Illuminating Progress: Is a $140K Income ’Poor’ in Today’s Crypto-Boosted Economy?

What does 'wealth' even mean anymore? A six-figure salary, once the hallmark of financial success, now gets you a front-row seat to the housing crisis and a side of avocado toast regret.

The New Math of 'Making It'

Forget the old benchmarks. The goalposts didn't just move—they sprouted rocket engines and blasted off. Traditional career ladders look more like escalators next to the vertical climbs seen in digital asset markets. While a $140,000 salary gets dissected in boardrooms, parallel economies are minting new definitions of value daily.

When Your Salary is the Stablecoin

Fiat paychecks are becoming the boring, low-yield savings account of personal income. The real action—and anxiety—happens off the books, in portfolios that can double or disappear between coffee breaks. It creates a bizarre dissonance: feeling financially secure on paper while watching internet strangers casually post life-changing gains. Talk about a performance review you can't schedule.

The Portfolio Paycheck

This isn't just about side hustles. It's a fundamental rewiring of how we perceive earning power. Active income is for covering the basics; passive, digital-asset growth is for building actual freedom. The most forward-thinking professionals aren't just asking for raises—they're allocating capital into systems that operate 24/7, bypassing the entire concept of a bi-weekly pay cycle.

So, is $140,000 poor? It's the wrong question. The right one is: what's your wallet's APY? After all, in the grand theater of modern finance, your salary is just the cover charge—the real show is in your private keys. And if you're not playing that game, you're not even in the building.

The joke is that someone stuck buying 1800s lighting technology at 1800s costs would indeed be impoverished because they wouldn’t have anything left over to spend on modern healthcare, housing or smartphones.

Green seems to make the same statistical mistake: He looks at modern families spending on vastly superior goods and services without accounting for the vastly superior value they’re getting.

“There is a major conceptual error in Green’s focus on high prices,” Cowen concludes. “Prices are high in large part because demand is high, which can only happen because so many more Americans can afford to buy things.”

$140,000 a year buys a lot of things.

Let’s check the charts.

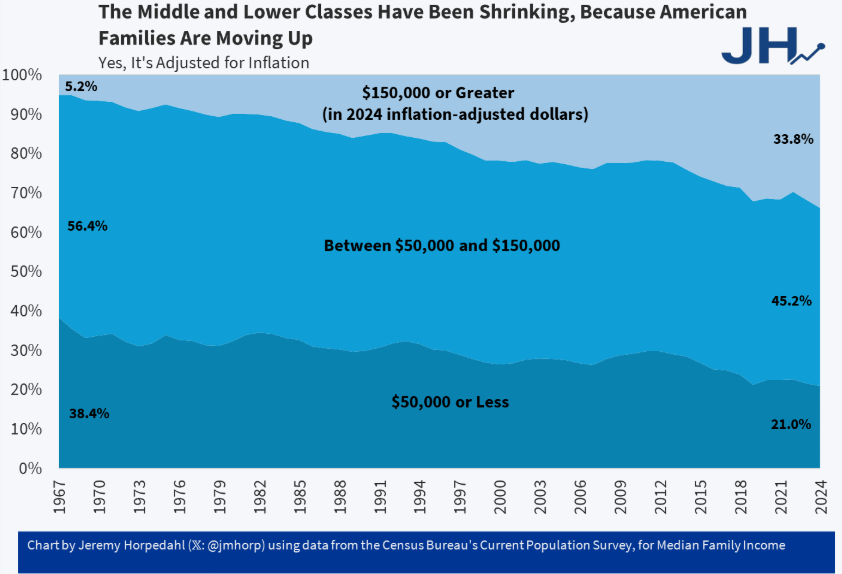

Moving on up:

The US middle class has been shrinking, but only because the upper class has been expanding. In 1967, 5.2% of US families earned over $150,000 (inflation adjusted) vs. nearly 34% now.

