Jup Lend vs. Kamino: The High-Stakes Battle for DeFi Dominance

Two lending titans are locked in a code war, and the winner takes the liquidity.

Forget the quiet hum of traditional finance. In the decentralized arena, protocols don't just compete—they clash. On one side, Jup Lend, the lending arm of a Solana-native juggernaut, leverages a massive existing user base. On the other, Kamino, a standalone powerhouse built for hyper-efficiency and leveraged strategies. Both promise to unlock yield, but their approaches reveal a fundamental split in DeFi's future.

The Scale Play vs. The Specialist

Jup Lend's strategy is pure network effect. It plugs directly into one of Solana's most formidable liquidity and distribution engines. The bet is simple: seamless integration trumps all. Users already swapping on the aggregator can lend and borrow with a couple of clicks—no new wallets, no new interfaces. It's convenience as a moat.

Kamino takes the opposite tack. It's a fortress of specialized finance, offering concentrated liquidity markets and automated vault strategies that appeal to capital-maximizing degens. It doesn't just want your deposits; it wants to actively manage them for optimal, often riskier, returns. This is yield farming on algorithmic steroids.

Where the Rubber Meets the Road

The real fight boils down to risk models and tokenomics. How does each protocol value collateral in a flash crash? What incentives—real yields or inflationary token emissions—keep liquidity sticky? One might offer the safety of a broad, established ecosystem; the other dangles the tantalizing, higher APY of a focused, aggressive vault. In a sector where 'sustainable' is often a euphemism for 'not yet exploited,' their long-term viability hinges on these unsexy, foundational details.

Choosing a side isn't just about today's rates. It's a vote for a vision. Do you back the integrated super-app aiming to be your one-stop DeFi shop, or the ruthless efficiency engine built by and for yield optimizers? In a market that rewards both liquidity and innovation, this isn't a fight with one winner. But it will decisively show which model the smart money—or at least, the money that hasn't been rekt yet—prefers. After all, in crypto, the best protocol is usually the one that survives the next market cycle without making its users bagholders.

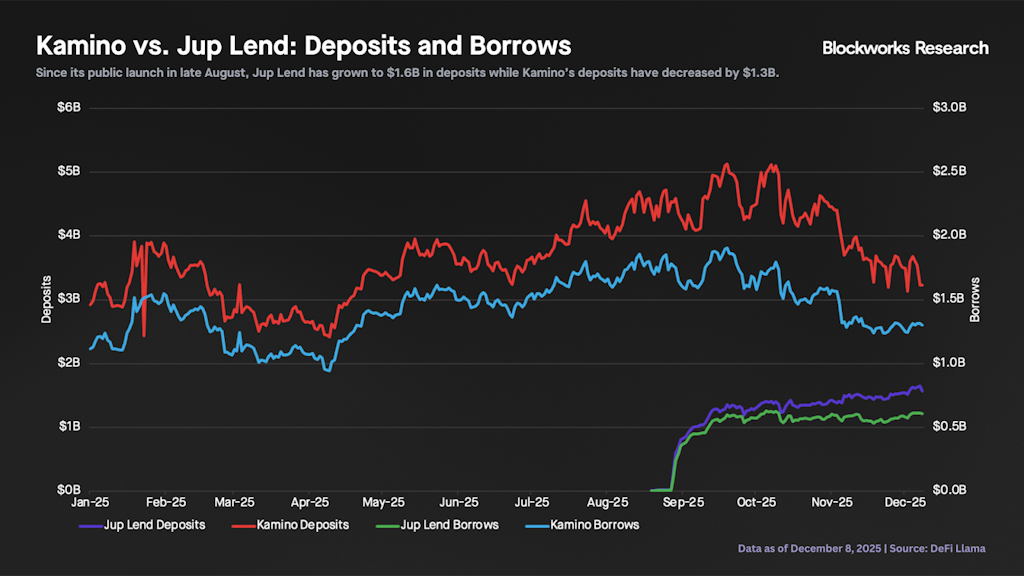

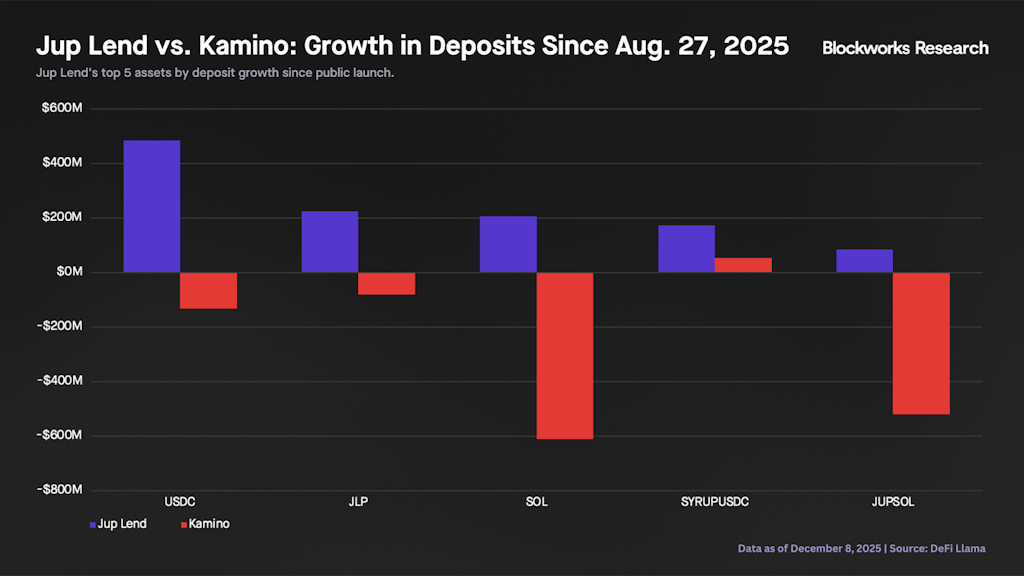

The top five assets by deposit growth since Jup Lend’s launch are USDC ($485 million), JLP ($225 million), SOL ($206 million), syrupUSDC ($174 million), and jupSOL ($85 million). During the same period, Kamino has seen sizable outflows for all of these assets, except syrupUSDC. However, even for syrupUSDC, Jup Lend still attracted roughly 3x more inflows.

Kamino’s growth over the past few months has come from assets not yet supported by Jup Lend. In particular, stablecoin inflows in Q4 have been driven by PYUSD ($42 million) and Phantom’s CASH ($125 million). Kamino has also been proactive in onboarding DATCO LSTs; most notably dfdvSOL and more recently fwdSOL.

Kamino’s PRIME integration stands out as a catalyst that can bring net new inflows into the money market. PRIME gives users exposure to a regulated credit pool backed by US real estate loans originated and serviced through Figure. This integration effectively gives access to a source of yield uncorrelated from crypto markets that may attract more institutional borrowers.

Wrapping up, Kamino and Jup Lend are obviously competitors, and competition is healthy as it drives innovation and ultimately benefits users. That said, as solana Foundation’s Lily Liu noted, instead of fighting with each other, Kamino and Jupiter should focus on growing the pie and capturing market share from other chains and TradFi thereafter. Combined, both money markets still account for less than 10% of Aave’s deposits, and without initiatives like the PRIME integration, it will be impossible to close this gap.

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.