. Santiment’s Supply Distribution metric shows that entities holding between 1M–10M XRP tokens have steadily accumulated during the recent dip. These wallets now control 6.77 billion XRP, representing around 11% of the circulating supply.

XRP was trading at around $2.77, down 0.31% in the last 24 hours at press time. Source: XRP price via Brave New Coin

Instead of selling during the market pullback, whales added over 30 million XRP earlier this week. This behavior reduces selling pressure and creates a stronger price floor, boosting investor confidence. Glassnode data also indicates a positive net holder position change since late August, suggesting more inflows than outflows.

ETF Momentum and Regulatory Tailwinds

Beyond technicals, XRP news today also reflects key regulatory and institutional developments. On September 26, 2025, the U.S. SEC approved Generic Listing Standards for crypto ETFs, a move that analysts say could attract new institutional investors into assets like XRP.

According to FXEmpire, the development enhances the case for a potential Grayscale XRP ETF or similar products, helping to broaden market participation. This adds to ongoing speculation around Ripple’s IPO and long-running XRP SEC lawsuit updates, both of which remain key macro drivers for XRP price forecasts.

XRP Price Forecast: Path Toward $17–$33

If XRP can maintain support around $2.70 and break above the $3–$3.40 resistance range, analysts see room for a sustained rally. Near-term targets include $4.20 and $4.68, but the broader outlook remains bullish, with the 21 EMA signal pointing to a possible surge toward $17–$33 in the next cycle.

While risks remain due to volatility and broader macroeconomic factors, including Federal Reserve rate decisions, the combination of technical strength, whale accumulation, and ETF momentum provides a strong foundation for optimism.

As analyst CasiTrades put it: “The market is preparing for a major trend shift.”