Corporate Bitcoin Hoarding Hits Record High as Strategy and Metaplanet Double Down

Two firms just flipped the ’irrational exuberance’ switch. Strategy and Metaplanet have ballooned their Bitcoin treasuries to unprecedented levels—because nothing says ’prudent risk management’ like betting the balance sheet on crypto volatility.

Who needs diversified portfolios when you can YOLO into digital scarcity? The move comes as institutional adoption creeps forward, though skeptics note these ’strategic reserves’ look suspiciously like leveraged gambles dressed in suits.

Meanwhile, traditional finance dinosaurs clutch their spreadsheets and whisper: ’But the Sharpe ratio...’

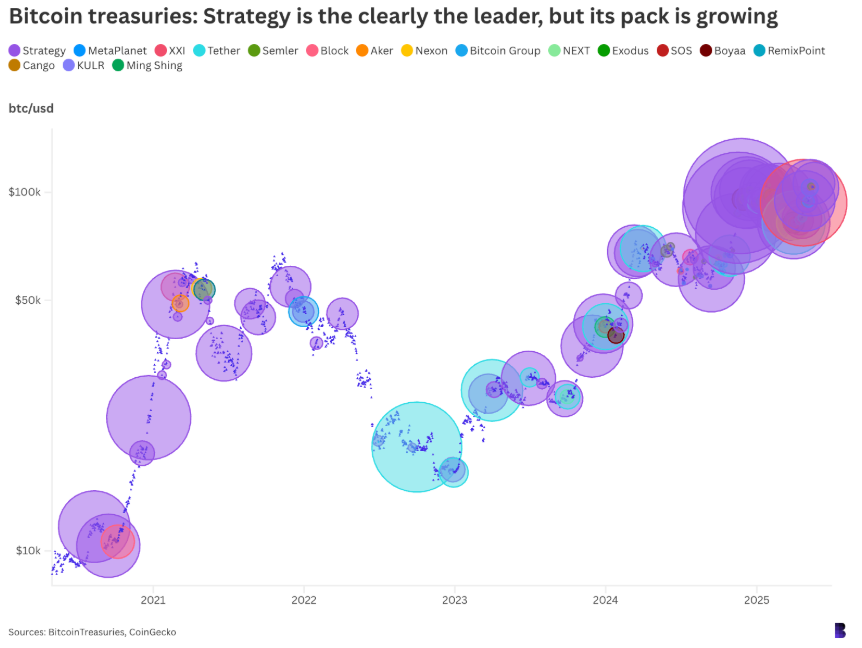

This morning, Strategy disclosed buying another 7,390 coins, bringing its running total to 576,230 BTC ($59 billion). Purple bubbles point to Strategy’s Bitcoin acquisition.

This morning, Strategy disclosed buying another 7,390 coins, bringing its running total to 576,230 BTC ($59 billion). Purple bubbles point to Strategy’s Bitcoin acquisition.

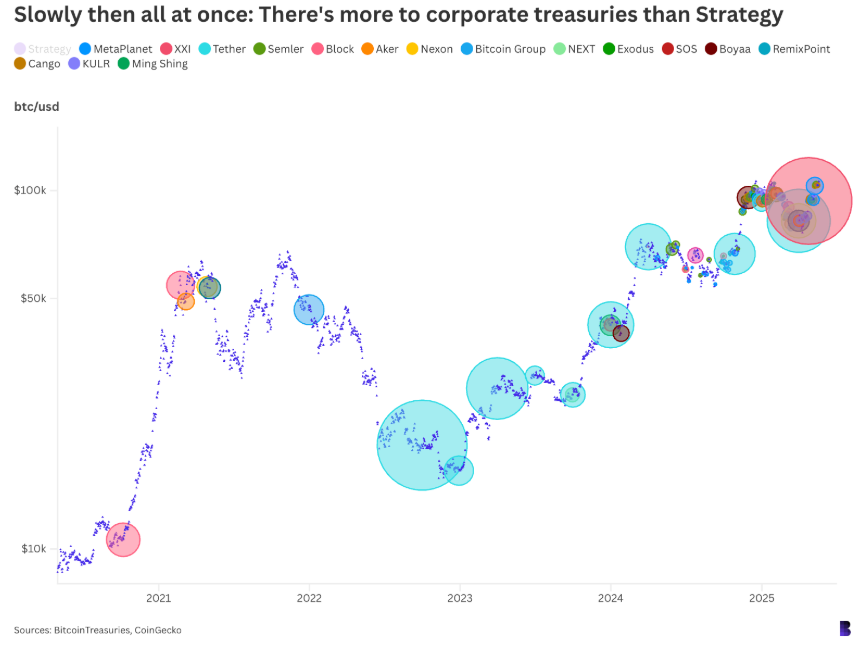

Tether now holds over 25% more bitcoin than it did last October: 100,521 BTC ($10.3 billion) as of its latest disclosure.

Metaplanet holds 700% more coins across the same period, today reaching 7,800 BTC ($800 million). Semler has meanwhile tripled its stack to 3,808 BTC ($390.1 million).

Some of the data on BitcoinTreasuries may be a little screwy (does Block. one really still have 164,000 BTC, worth $16.8 billion?), but that’s besides the point.

The rate at which businesses are adopting bitcoin to reinforce treasuries (and copy the Strategy acquisition playbook) has, in turn, advanced Bitcoin to its intermediate phase.

And just like the internet, mobile phones and social media, businesses were significantly slower to adopt Bitcoin than the public. It was now a decade ago, in 2015, that individuals in Venezuela and Argentina adopted bitcoin to protect their wealth from hyperinflation.

A handful of governments have clearly developed a keen understanding of the technology adoption curve and acted accordingly. We all know what comes next.

- The Breakdown: Decoding crypto and the markets. Daily.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- 0xResearch: Alpha directly in your inbox.

- Lightspeed: All things Solana.

- The Drop: Apps, games, memes and more.

- Supply Shock: Bitcoin, bitcoin, bitcoin.