ETH vs. BTC: Is Ethereum’s Rally Just Beginning or Already Over?

Ethereum's surge against Bitcoin sparks debate: temporary spike or sustained dominance shift?

The Momentum Question

ETH's recent performance against BTC has traders divided—some see classic profit-taking, others spot fundamental strength finally playing out. Network upgrades and institutional adoption patterns suggest this might be more than just a flash in the pan.

Market Dynamics at Play

While Bitcoin remains the digital gold standard, Ethereum's utility-driven ecosystem continues attracting developer momentum. The flippening talk resurfaces every cycle—but this time, DeFi and NFT infrastructure add weight to the argument.

Traditional finance skeptics, of course, call it speculative froth—because nothing says 'serious investment' like dismissing entire asset classes that outperform your precious bonds.

One thing's clear: in crypto, early days often look identical to final chapters—until they don't.

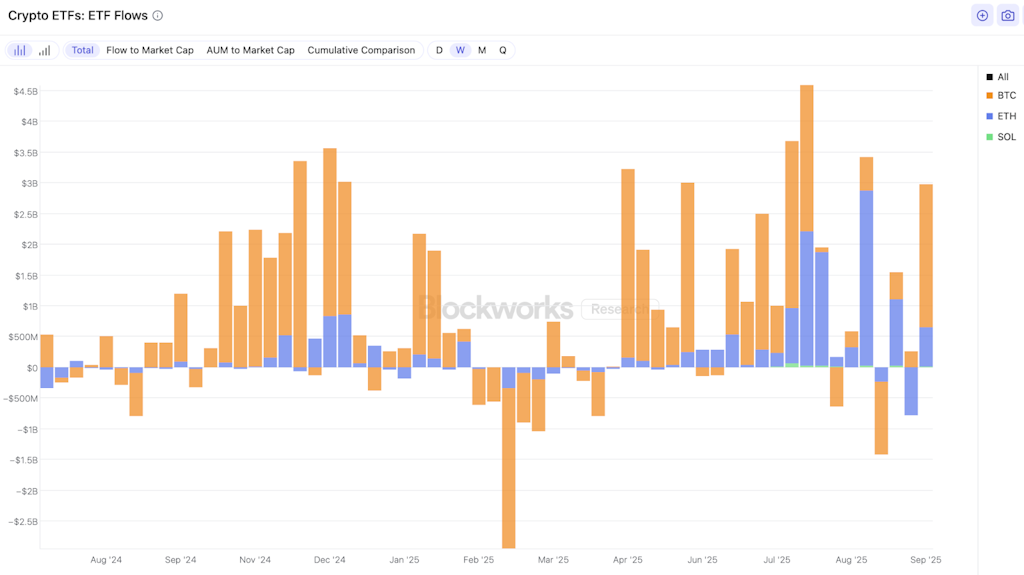

The ETH ETF inflows have come as several crypto treasury companies have been buying ether at scale.

Within roughly the same period as the ETH ETF inflow momentum, companies have bought more ETH than BTC in nine of the last 10 full weeks (we’re still early in the most recent week displayed):

Touting the largest ETH treasury is BitMine Immersion Technologies, which said Monday it now holds more than 2.1 million ETH (worth nearly $10 billion). It’s not hard to find BitMine Chair Tom Lee on television talking about ETH’s potential. For those who don’t know what television is, you can catch his CNBC interviews on the internet, too.

Of course, companies like BitMine and SharpLink Gaming are buying ETH itself, not the ETFs. So why exactly are we seeing the ETF inflows and corporate ETH buying coinciding?

It’s perhaps as simple as there being a clearer narrative for ethereum now, Bloomberg Intelligence’s James Seyffart told me. He noted Tom Lee’s interviews as likely contributing to the demand.

“Combined with the fact that ETH bottomed and took off like a rocket ship and people are piling on,” Seyffart said. “Throw in the [digital asset treasury companies’] narrative and it’s all contributing to the price and flows for ETH and ETH ETFs.”

ETH holds the YTD return edge over BTC, 35% to 25%. Here’s what ETH price has done in the last month, as of 2 pm ET:

But bitcoin ETFs are likely to remain dominant in the FLOW category in the long term given their simpler proposition as a digital store of value, Seyffart added. Even with the recent ETH ETF momentum, global BTC products have the net inflow edge in 2025: ~$24 billion to ~$12 billion.

“That said, if [ETH] gets to a point where its market value surpasses bitcoin, it’s likely the ETF side of things WOULD follow suit,” he noted.

Currently at $2.3 trillion for BTC and $540 billion for ETH, that would take a lot.

Near- and long-term ETH expectations

I’ve written how industry watchers expect a 25bps rate cut from the Fed tomorrow, given soft labor market data. Lower rates generally support risk assets like BTC and ETH.

That said, the bar for a positive surprise is now high, said LMAX Group’s Joel Kruger.

“With aggressive Fed easing already priced in, any indication that the committee is less dovish than anticipated could disappoint markets, lifting yields and weighing on equities and crypto alike,” he told me.

Longer-term, Hashdex CIO Samir Kerbage wrote that ETH’s role as “global plumbing” strengthens as infrastructure scales and tokenization explodes. He expects ETH to surpass $10,000 “once we start to see stablecoin solutions being implemented for US payments.”

As per usual, time will tell.

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.