FAIR Protocol Shatters MEV Barriers, Unlocks True Privacy-Focused Blockchain Applications

Front-running bots just met their match. A new cryptographic breakthrough threatens to dismantle the extractive economy of maximal extractable value—and Wall Street's blockchain imitators won't know what hit them.

The Privacy Revolution Begins

FAIR's architecture doesn't just tweak existing systems—it rebuilds them from the ground up. By implementing zero-knowledge proofs at the consensus layer, transactions become mathematically invisible to predatory algorithms. No more sandwich attacks. No more time-bandit exploits. The playing field levels instantly.

Beyond Speculation: Real-World Applications

Private voting systems that can't be manipulated. Medical records that remain confidential even on public ledgers. Supply chain data that protects competitive advantages. These aren't theoretical use cases—they're live implementations running on FAIR's testnet right now.

The Finance Industry's Worst Nightmare

Traditional finance firms have been trying to rebrand blockchain as 'distributed ledger technology' for years—mostly to avoid admitting cryptocurrencies threaten their rent-seeking business models. FAIR exposes this charade by delivering what banks promised but never delivered: actual financial privacy.

As one developer quipped: 'Wall Street wanted blockchain without the crypto-anarchy. They're about to get anarcho-capitalism without the Wall Street.' The revolution won't be televised—but it will be cryptographically verified.

Solving MEV at the protocol level

Within the broader SKALE ecosystem, FAIR is positioned to be the home of liquidity and a platform for the next generation of AI-driven liquid markets.

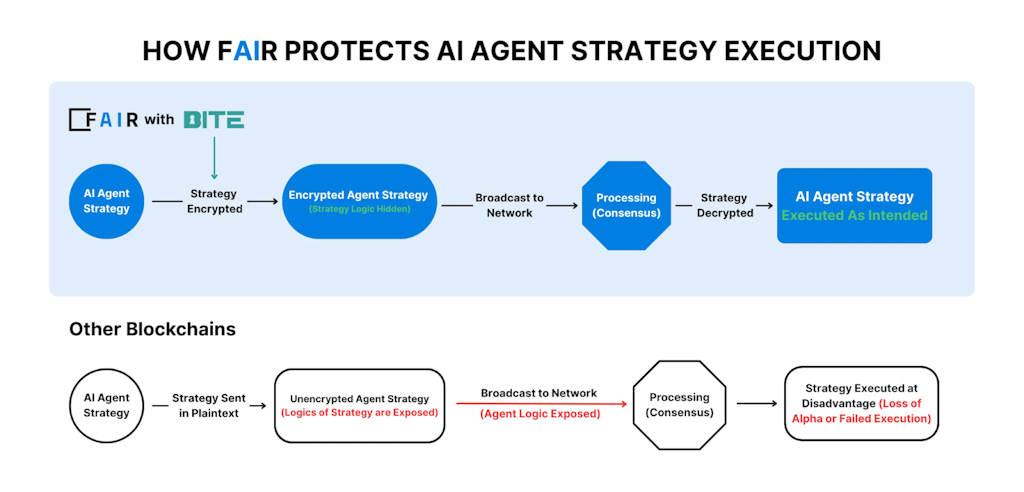

It’s a LAYER 1 blockchain designed to make markets and applications safer, private, and usable at scale, combining native MEV resistance, a hyper-optimized EVM, and onchain AI capabilities into a single architecture. To do so, FAIR embeds Blockchain Integrated Threshold Encryption (BITE) directly into the consensus layer, ensuring that transactions remain encrypted until after finalization. This new consensus primitive, called Proof-of-Encryption, eliminates front-running, sandwich attacks, and enables onchain privacy without sacrificing security or decentralization.

FAIR’s approach directly addresses the major privacy issue of pending transactions sitting exposed in the mempool before confirmation, which is present on networks like ethereum (and other EVM chains) and Solana. On those chains, anyone can see the details (function calls, amounts, destinations, and timing) and use that information to exploit users. Limit orders are quickly front-run, index rebalancing strategies get picked apart, and onchain logic is beaten before it can execute.

On FAIR, every transaction is encrypted before consensus and decrypted only after finalization. Validators, bots, and searchers never see the contents early enough to interfere, making it the first blockchain to eliminate MEV at the consensus level. With BITE making encrypted transactions the default, FAIR offers a foundation ideal for any protocols that need privacy, performance, and security to coexist without compromising the user experience.

The implications of this system are far-reaching across onchain use cases: DeFi strategies can operate without leaking intent, AI agents can run complex trading logic onchain without exposing their playbooks, and institutions gain a secure environment where liquidity can MOVE confidently.

Looking closer at BITE

Bitcoin introduced Proof of Work. Ethereum introduced Proof of Stake. Proof of Encryption is the next step for blockchain, and BITE is the engine that makes it possible for FAIR.

