Miners Power Higher as Plasma’s Stablecoin Hype Fades - The Real Crypto Shift Begins

Mining operations surge while stablecoin promises crumble

The Infrastructure Awakening

While flashy stablecoin projects capture headlines, miners are quietly building the foundation. Hash rates hit new peaks as computational power becomes the real currency. Plasma's fading stablecoin dream reveals a fundamental truth - infrastructure outlasts hype.

The Mining Renaissance

Rig deployments accelerate globally as energy-efficient operations dominate. Old-school mining farms upgrade to next-gen hardware, proving that physical assets still drive digital value. The numbers don't lie - mining profitability metrics show sustained growth despite market volatility.

Stablecoin Reality Check

Another 'revolutionary' stablecoin project joins the graveyard of broken promises. The pattern's familiar - grand announcements, temporary price pumps, then the slow fade into irrelevance. Meanwhile, miners keep validating transactions and securing networks like clockwork.

Because in crypto, the real money isn't in chasing the next big thing - it's in powering the things that already work. The suits can keep playing with their digital Monopoly money while the miners cash real checks.

This miner outperformance reflects a structural shift in how the market values the sector. Previously viewed primarily as Leveraged proxies to BTC, miners are now increasingly seen as infrastructure providers controlling scarce, pre-permitted power capacity and high-density data-center real estate that can be monetized via either hash or AI/HPC hosting. This generates approximately 70% more revenue per megawatt than BTC mining, with contracts delivering roughly $149K/MW-month vs. $87K/MW-month from mining at current hashprice levels.

Several miners, including Core Scientific (CORZ), Cipher Mining (CIFR), Iris Energy (IREN), CleanSpark (CLSK), and TeraWulf (WULF), are benefiting from this trend. They’ve secured multi-year hosting agreements that deliver contracted, dollar-linked cash flows in addition to mining revenues.

Leadership remains highly concentrated. Heavyweight CLSK, IREN, and WULF have delivered outsized, triple-digit performance YTD, supported by three key competitive advantages:

Conversely, laggards within the sector typically have smaller operating footprints, higher energy costs, weaker balance sheets or limited progress on pivoting infrastructure toward AI/HPC workloads.

— Shaunda

Plasma has liquidity, but now it needs life

As Plasma Mainnet approaches its one-month anniversary, it’s a good time to assess whether it has lived up to its reputation as the stablecoin chain. After an explosive start, the price action of XPL has been brutalized. It is down -43% in the past week and -70% from its all-time high.

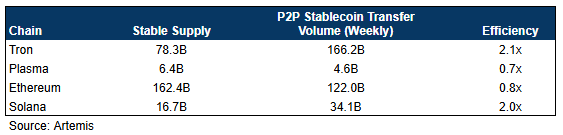

Despite ranking as the fourth-largest chain by DeFi TVL at $8.42 billion, Plasma’s defining feature should be utility, not deposits. The hallmark of a stablecoin chain is active circulation. Weekly P2P transfer data shows Tron and Solana leading by a wide margin, with each stablecoin dollar turning over roughly twice per week. Plasma and ethereum lag, suggesting most stablecoins are either parked in farms or left idle.

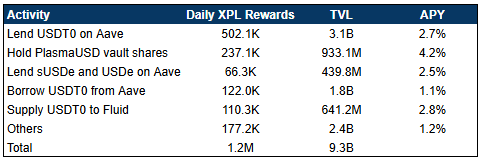

Around 65% of Plasma’s stablecoins are deposited in lending protocols such as Aave, reflecting a farming-heavy ecosystem. Incentives explain the behavior. Roughly $230K in daily rewards are given for lending and $55K for borrowing USDT0 on Aave. While TVL bootstrapping has its place, incentives on stablecoins should ideally fuel usage, not just inflate metrics.

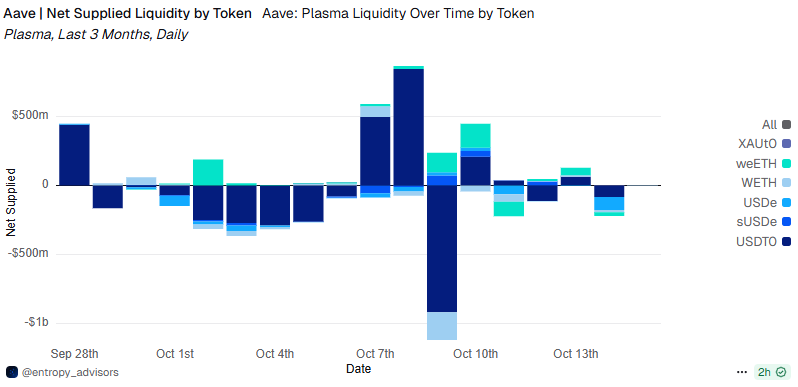

This TVL is proving far from sticky. As XPL’s price fell, rewards declined, prompting large withdrawals and loan repayments. With limited real utility, XPL has effectively become a reward token, facing continuous sell pressure from roughly 25% annualized inflation.

Plasma’s next phase must MOVE beyond incentives. Unless users begin using USDT0 for payments or unique use cases for stables emerge, it risks losing out to the next yield farm. Still, there are bright spots. Neutrl opens pre-deposits today with $50 million in capital to offer hedged OTC and delta-neutral yield strategies. This gives retail access to institutional-grade products traditionally locked behind OTC desks. If projects like Neutrl gain traction on Plasma and merchant integrations follow, Plasma could still evolve from a yield farm to a functional stablecoin economy.

— Kunal

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.