Dogwifhat Defies Gravity at $0.75 as Wedge Breakout Targets $0.50 Zone

Dogwifhat's price action just flipped the technical script—holding firm at $0.75 while a wedge pattern screams momentum shift.

Breaking Down the Formation

Traders watched the consolidation tighten like a spring before today's decisive move. The wedge breakout signals potential downside momentum, with the $0.50 level emerging as the next logical battleground.

Market Mechanics in Play

Volume patterns suggest institutional interest—or maybe just another pack of degens chasing the next dopamine hit. Either way, the chart doesn't lie: this pattern historically precedes significant price movements.

Target Zone Activation

The $0.50 target zone now becomes the make-or-break level. A hold there could trigger reversal patterns, while breakdowns might test lower supports. Because nothing says 'sound investment' like a meme coin named after canine headwear.

The recent breakout above resistance has brought renewed optimism, pushing the price higher before cooling back into consolidation. At $0.75, the asset sits just above key support, where the next MOVE could determine whether momentum extends further or fades into correction.

Wedge Formation Fuels Optimism

According to analyst Lyx on X, the descending wedge structure for TROLL has already produced a breakout, with volume expansion confirming strong participation. Historically, this pattern has marked turning points where selling pressure fades and bulls regain control.

The analyst highlighted that such setups often retrace a significant share of the prior decline, with current projections suggesting possible continuation toward the $0.35–$0.50 region if momentum remains intact.

Source: X

This bullish context underscores that traders are eyeing higher levels in anticipation of a sustained recovery. The breakout has also shifted sentiment across shorter timeframes, with higher highs and higher lows forming consistently. While short-term pullbacks remain possible, the overall wedge resolution continues to support Optimism for further advances in the sessions ahead.

Market Data Shows Stability

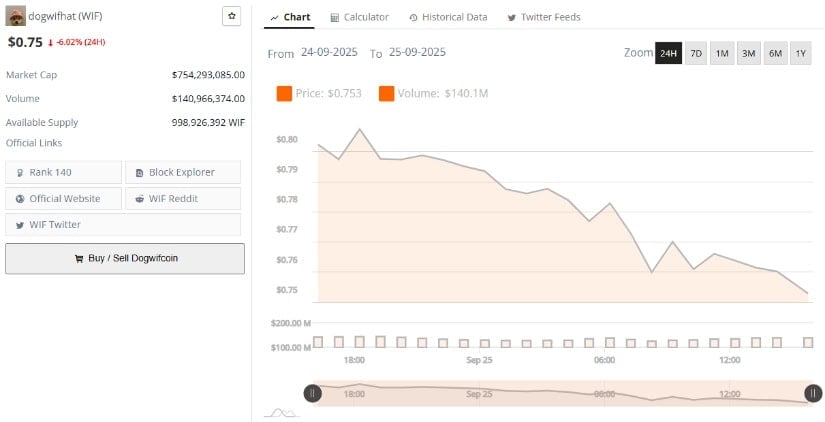

ON one hand, data from BraveNewCoin highlights a solid backdrop for the asset despite short-term volatility. dogwifhat currently trades at $0.75 with a market cap of approximately $754.2 million and a 24-hour trading volume of $141 million. Daily fluctuations remain active, but liquidity levels show consistent participation across exchanges.

Source: BraveNewCoin

The circulating supply sits NEAR 998 million tokens, supporting transparent tokenomics and deep liquidity for trading. Market forecasts suggest continued stability within the $0.70–$0.80 corridor as buyers and sellers contest direction. If inflows strengthen into the end of September, averages could lift toward $0.82, supported by broader market interest and recovering sentiment.

These figures point to resilience even as the asset consolidates under resistance. With liquidity intact and network activity consistent, the coin appears structurally positioned to sustain higher participation in the next phase of trading.

Technicals Suggest Pressure Persists

Despite the wedge breakout, short-term indicators reveal continued weakness. The MACD remains below zero, with the histogram trending negative, signaling that bearish momentum still outweighs buying pressure.

Unless a bullish crossover develops soon, consolidation could extend or test lower supports at $0.70 and $0.65.

Source: TradingView

The Relative Vigor Index (RVI) sits at 34.16 against its moving average at 51.85, further highlighting limited strength from buyers. Readings below 50 generally indicate sellers remain in control, and the declining slope of the RVI suggests caution is warranted.

Still, with the indicator nearing oversold conditions, a rebound from current levels cannot be ruled out. Confirmation above resistance WOULD be the clearest signal of renewed upside potential.