Beyond Launchpads: Why Crypto’s Mass Adoption Demands More Than Just Token Launches

Crypto's infrastructure obsession misses the bigger picture—real adoption requires solving actual human problems, not just creating more trading instruments.

The User Experience Gap

Mainstream users won't tolerate seed phrases or gas fees. Until blockchain interactions become as seamless as tapping a credit card, we're building for speculators, not users.

Regulatory Headwinds

The SEC's enforcement-first approach creates uncertainty that keeps institutional money sidelined. Clear frameworks—not more memecoins—would unlock trillions in traditional finance capital.

Real-World Utility Deficit

Show me one blockchain application that outperforms existing solutions for non-crypto natives. Exactly—until we solve real pain points better than Web2, adoption remains theoretical.

Wall Street's watching—they'll adopt when returns outweigh compliance headaches, not a moment sooner. The industry's obsession with launchpads feels like rearranging deck chairs on the Titanic while ignoring the iceberg of usability issues.

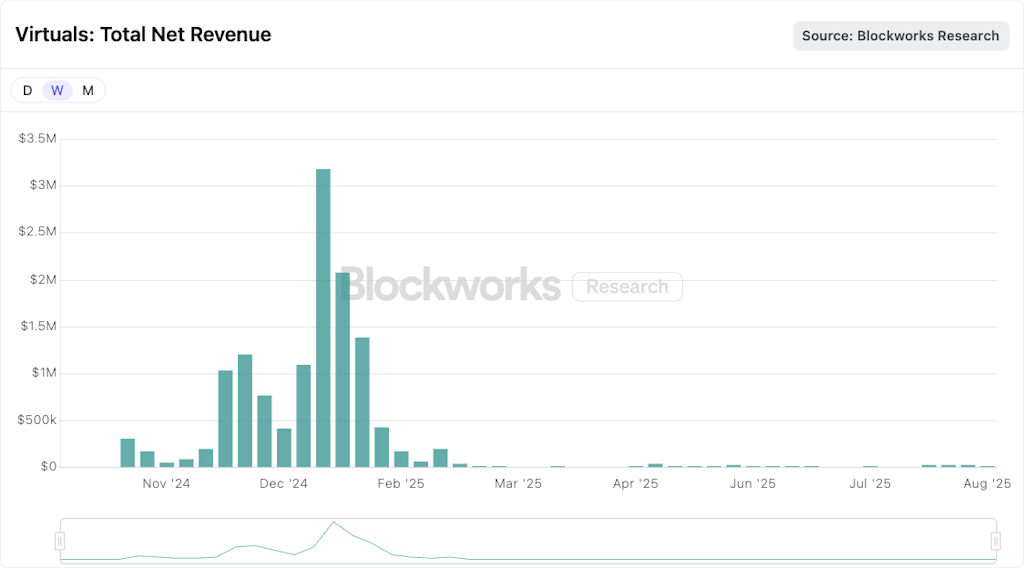

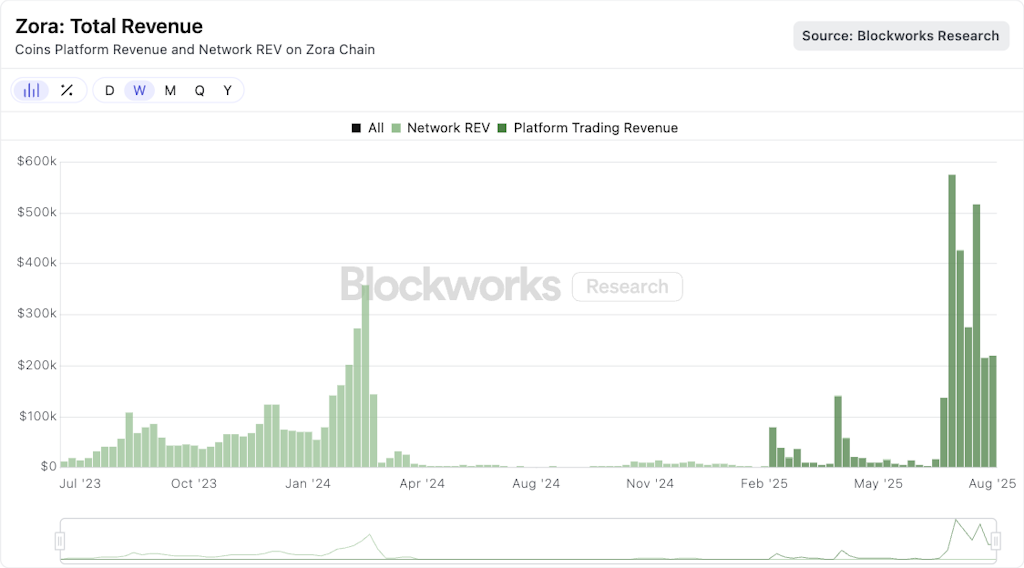

Zora, which supports creator coins and turns every post into a tradable coin, has otherwise arrived at a key inflection point.

