Hedera Forges Global Finance Rails as Stablecoin and CBDC Adoption Accelerates

Hedera's hashgraph network positions itself as the backbone for next-generation financial infrastructure—just as central banks worldwide scramble to digitize their currencies.

The Stablecoin Surge

Private stablecoin issuers flock to Hedera's enterprise-grade platform, drawn by its lightning-fast finality and predictable fees that leave legacy banking systems in the dust.

CBDC Race Intensifies

Multiple central banks now prototype digital currencies on Hedera's ledger—because apparently watching from the sidelines while private stablecoins eat their lunch wasn't a viable long-term strategy.

Global Rails Take Shape

The network stitches together cross-border payment corridors that bypass traditional intermediaries, cutting settlement times from days to seconds while somehow making finance bureaucrats nervous.

Hedera doesn't just enable financial innovation—it bulldozes through legacy roadblocks with institutional-grade throughput that makes traditional finance look like it's running on dial-up. A welcome disruption for everyone except those still betting on fax machines for interbank settlements.

Key support NEAR $0.16 and Fibonacci targets up to $3.30 signal potential for a major breakout, positioning it as a leading blockchain for tokenization and real-world digital payment solutions.

HBAR Technical Setup Points to 2025/26 Price Discovery

Analyst ChartNerd reports that the native token may be preparing for a strong upward cycle similar to 2021. The chart indicates a comparable consolidation phase that previously preceded a rapid surge. Key Fibonacci extensions outline projected price targets between $1.20 and $3.30 during the 2025/26 cycle if the structure repeats.

HBARUSDT Source:x

The analysis identifies $0.16 (20-week EMA) and $0.11 (0.5 Fibonacci retracement) as critical support levels forming a launchpad for potential growth. The asset trades near $0.22, where maintaining strength above these support levels could signal renewed momentum toward higher Fibonacci extension targets of $1.20, $1.77, and $3.09.

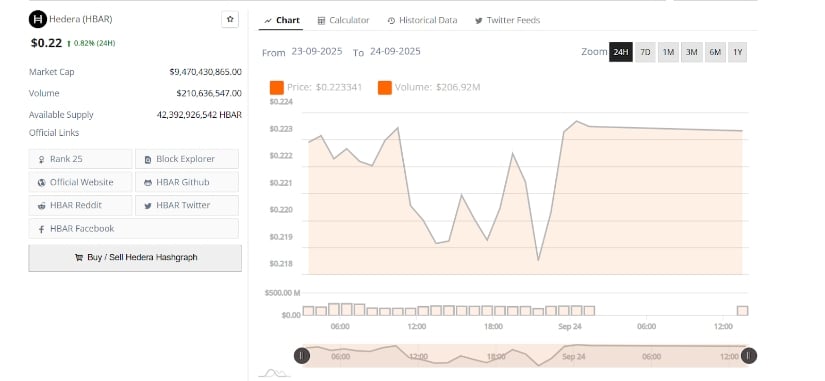

Steady Market Activity and Price Movement

HBAR has recorded a modest 0.82% increase in 24 hours, trading around $0.22. Price movement during this period fluctuated between $0.223 and $0.218 before recovering to current levels, indicating buyer activity around key support. A decisive break above $0.223 could provide a base for testing higher price levels.

HBARUSD Source: BraveNewCoin

Trading volume reached $210.6 million, reflecting steady participation despite intraday swings. The token’s market capitalization stands at $9.47 billion, with over 42.39 billion in supply, placing it 25th among cryptocurrencies. Consistent liquidity and a stable supply indicate market resilience as the network approaches a new growth phase.

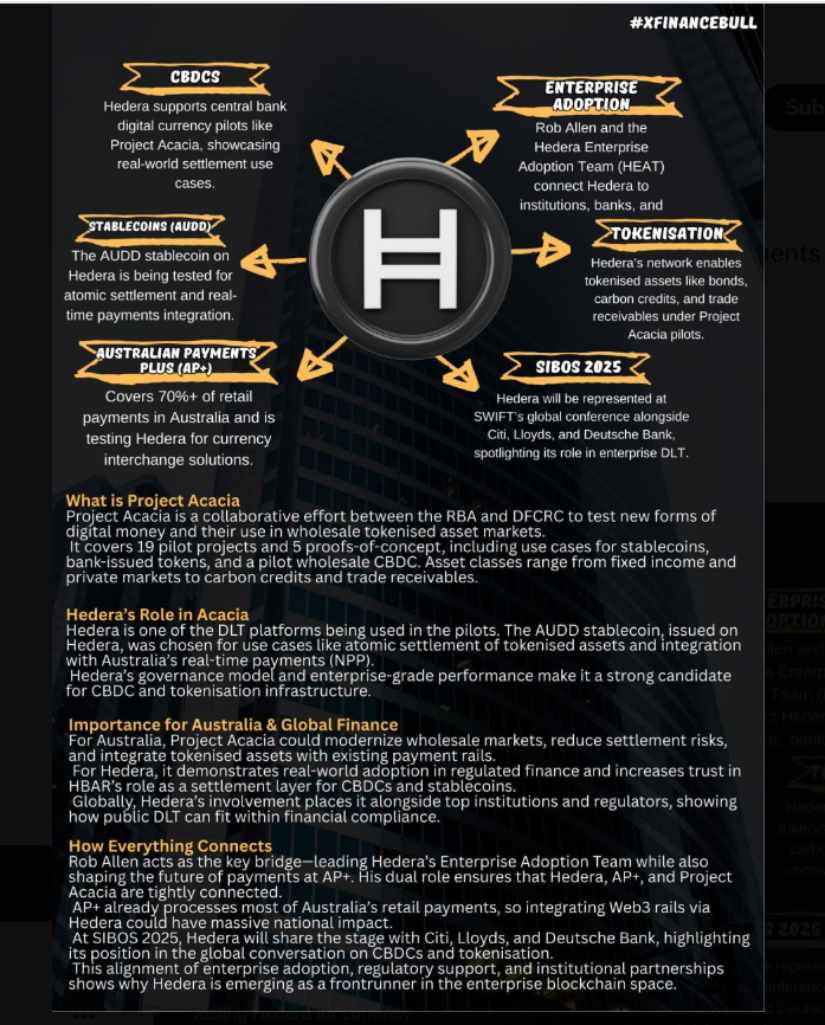

Expanding Role in Stablecoin and CBDC Projects

Beyond technical analysis, the memecoin is strengthening its position within global finance. The network supports central bank digital currency (CBDC) pilots such as Project Acacia, a collaboration between the Reserve Bank of Australia and the Digital Finance Cooperative Research Centre. This initiative explores tokenized assets, stablecoins, and wholesale CBDC use cases on its network.

Source:x

Hedera also powers the AUDD stablecoin, enabling real-time payments and atomic settlement. According to industry data, more than 70% of Australian retail payments FLOW through Australian Payments Plus (AP+), which leverages it for scalable settlement. These developments demonstrate the enterprise-grade governance and secure, high-speed network built for regulated financial environments.

Strengthening Global Finance Connectivity

The platform’s global reach will be visible at SIBOS 2025, where Hedera will share the stage with leading financial institutions, including Citi, Lloyds, and Deutsche Bank. Rob Allen and the Hedera Enterprise Adoption Team are working with banks and regulators to integrate their technology into tokenized markets for assets such as bonds and carbon credits.

With technical setups pointing to a bullish market cycle and expanding adoption in CBDC and stablecoin infrastructure, the asset continues to establish the technological base for digital finance. By combining reliable on-chain settlement with regulatory engagement, the network is positioning itself as a key component in the next generation of payment and tokenization systems.