Consumer Crypto Goes Mainstream: How 3 Projects Are Rewriting the Rules

Forget niche traders—these protocols are bringing digital assets to the masses. From decentralized social media to gamified savings, crypto’s breaking out of its speculative cage.

Subheading: The TikTok-ification of Finance

One project’s viral referral system makes Coinbase’s 2017 growth look sluggish—and yes, Wall Street analysts are already calling it a ’bubble.’

Subheading: Bypassing Banks, One Coffee at a Time

A micro-payments app now processes more daily transactions than Venmo in three states. Take that, legacy finance fees.

Subheading: When Loyalty Points Meet DeFi

Retailers are quietly replacing coupon systems with tokenized rewards. Suddenly that 2% cashback looks positively medieval.

Close: The revolution won’t be institutionalized. As these projects prove, crypto’s killer app might just be cutting out middlemen—while making finance actually fun.

“Importantly, Pump[dot]fun didn’t invent anything new. It simply addressed latent demand. For years, crypto natives have bent over backwards to issue arbitrary assets with funny names, trade them, and find the next 1000x,” Connor wrote. Pump[dot]fun just simply took advantage of the narrative.

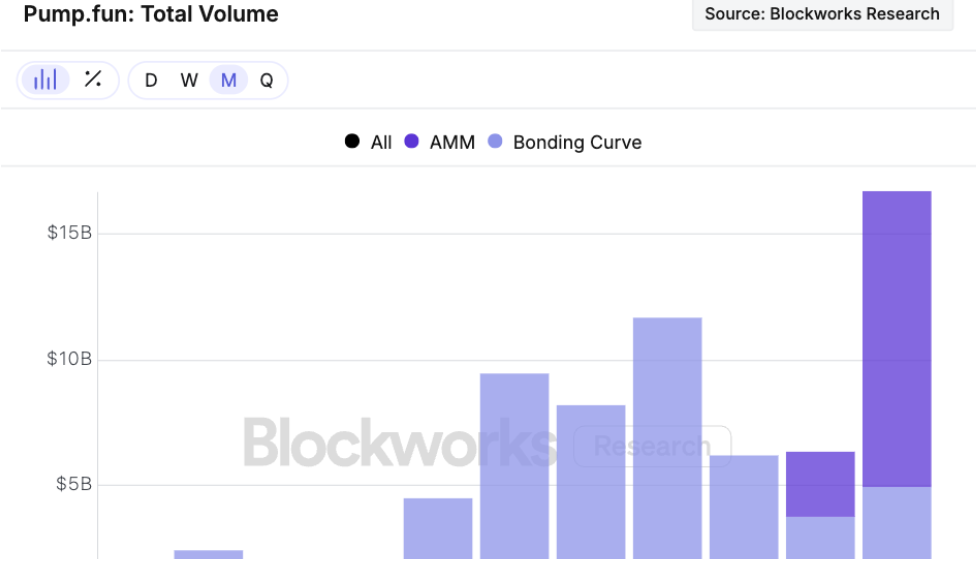

I mean, just take a look at Pump[dot]fun’s total volume.

But the effects go further than just the platform, Connor told me. It’s also sparked a rise in overall memecoins.

“A handful of crypto native funds are telling us they believe Pump[dot]fun style memecoin trading has staying power. We think the market is starting to wake up to this reality, as builders are leaning harder into the category,” he wrote.

Stemming from similar roots, Blockworks Research thinks that social tokens, too, have their own staying power…but they’ll need to somehow sustain value. Time[dot]fun’s sought to solve that issue by allowing creators to both earn trading fees when minutes are sold or bought, and allowing them to earn fees on volume and the redemption of minutes by fans.

For a non-crypto comparison, think Cameo’s playbook.

But Time and Believe each have a ways to go to prove that they can maintain Pump[dot]fun level traction.

Candidly, I’ve had multiple discussions with Connor on Believe and, initially, I was lukewarm to it. But he has a compelling case. And the chart does speak for itself.

Believe is different from either Pump[dot]fun or Time[dot]fun in that it seeks to give traders and developers access to a market where the two can directly interact. The goal is to remove venture capital from the picture and let traders invest in smaller projects aiming to build apps.

“The potential equity valuation of a few million dollars of free cash flow WOULD be low, but let’s say, best case, may be valued at 20M USD via its forward [free cash flow], plus some premium for growth via a large installed base of a few [hundred] thousand or million downloads,” Connor explained.

“While this is a fantastic outcome for the founder, this outcome is too small for a VC portfolio. By targeting this underserved cohort on the supply side, Believe brings venture-like upside to a growing cohort of retail crypto capital,” he said.

If successful, a market for crypto opens up, similar to one giving TradFi traders access to private companies like SpaceX. Undoubtedly, there’s demand, but for how long?

Even with Pump[dot]fun’s record, you can see in the charts that there have been times when activity has dipped due to decreased appetite.

It’s hard to deny the data, though, and for now it looks like these three act as a way to not only get retail investors in the door but keep them active in the space.

- The Breakdown: Decoding crypto and the markets. Daily.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- 0xResearch: Alpha directly in your inbox.

- Lightspeed: All things Solana.

- The Drop: Apps, games, memes and more.

- Supply Shock: Bitcoin, bitcoin, bitcoin.