On one hand, August was a record month for Zora protocol revenue, reaching $1.3 million, and number of posts, with 1.1 million pieces of content tokenized. But on the weekly scale, revenue has fallen by more than half and stayed there for the past fortnight running, with only $20,000 per day a regular occurrence right now.

The total number of posting accounts has also dropped to about 8,000 per day, down 60% from an August 14 peak of 21,000.

Of course, it’s too early to call time on Zora, and maybe these ups and downs will become mere blips on the path to mass adoption by content creators and consumers.

It’s more likely that both Zora and Virtuals have simply run headfirst into the same wall: There’s just not enough people in crypto who want to do more than trade on exchanges to consistently drive growth.

To be clear: Trading apps are apps too. With that in mind, Base does have a relatively popular app in Aerodrome, the AMM that’s pulling in anywhere from two-thirds to three-quarters of total app revenue on Base, per BWR data.

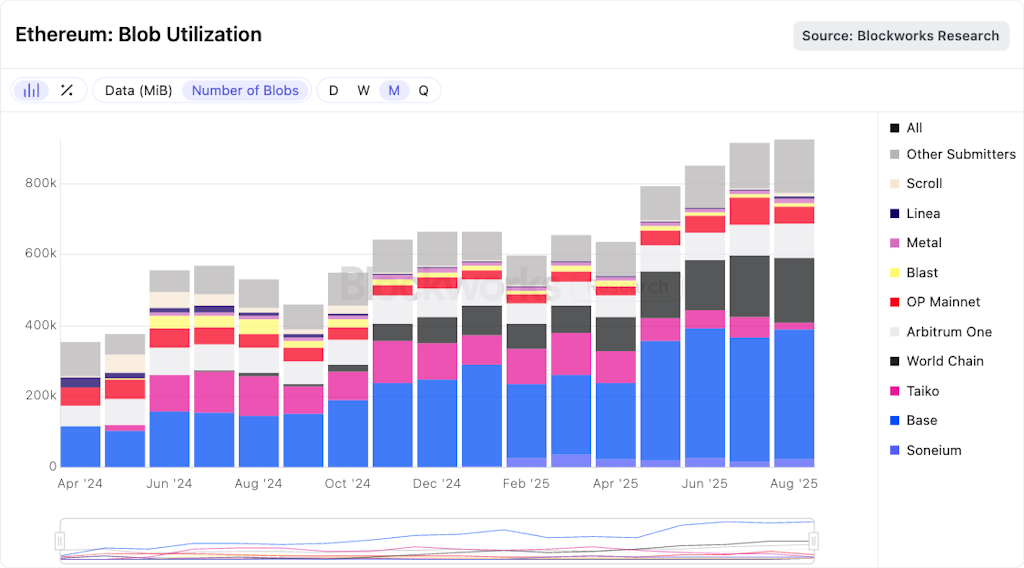

That’s around $15 million last month, which is decent but less than half the revenue made by pump.fun. It’s enough to place in first place when it comes to ethereum layer-2s, with about 40% of all blobs posted to Ethereum mainnet coming from Base right now.

However, to the outside world, DEXs, AMMs, launchpads and so on are not “apps” in the traditional sense. Which, when we’re discussing heady concepts like massive mainstream adoption and widespread tokenization, is about all that really matters.

To the general public, an app needs to serve a purpose other than financial speculation, else it’s just a gaming venue in the minds of many and no different than PokerStars or DraftKings. Think Uber, AirBnB, Spotify, MyFitnessPal, Instagram, TikTok and Tinder, more than Robinhood and Trade Republic.

This dichotomy is why even Polymarket transcending the culture chasm might not be particularly satisfying, at least in a holistic sense.

While there’s certainly room for prediction markets to serve as “truth oracles” in our inevitable hyperfinancialized, media-minimized future, for now Polymarket is just a venue for betting on stuff happening in the culture. Markets related to politics attract about one-third of all open interest right now, followed by markets related to crypto prices (15%) and sports (12%).

Zora and Virtuals are indeed cool in their own ways. Helping creators to monetize their work and build fan bases with crypto is compelling, and has been for the better part of a decade, dating right back to Steemit. And perhaps AI agents will indeed be the eventual gateway for regular humans to interact with blockchain protocols — why not gain exposure to the most popular ones?

Loading Tweet..Underneath all the branding and presentation, however, Zora and Virtuals are still launchpads, and generously assuming that active addresses translate to active users apparently means there are only at most 20,000 or so people in crypto today willing to experiment with them (and slog through the often tricky EVM user experience, at least).

That’s with the indirect support of Coinbase, the closest thing crypto has to a majorly influential corporate powerhouse.

Maybe next cycle, there will be 50,000 willing participants. But I have a feeling the outside world won’t be convinced.

In the crypto space, tokenization for tokenization’s sake makes sense — everything that can be digitally represented is technically valuable. And depending on how broad your definition of value, intrinsically so.

The real question is thus: to whom, and for how long?

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.