Inside the S&P 500’s HOOD Inclusion and MSTR Rebuff: What Wall Street Isn’t Telling You

The index gods giveth, and the index gods taketh away—welcome to modern finance's most arbitrary selection process.

HOOD's Meteoric Ascent

Robinhood cracks the S&P's velvet ropes—retail's favorite trading app now sits at the big kids' table. The inclusion signals more than just market cap growth; it represents traditional finance's reluctant embrace of democratized trading platforms.

MSTR's Cold Shoulder

Meanwhile, MicroStrategy gets the institutional silent treatment—the S&P committee apparently isn't buying the 'Bitcoin proxy' narrative. The rejection speaks volumes about Wall Street's continued skepticism toward crypto-adjacent plays, no matter how massive their treasury allocations become.

The selection process remains as transparent as a hedge fund's fee structure—because nothing says 'market efficiency' like a committee deciding which companies make the cut behind closed doors.

Robinhood’s crypto transaction revenue was $160 million in Q2 — making up ~30% of the company’s $539 million in overall transaction revenue. That $160 million figure was down ~37% from Q1 crypto revenue, but marked a 98% year-over-year increase.

Robinhood has doubled down on crypto this year, launching stock tokens in Europe and crypto staking to eligible US customers. It also closed its acquisition of Bitstamp and even shared plans for a layer-2 blockchain.

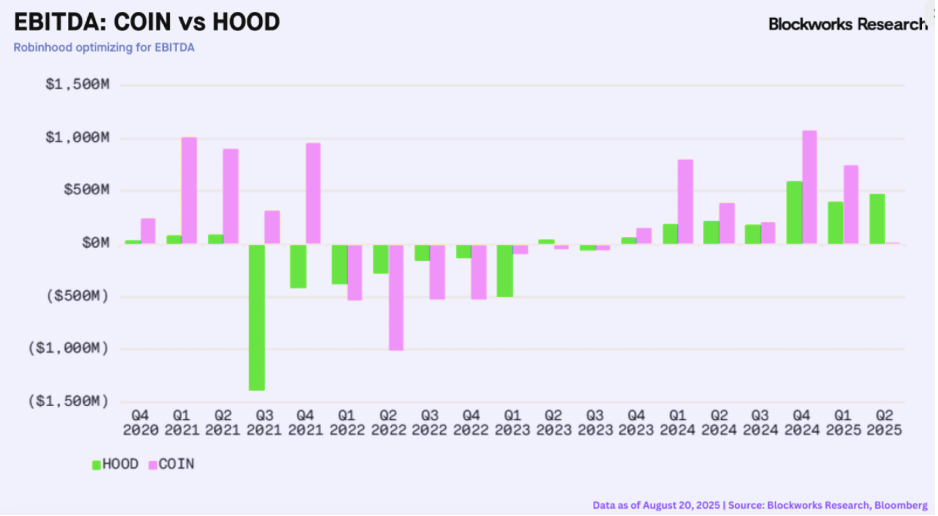

So investors with capital in an S&P 500 fund will soon be exposed to both COIN and HOOD automatically. But those still looking to choose between them may consider what Blockworks Research analyst Marc Arjoon called the “beta vs. balance” trade-off.

“Coinbase offers superior upside convexity to crypto cycles but with materially higher earnings volatility,” he wrote in an Aug. 29 report. “Robinhood’s improving, more repeatable EBITDA supports a higher quality multiple.”

Despite speculation that Michael Saylor’s Strategy could also be added to the S&P 500, the largest corporate holder of bitcoin was left out of the index for now. Strategy’s market cap of $93 billion is ~4x above the S&P 500 minimum of $22.7 billion, making it one of the biggest companies not in the index.

The omission says less about Strategy’s business and more about the index committee’s evolving comfort level with bitcoin-centric corporate models, Benchmark analyst Mark Palmer argued in a Monday research note. The company, after all, logged a profitable second quarter — the last criteria it required for S&P 500 inclusion.

“But the index is not a purely rules-based club,” Palmer added. “The committee explicitly reserves judgment to maintain sector balance and index representativeness such that a company can ‘check all the boxes’ and still find itself waiting for a slot.”

Loading Tweet..Finally, it’s worth mentioning that CoinShares yesterday revealed a plan to go public in the US later this year via a deal with a SPAC called Vine Hill Capital Investment Corp. It’s currently listed on the Nasdaq Stockholm.

It’s part of CoinShares’ broader strategy to expand in the US after buying Valkyrie’s fund business last year. The largest crypto ETP issuer in Europe has seen its assets under management triple to about $10 billion over the past two years.

This comes a couple months after we saw competing asset manager Grayscale appear to take a step toward going public. All’s to say, the year of crypto-public markets intersection rages on.

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.