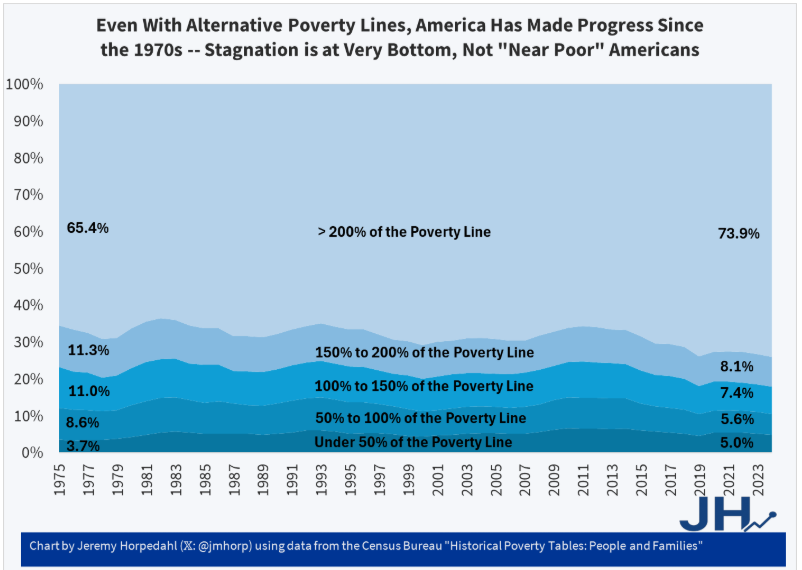

People have been moving up into the middle class, too:

The percentage of Americans with income more than 200% of the federal poverty line (c. $60,000 for a family of four) has risen by 8.5 percentage points since 1975.

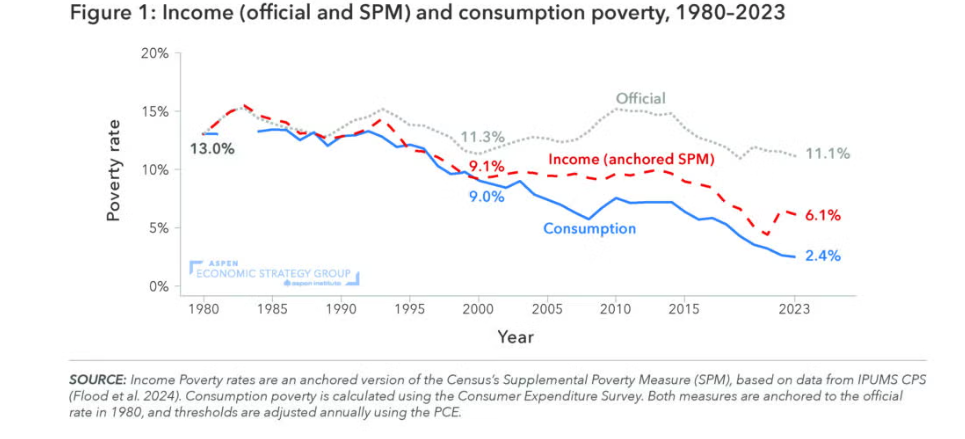

Poverty, however measured, is trending down:

This chart from the Economic Strategy Group shows that poverty has fallen by roughly half according to income-based measures and by more than 80% using consumption-based measures — in both cases, more than government statistics indicate.

Consumption is up:

An academic study of “consumption poverty” (in green) and “after-tax poverty” (in red) shows that the official, CPI-based measure of poverty fails to capture decades of improvement.

More food:

Americans consume about 3,800 calories a day — 15% more than we did in 1985 and roughly 50% more than we’re supposed to.

More healthcare:

8.2% of Americans were uninsured in 2024, down from 16% in 2010.

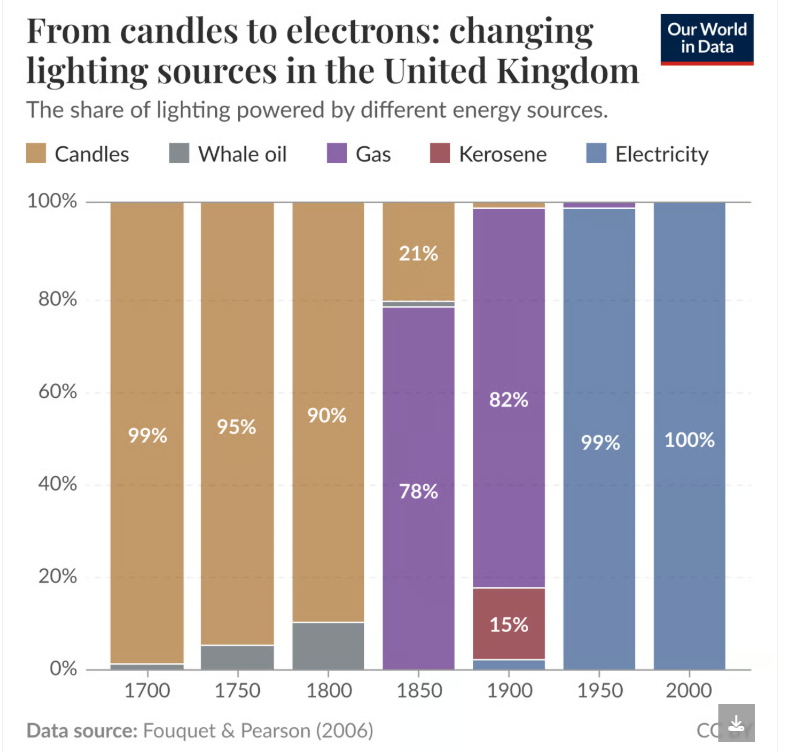

Candles were once a luxury good:

This is a reminder that as recently as 1800, candles were so expensive that it was economic for people to venture out into the oceans and risk their lives hunting whales.

