The Day George Clooney Sent Bitcoin Crashing Below $0.01: A Wild Crypto Tale

Hollywood meets blockchain—and chaos ensues. When A-lister George Clooney's name got tangled in a bizarre market manipulation scheme, Bitcoin briefly nosedived to sub-penny levels. Here's how celebrity power warped crypto's reality.

The Flash Crash That Defied Logic

Markets blinked. Traders gasped. For one surreal moment, Bitcoin traded like a defunct meme stock—all because of a fabricated Clooney connection. Exchanges scrambled to halt trading as liquidity evaporated faster than a Netflix biopic budget.

Celebrity Crypto Contagion

The incident exposed crypto's lingering celebrity obsession—where a single name can still move markets more than fundamental analysis. (Take notes, Wall Street analysts who spent 80-hour weeks on tokenomics reports.)

Regulators later confirmed the crash stemmed from coordinated wash trading—proving once again that in crypto, truth really is stranger than fiction. The ultimate irony? Clooney himself reportedly holds zero Bitcoin—preferring tequila investments that actually age well.

The pastebin that sent bitcoin to zero

The pastebin that sent bitcoin to zero

As it turned out, ~cRazIeStinGeR~ may have told the truth. Preceding the crash, an unidentified user on the long-gone InsidePro password recovery forums, “georgeclooney,” asked for help in cracking hashed passwords from the stolen database.

A number of the hashes were weak and were quickly brute-forced, according to a timeline of events pieced together by investor Marc Bevand. “Some users discovering the leak have run password brute-forcers themselves against the hash list and easily broke hundreds of them. Contrary to previous claims from the MtGox owner, this indicates that many accounts had been compromised for at least days, if not weeks, before today’s attack.”

And considering georgeclooney knew about the hashes before the database was leaked online, Bevand concluded that they were likely the same person who sent bitcoin spiraling.

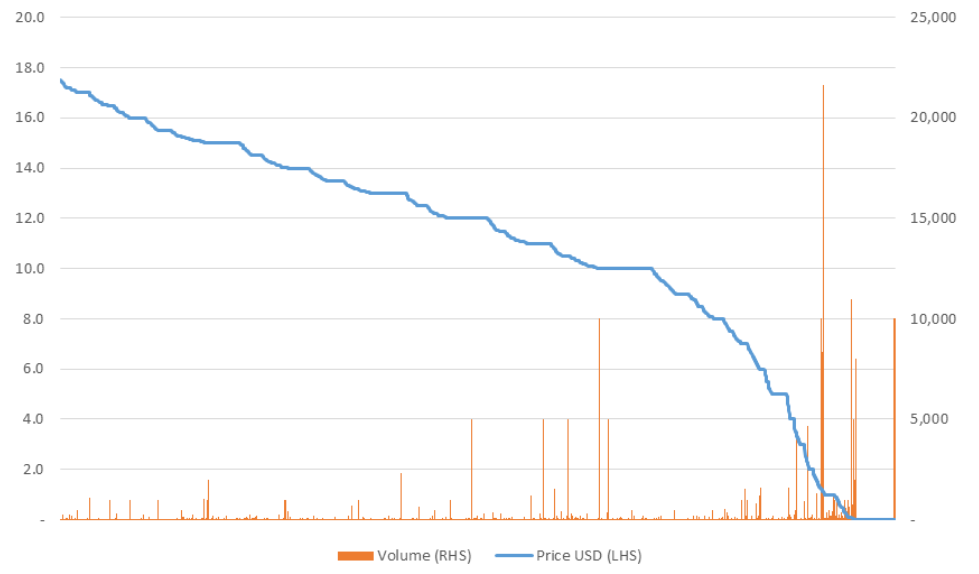

At exactly 36 seconds past 5:15pm, UTC, on June 19, 2011, that person placed a number of orders to sell hundreds of thousands of bitcoins at once. Bevand reported that it took 30 minutes for Mt. Gox to process those orders and had been totally unresponsive during that time, as is reflected in BitcoinChannel’s video.

In total, the hacker had traded more than $1.5 million BTC out of a total daily volume of $1.8 million. They then appeared to attempt to buy bitcoin back on the way up for more profits, as did other users, driving bitcoin’s price back up to a few dollars.

One user in particular, “Kevin,” claimed to have bought 259,684 BTC for $3,000 ($0.016 on average) but was only able to withdraw 643 BTC before Karpelès took Mt. Gox offline to sort through the mess.

In the end, Mt. Gox was saved due to its $1,000 withdrawal limits for both US dollars and bitcoins (the latter of which was unknown to the public until this event). These limits contained most of the damage to the platform’s internal, offchain order books.

Karpelès opted to roll back the trading engine to before the compromised accounts began their coordinated dumps, a MOVE which faced controversy at the time. It’s believed up to around 900 accounts may have been affected, and the platform would stay closed until August.

It could be that the hacker knew about the withdrawal limits, and chose to crash the price of bitcoin, perhaps as part of a plot to siphon up to 100,000 BTC, if they were priced at $0.01 apiece, thereby skirting the $1,000 cap.

“Or perhaps, as it is sometimes the case, the attacker’s purpose was simply to cause mayhem for fun (think a script kiddie doing random things). Not all attackers are like the well-prepared robbers in Ocean’s 11, with a precise plan of action. This is probably the simplest explanation,” Bevand wrote.

- The Breakdown: Decoding crypto and the markets. Daily.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- 0xResearch: Alpha directly in your inbox.

- Lightspeed: All things Solana.

- The Drop: Apps, games, memes and more.

- Supply Shock: Bitcoin, bitcoin, bitcoin.