Lido’s Game-Changing Earn Vaults Launch with Veda and Mellow - Simplified Staking Just Dropped

Lido shatters DeFi complexity with sleek new Earn vaults—partnering with Veda and Mellow to deliver one-click yield.

Streamlined Staking, Zero Headaches

Gone are the days of navigating labyrinthine protocols. Lido's vault architecture automates optimal yield strategies while cutting technical barriers—finally making institutional-grade returns accessible to mainstream users.

Veda's oracle infrastructure feeds real-time pricing, while Mellow's yield optimization handles the heavy lifting. The result? A passive income pipeline that bypasses traditional finance's gatekeepers.

Because why let banks take a cut when code can do it better?

Another 'innovation' that basically automates what crypto should've been doing all along—but hey, at least the suits might finally get it.

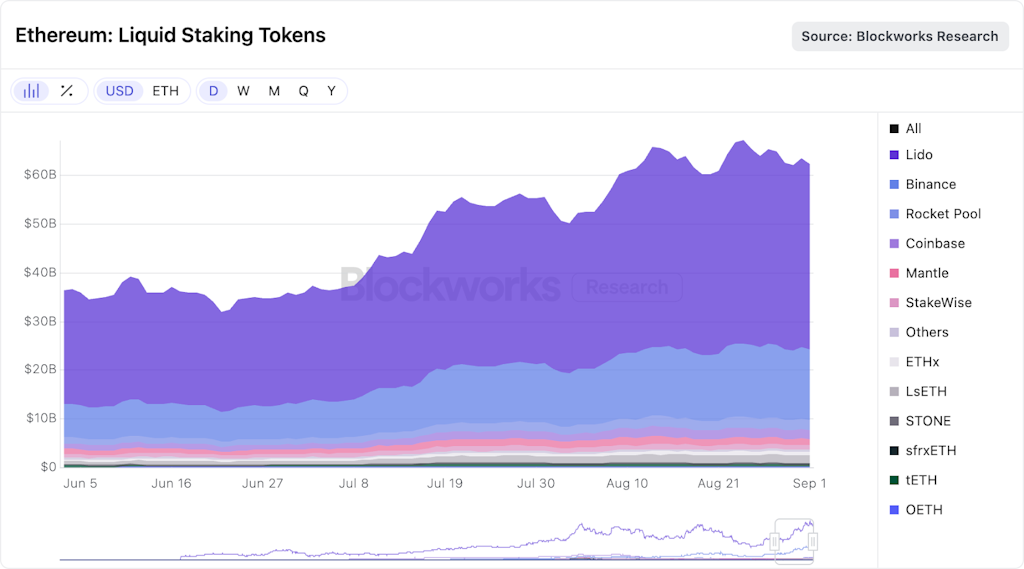

Source: Blockworks Research

Source: Blockworks Research

The Mellow alternative

The second strategy listed in Earn, DVV, is built on Mellow’s modular vault architecture and introduces a different approach — this time centered on validator decentralization. Each strategy is boxed into an isolated “Subvault,” designed to prevent unintended interactions.

“Each Subvault is an isolated module with its own rules. It can only hold a limited number of shares, accept deposits in a predefined set of assets, and execute a restricted list of calls,” Mellow founder Nick Stoev told Blockworks.

Control over these vaults is initially shared between Mellow and Lido via a 5-of-8 multisig. Price reporting and redemption processes, meanwhile, are structured to resist manipulation.

“If the report is flagged as suspicious, it must be explicitly accepted by an authorized acceptor in a separate transaction before being processed,” Stoev said.

Redemption requests are handled in batches, and everyone in a batch receives the same price.

“Redemption requests are queued and processed in batches at the next oracle update,” Stoev noted, “and all requests in the batch receive the same price.”

That price is fixed at the time of the oracle report, not during the final withdrawal.

“Liquidity settlement occurs in a separate step: It may be immediate after the price report or staged.” The batch price is fixed, but settlement can be configured between 1 day and 2 weeks.

Even for addresses with fast-lane permissions — a whitelisted set of entities that are granted privileged access to faster deposits and withdrawals from Mellow’s vaults — access is constrained by pricing rules.

Some strategies will touch centralized exchanges, in which case asset custody is protected through Copper’s MPC-based ClearLoop integration “or equivalent infrastructure,” Stoev said. Thanks to MPC, “no single party ever controls the private key; transactions require joint cryptographic authorization,” he added, describing a design meant to keep assets segregated and avoid rule out rehypothecation.

For stETH holders, Stoev confirmed the vaults adhere to Lido’s core design guardrails.

“Subvaults anchored to stETH interact directly with the Lido protocol and comply with the ‘no harm to stETH users’ constraint,” he said.

With GGV now live and DVV arriving in mid-September, Earn brings Lido users a new way to access DeFi and validator yields, off-loading most of the effort while keeping safety and simplicity top of mind.

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.