Litecoin (LTC) Price Prediction: ETF News Ignites Surge - Strong Support Sets Stage for $200 Breakout

Litecoin rockets on ETF speculation as institutional interest floods the market.

The Support Floor Holds Firm

LTC finds solid footing after the recent surge—traders are betting this isn't just another pump-and-dump. The $200 target suddenly looks within reach, unlike those 'guaranteed returns' your financial advisor promised last quarter.

Technical Momentum Builds

Price action suggests sustained bullish pressure as volume spikes. Market sentiment shifts from cautious optimism to outright FOMO.

Institutional Validation Changes the Game

ETF news transforms Litecoin from altcoin afterthought to legitimate portfolio asset. Wall Street finally discovers what crypto natives knew years ago—minus the 2% management fees, of course.

Can LTC actually hit $200? The charts say maybe. The fundamentals say probably. And your broker? Still explaining what blockchain is.

The sudden price movement follows one of the largest whale accumulation events in months, highlighting growing institutional confidence. Analysts suggest that the combination of Litecoin ETF momentum and favorable on-chain metrics positions LTC for a potential rally, offering both short-term trading opportunities and long-term growth prospects.

Institutional Interest Drives LTC Rally

The recent spike in Litecoin price is closely tied to institutional activity. Grayscale’s LTC ETF filing triggered one of the largest whale buying sprees observed in months. Data from trader PRIME shows that wallets holding at least 1,000 LTC added 181,000 coins in just 24 hours.

This isn’t retail FOMO but calculated accumulation. Within 12 hours of the ETF news, Santiment recorded over 349 transactions worth more than $1 million each, highlighting the magnitude of smart money positioning.

Grayscale’s Litecoin ETF application has sparked significant institutional interest, with wallets holding over 1,000 LTC accumulating 181,000 coins in a single day. PRIME 𝕏 via X

The ETF filing positions Litecoin in the spotlight alongside Bitcoin and Ethereum, giving it a stronger institutional narrative. The filing alone signals that traditional finance is increasingly treating LTC as a serious investable asset.

Technical Support and Price Resilience

Even after a recent breakdown, Litecoin has demonstrated resilience. LTC held above the psychological $100 level following a dip to $105.49, and on-chain metrics, such as the MVRV ratio, suggest minimal immediate selling pressure. The ratio currently sits at 12.11%, indicating that many holders are underwater, reducing the likelihood of panic selling.

Litecoin remains a major crypto player despite slower growth, with whales driving periodic 50%+ rallies; the recent weekly W-bottom signals potential upside for LTC. Crypto Check on TradingView

Additionally, the Relative Strength Index (RSI) and Money Flow Index (MFI) signal potential for renewed buying momentum. A sustained MOVE above the $115.24 resistance could pave the way for a rally to $147.55 or higher. Analysts note that if momentum continues, LTC may even target the $200 mark.

Key Drivers Behind Litecoin’s Potential Upside

Several factors are fueling Optimism for Litecoin’s near-term outlook:

-

ETF Momentum: The Grayscale filing shines a light on LTC’s institutional appeal, potentially attracting further investment.

-

Whale Accumulation: Significant buying from large holders creates a strong base for price support.

-

Technical Setup: On-chain data and price patterns suggest LTC is primed for a potential breakout.

-

Market Timing: Historical trends show LTC often performs well during broader crypto bull cycles, reinforcing its role as “digital silver” alongside Bitcoin.

Analysts suggest that the convergence of these factors could set the stage for a multi-month rally if broader crypto market conditions remain favorable.

LTC Price Forecast: What Investors Should Watch

Short-term traders should monitor key levels for risk management. Short-term traders must monitor important levels for risk management. A supporting level of $100-$105 provides a cushioning bottom, and important resistance levels of $115-$120 will determine whether the bounce can be sustained. A breakout can trigger higher targets at $147 and even $200, in line with bullish Litecoin Price forecasts.

No prediction is ever absolute, but the incoming Litecoin ETF news, institutional market positioning, and technical momentum give LTC a positive outlook for 2025. Investors can also consider forthcoming Litecoin halving events, which have had an impact on the coin’s supply-demand equilibrium and price trends in history.

Final Thoughts

Litecoin’s recent behavior illustrates a mix of strong technical support coupled with institutional buying. The market reaction to the filing of the Grayscale ETF is a sign of improved faith in LTC as a long-term investment-grade asset. With price firming above key levels and whale buying continuing, all is ready for the possibility of a rally that could see Litecoin heading towards the $200 level.

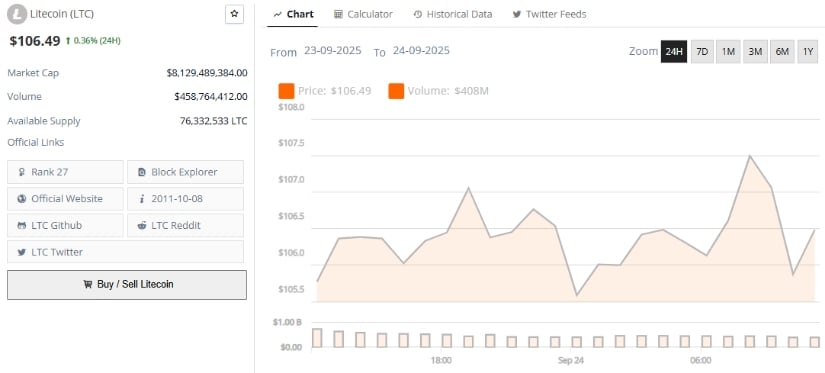

Litecoin was trading at around $106.49, up 0.36% in the last 24 hours at press time. Source: Brave New Coin

For Litecoin price today followers, investors, and Litecoin predictions, the coming weeks will be critical in determining whether the present bullish momentum can be sustained.