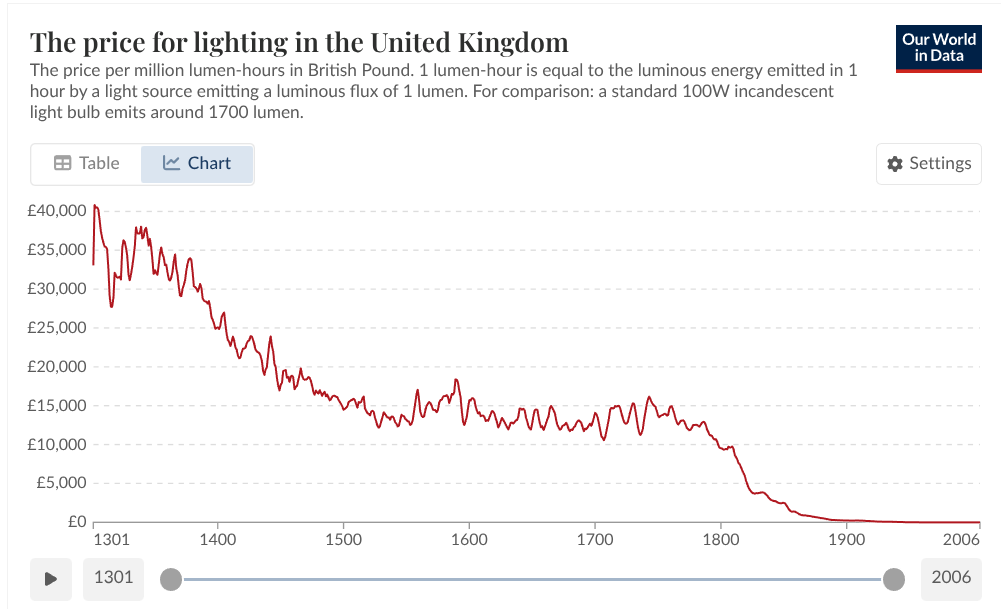

Illuminating:

A million lumen-hours is roughly the amount of light you’d get from an ordinary household light bulb running continuously for about two months. In the year 1300, that would have cost the equivalent of $52,000. Yikes.

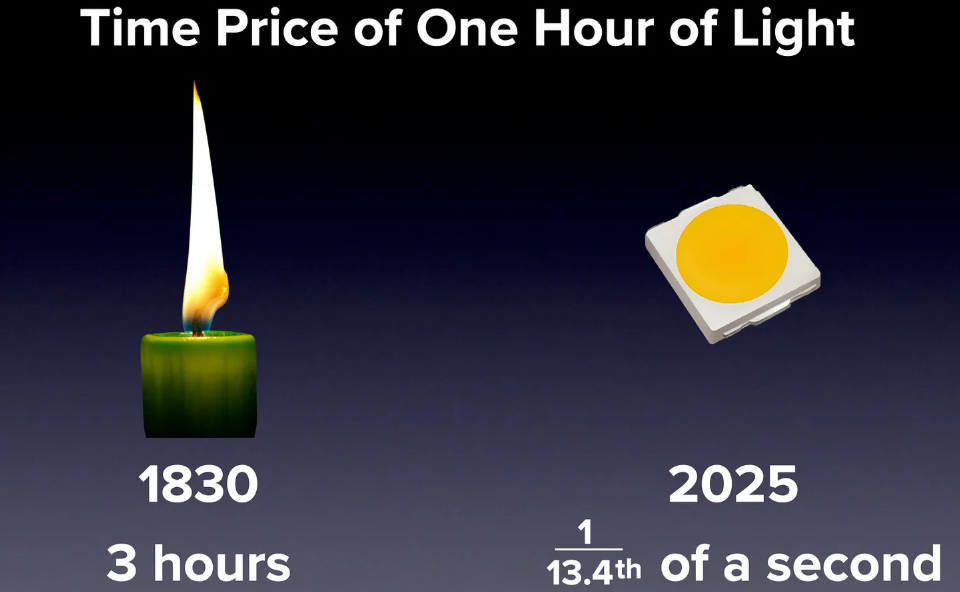

In Nordhaus terms:

William Nordhaus made economic progress more tangible by calculating the “time-price” of light. In 1830, you had to work three hours to afford a single hour of candlelight. Today, you earn that same hour of light in one-thirteenth of a second.

Have a great weekend, upper-class readers.

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.