Revolutionizing Crypto: The Breakthrough Framework for Unprecedented Token Market Transparency

Crypto's dirty little secret? Nobody really knows what's happening under the hood. Until now.

Forget the smoke-and-mirrors act plaguing digital asset markets. A radical new transparency protocol is tearing down the curtains—and Wall Street's playbook won't work here.

How This Changes Everything

Real-time settlement tracking cuts through wash trading nonsense. On-chain verification bypasses 'trust us' middlemen. Suddenly, that 'organic' 300% token pump looks... different.

The Fine Print

Early adopters report 90% fewer 'unexplained' wallet movements. Of course, some funds still can't decide if they prefer transparency or their offshore accounting tricks.

One thing's certain: When the SEC finally catches up in 2027, they'll claim they invented the concept.

The Initial Cohort

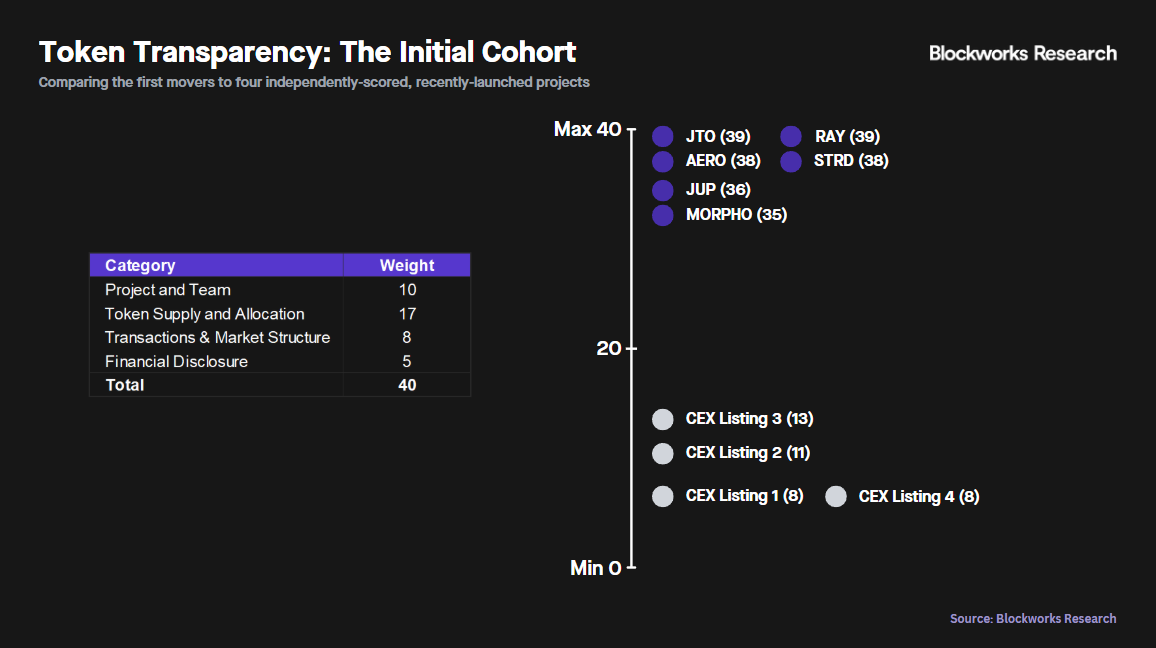

The framework is now live with an initial cohort of project submissions, including Jito, Aerodrome, Raydium, Stride, Jupiter and Morpho. Completed submissions are publicly available on the Blockworks website, and we encourage other token projects to reach out and apply.

I have immense respect for all teams that participated in the initial round of disclosures. There is no precedent for transparency; these are the first movers that set a new bar.

The transparency scores of the initial cohort all exceed 35, showcasing high visibility into each project’s operations. This will serve as a credible signal in a field of noise that will show the market these players are long-term oriented.

We were excited to see this push previously inaccessible information to the market, especially in responses related to the relationship between token and equity, any advisory billings to the foundation, and market Maker agreements.

To put the scores of the initial cohort into perspective, we independently scored four recently launched projects that we believe have taken advantage of the lack of disclosure in this industry. The transparency scores of the problem group range from 8 to 13 — a stark contrast to the initial cohort. Yet, each of these tokens was still listed on a centralized exchange.

Note, these scores are just for comparative purposes, as we did not reach out to these teams for additional information outside of what is already publicly available.

Framework Details

The framework’s criteria are divided into four categories:

- Project and Team

- Token Supply and Allocation

- Transactions & Market Structure

- Financial Disclosure

Investors gain visibility into the operations of businesses and limit the risk of manipulation and abuse through transparent disclosure of these criteria. Negative events across the market in recent months prove the need for a standardized transparency standard.

Each criterion is weighted 0–3 by materiality. Then, it is calculated and aggregated into a “transparency score” that reflects the project’s transparency.

Importantly, this score isa quality assessment on the team or project. Rather, it is a measure of the project or team’s overall transparency.

The responses, scores, and the framework itself will all be open source and publicly available to access.

Blockworks calls on the community to provide feedback on the criteria, for projects to complete the framework, for exchanges to use the framework as a resource in the listings process, and for investors to leverage the framework for due diligence.

We view this as a working document subject to future improvements and iteration. For a deeper conversation, reach out at [email protected].

- The Breakdown: Decoding crypto and the markets. Daily.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- 0xResearch: Alpha directly in your inbox.

- Lightspeed: All things Solana.

- The Drop: Apps, games, memes and more.

- Supply Shock: Bitcoin, bitcoin, bitcoin.