Aave Defies Market Volatility with Stellar Q3 Performance - Stani Positions for Major Q4 Rally

Aave just delivered a masterclass in DeFi resilience while traditional finance keeps hitting the snooze button.

Revenue That Won't Quit

The lending protocol's Q3 numbers tell a story of steady growth despite market turbulence - proving once again that decentralized finance doesn't need Wall Street's permission to print money.

Calmer Waters Ahead

With interest rates stabilizing and protocol revenue holding strong, Aave's showing the kind of fundamentals that make traditional bankers nervous - actual sustainable growth without federal bailouts.

Stani's Macro Gambit

Founder Stani Kulechov isn't just watching from the sidelines - he's positioning the protocol to catch what could be the biggest macroeconomic tailwind of Q4. Because while traditional finance worries about rate hikes, DeFi builds through them.

Another quarter, another reminder that the future of finance doesn't need permission to succeed - it just needs code that works and communities that believe. Wall Street's still trying to figure out Web3 while Aave's busy building it.

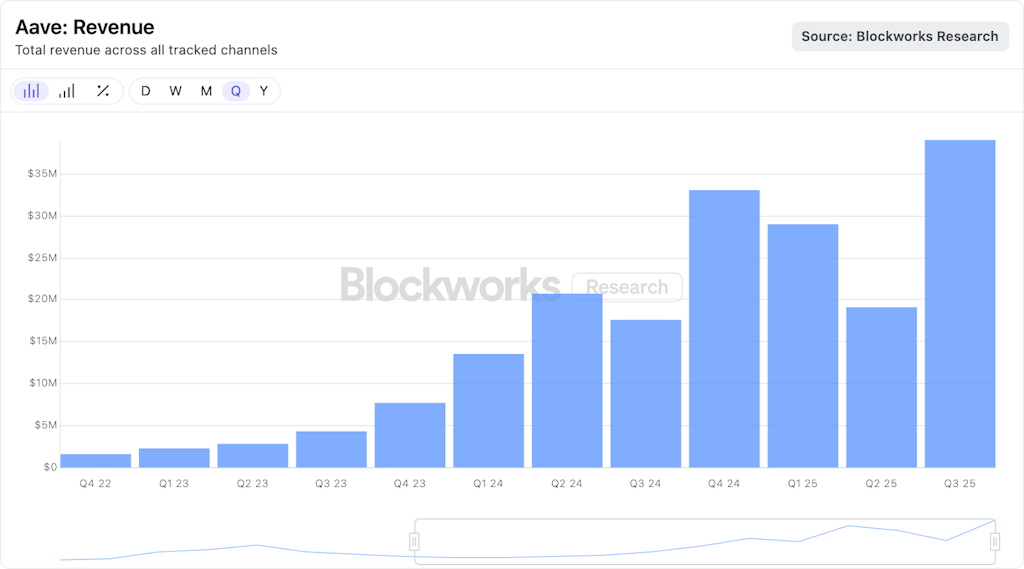

Blockworks Research financials dashboard makes it easy to see the mix in one view | Source: Blockworks Research

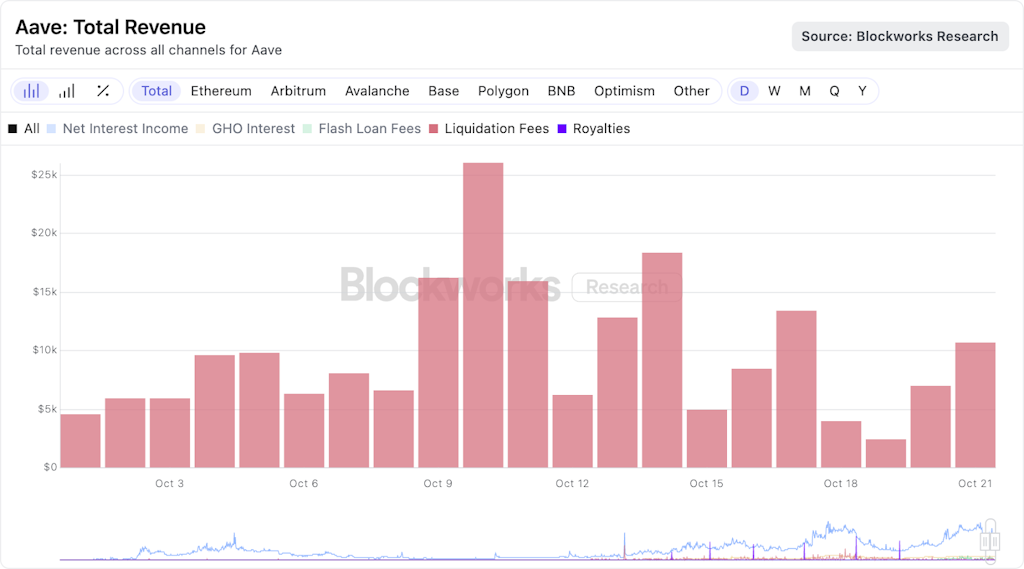

Blockworks Research financials dashboard makes it easy to see the mix in one view | Source: Blockworks Research

A calmer rate backdrop also showed up in stablecoin supply APYs on Ethereum, which settled into the 3%–5% range after the late-2024 spikes.

That normalization coincided with a steady climb in total deposits and outstanding loans, pushing Aave’s footprint back toward cycle highs across deployments.

“What’s powerful about DeFi is transparency — you can actually see where the yield is coming from,” Kulechov said.

All together, that added up to a record quarter for the protocol, topping Q4 2024 and reversing a two quarter slide.

Kulechov was pleased with how DeFi dapps handled the bout of extreme volatility.

“They get stress tested based on the parameters and risk assessments done before events like this,” he said. “We liquidated over $200 million worth of collateral — that’s the native way the protocol keeps solvency in turbulence.”

Euler, by contrast, saw fewer liquidations, CEO Michael Bentley explained on the panel, citing a difference in the typical borrower mix.

“People build bespoke credit markets [on Euler] — some use just-in-time liquidity to market make or provide instant redemption for RWAs [and] every market on Euler has a unique use case,” Bentley said.

On product roadmap and Q4 direction, Bentley pointed to “more integrations with fintechs — and new products coming online.”

“We’ve been working a lot on fixed rate products, so we’re going to keep innovating and pushing out new products for integrators using Euler,” he said.

Kulechov’s focus heading into year-end is on macro.

“I’m super eager for central bank rates to go down. Historically, when that happens, financial innovation accelerates. Rate cuts could create big ARB opportunities between TradFi and DeFi. If DeFi remains safe, we’ll see more traditional participants — neobanks, fintechs — plugging in for yield.”

When policy rates drift lower, spreads between on-chain funding and TradFi tend to widen, setting up the kind of basis-style flows that supported lending during prior easing cycles.

The quarter is also expected to see the launch of Aave V4, which aims to streamline the protocol’s architecture and expand its product surface for both crypto-native and institutional users.

Armed with granular data, DeFi watchers can track the same protocol levers Kulechov highlighted — deposits vs. loans, revenue composition, liquidation activity, and rate volatility — and judge whether the coming macro shift turns into the “arb opportunities” he expects.

If it does, Aave’s metrics should tell the story quickly: spreads widen, utilization grinds higher, and net interest continues to climb alongside deposits.

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.