Bitcoin’s Supply Crisis: Why the Entire Curve Says You’re Already Too Late

The math doesn't lie—we're staring down a brutal supply crunch.

The 21 million cap just got real

Whales and retail traders finally agree on something: there aren't enough satoshis to go around. With institutional adoption accelerating and halvings slicing new supply, the 'digital gold' narrative is colliding with cold, hard arithmetic.

Your keys, your problem now

Exchanges report record BTC withdrawals as investors wake up to custody risks. Meanwhile, Wall Street's shiny new ETFs vacuum up coins faster than miners can mint them—turns out 'number go up' works better when supply actually exists.

The coming FOMO singularity

As price discovery meets absolute scarcity, we're entering the phase where 'buy the dip' becomes 'beg for scraps.' (But hey—at least your financial advisor finally believes in Bitcoin...right after BlackRock did.)

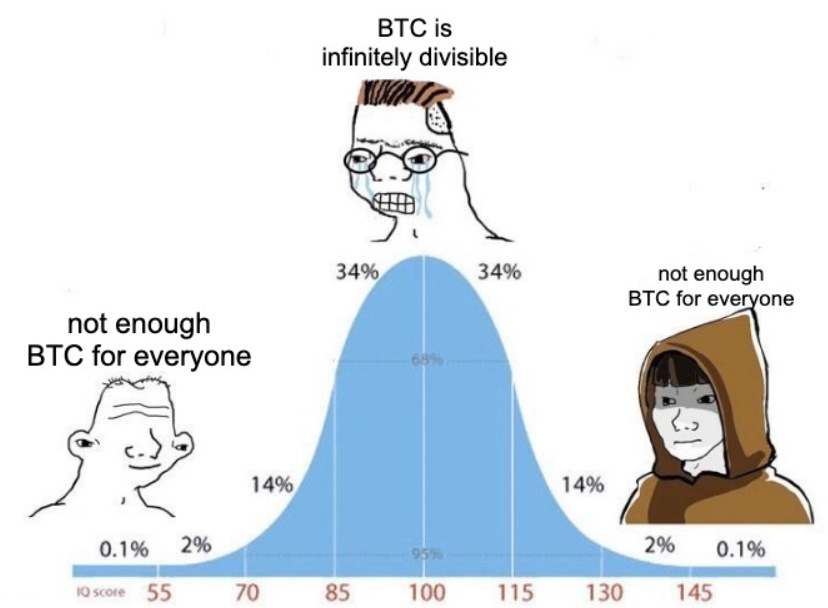

Mid-curving is almost never the optimal strategy. Except for, perhaps, very specific points in a cycle — particularly in DEEP bear markets, when vibes and narratives are less powerful.

Right now, the extreme ends of the bell curve are both screaming one thing: There’s not enough Bitcoin for everyone.

For example, the left-curve take on bitcoin scarcity goes something like this:

Bitcoin is currently only programmed to release 21 million BTC. Most of it has already been mined.

In fact, mining proceeds are now a tiny drop in the bucket compared to the trading activity across Binance and Coinbase, equivalent to less than 1% of their combined daily volume.

Now subtract the coins that are believed to have been lost — up to an estimated 4 million coins, or almost 20% of the entire intended supply.

We’re left with 15.9 million BTC in circulation right now. At the same time, there are more than 58 million USD millionaires around the world. That puts the millionaire-to-bitcoin ratio at 3.6-to-1.

If you think the smart money (millionaires) will increasingly want to buy bitcoin over time — at size — then there’s only one way the price can go. Up. It’s simple supply and demand.

Mid-curvers WOULD point out that bitcoin is divisible by eight decimal places. So while whole bitcoin is scarce, individual satoshis are obviously anything but.

For neatness’ sake, we’ll say the current circulating supply of sats, minus the ones supposedly lost forever, is 1,590,000,000,000,000. That’s one quadrillion, five hundred ninety trillion sats — 190,000x larger than the total human population.

So, an even distribution of the current sat supply to every person on Earth would equate to 190,000 sats.

A common rebuttal to this logic has historically been, fittingly, about pizza. Imagine you have a delicious cheese pizza, and you need to feed a village with it. Except it’s nowhere NEAR big enough.

Does cutting it into infinitely smaller slices help? Of course not, you’re left with the same amount of pizza. 1 pizza = 1 pizza; 1 BTC = 1 BTC.

Clearly, the pizza rebuttal has a flaw: Imagine that each one of those tiny slices can grow into a giant pizza, like adding water to one of those toys that rapidly expand when wet. Suddenly, the whole village can be easily fed, and perhaps even the neighbouring villages, too.

Along the same lines, consensus is forming that bitcoin is destined to reach $1 million per coin. Bloomberg Terminal just began denominating BTC in millions (current price: $0.122 million).

Now let’s take it to the extreme.

If hyperbitcoinization really happens and bitcoin becomes worth, say, $500 million apiece, then each satoshi would be equal to about $5. At that point, perhaps we would be marveling at the price of individual sats instead of whole bitcoins.

And besides, it’s technically possible to add even more decimal points to bitcoin, somewhere down the line, where whole coins are impossibly expensive. Lightning even tracks so-called “millisatoshis,” miniscule units that are 1/1000 of a sat.

But remember, this is no time for mid-curving. If you fancy yourself on the right-hand side of the curve, then the sentiment is exactly the same as the left: there’s not enough BTC for everyone, as proven by its recent repeated all-time highs.

It’s simple supply and demand.

- The Breakdown: Decoding crypto and the markets. Daily.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- 0xResearch: Alpha directly in your inbox.

- Lightspeed: All things Solana.

- The Drop: Apps, games, memes and more.

- Supply Shock: Bitcoin, bitcoin, bitcoin.