VanEck Charges Ahead: Filing for Revolutionary Hyperliquid Staking ETF and European ETP

Wall Street meets DeFi as VanEck pushes traditional finance boundaries.

BREAKING THE MOLD

VanEck isn't just dipping toes—it's diving headfirst into liquid staking. The asset manager's latest move targets the red-hot Hyperliquid ecosystem, seeking regulatory approval for products that bridge traditional finance with decentralized yield opportunities.

EUROPEAN EXPANSION

Across the pond, the European ETP filing signals serious institutional appetite. This isn't just another crypto product—it's structured exposure designed for sophisticated investors craving staking rewards without operational headaches.

THE BOTTOM LINE

Traditional finance finally acknowledges what crypto natives knew years ago: staking yields beat those pathetic traditional savings rates. Maybe banks will finally offer more than 0.5% interest now that competition arrives in an ETF wrapper.

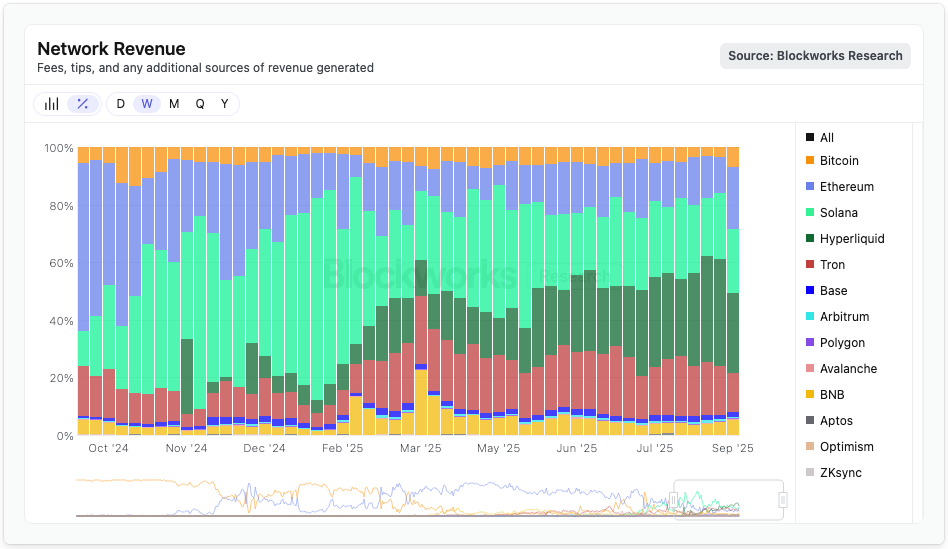

Source: Blockworks Research

Source: Blockworks Research

VanEck finds Hyperliquid to be an attractive ETF candidate because it has “plenty of demand” but does not currently trade on major US crypto exchanges like Coinbase, Dacruz said. A HYPE staking ETF would give US investors better access to the token — and perhaps nudge exchanges to list the token, he added.

The firm’s Hyperliquid products WOULD depend on regulatory approval, although 21Shares successfully launched a European Hyperliquid ETP in August.

In the US, approvals may take a little more time. The SEC has a slew of crypto ETF applications to work through, including ones for larger tokens like XRP and SOL.

VanEck has also applied to list ETFs for AVAX, SOL, JitoSOL, and BNB.

The MOVE comes amid a sweepstakes to issue USDH, a ticker reserved for a Hyperliquid-aligned stablecoin. One of the contestants is Agora, a stablecoin startup co-founded by Nick van Eck, son of VanEck CEO Jan van Eck. The senior van Eck posted on X defending Agora’s proposal to issue USDH, and VanEck reportedly helps manage Agora’s reserves.

The CEO also added that the firm is “bullish Hyperliquid.”

Dacruz said VanEck’s decision to file for Hyperliquid ETPs is“completely separate” from Agora’s USDH bid and stressed that the products are not contingent on Agora being USDH’s issuer. He also noted Agora and VanEck are separate entities.

If VanEck gets its HYPE ETF filing in first, it would continue a trend for the firm, which was also first to file for both Solana and ethereum ETFs.

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.