By embedding encryption directly into the consensus layer, BITE ensures that every transaction remains private until it is finalized. This closes the exploit window that enables MEV, preventing validators, bots, and searchers from ever seeing pending activity in time to interfere. At the same time, this foundation opens the door to a new class of blockchain functionality. With transactions hidden until settlement, developers can enable encrypted execution, build conditional transactions that trigger automatically when predefined criteria are met, create private data availability through re-encryption, and even run fully end-to-end encrypted operations via Threshold Fully Homomorphic Encryption (TFHE).

Encrypted Transactions

Encrypted transactions allow MEV-free computation directly on the EVM, without the need for a secondary network or rollup. They improve execution for existing DeFi protocols such as AMMs and prediction markets by reducing slippage and protecting against sandwich attacks.

Conditional Transactions

Conditional transactions are an innovative blockchain primitive built into FAIR that enables encrypted execution to automatically trigger once predefined conditions are met. When the condition is satisfied, the data is decrypted and executed in the next block with no further action required from the user.

This creates an environment where innovation can thrive within existing applications and net-new protocols. Trading applications can implement fully automated limit orders that bad actors or MEV bots cannot manipulate. Developers on the cutting edge can build prediction markets that cannot be manipulated by whales, whether in traditional markets or in shielded, privacy-preserving designs.

Private Data Sharing

Private data sharing on FAIR leverages re-encryption to produce private results rather than public execution. This technology enables the implementation of encrypted voting and other sensitive applications without requiring the development of specialized privacy components. In this scenario, only individuals with the proper authorization can access the results, protecting voter privacy while keeping the process trustworthy.

Another use case is supply chain tracking. Secure supply chain tracking requires that sensitive information stays encrypted at every stage, even on a blockchain. Using private execution and re-encryption with FAIR allows the FLOW of private information to the correct individuals and entities while simultaneously automating access to public information about the broader supply chain that can and should be public.

Fully Encrypted Smart Contract Data

Through Threshold Fully Homomorphic Encryption (THFE), FAIR enables mathematical operations to be performed directly on encrypted data. This allows changes to occur on data without any decryption for maximum security.

Key applications of this feature include fully onchain banking systems that preserve the privacy of balances, or proofs of asset ownership that demonstrate control without disclosing the specific assets, and onchain credit systems.

Implications for key rising sectors

With MEV removed, blockchain no longer functions as a zero-sum contest between users and extractors. What begins with fair execution translates into deeper liquidity, greater capital efficiency, and a foundation where both individuals and institutions can participate confidently.

By making encrypted execution the default, BITE creates the conditions for capital and innovation to move onchain at scale, and FAIR becomes an environment purpose-built for AI agents, financial institutions, and DeFi users that demand fair, fast, and confidential execution.

Autonomous AI agents

Picture an autonomous trading agent scanning the markets, executing thousands of trades in a single day. On today’s blockchains, every move it makes is broadcast in the mempool before it settles.

Competitors can copy it, frontrun it, or manipulate outcomes in real time. What should be a breakthrough in automation is instead an open invitation for exploitation. To avoid this, most agents are forced offchain or into centralized executors, where their logic is SAFE but no longer open or composable. This stalls the promise of agentic DeFi before it starts.

With FAIR’s Proof-of-Encryption, transaction intent is sealed before it enters the mempool. There is nothing to simulate, reorder, or frontrun; strategies remain private until they have already been executed. This simple shift creates the conditions for AI agents to operate fully onchain, safely, and at scale.

The implications are immediate. Arbitrage agents can protect their edge because trade routes remain hidden. Vaults can rebalance positions on schedule without broadcasting strategy rules. DCA programs and limit orders can execute cleanly at intended prices. Indexes and structured products can adjust weights without telegraphing trades to the market. Even cross-chain liquidity can be routed without exposing timing or path. For the first time, financial automation can exist entirely onchain without dependence on offchain relays or trusted middlemen.

The Ripple effects extend far beyond individual agents, traders keep more of their profits, protocols gain efficiency and tighter spreads, and institutions gain confidence in execution quality. And with day-one access to liquidity across 300+ existing applications in the SKALE ecosystem, FAIR provides the foundation for AI-driven markets to scale openly and securely.

Encrypted DeFi

DeFi was meant to level the playing field. Yet for traders, what should be straightforward often feels like running uphill against invisible adversaries (remember the James Wynn saga?) Limit orders hang exposed in the mempool, inviting bots to frontrun and manipulate execution. Central limit order books (CLOBs), the backbone of traditional markets, have never worked as designed onchain because orders are picked apart before they land, turning what should be efficient markets into unpredictable minefields.

Token launch results have been similarly poor. On platforms like PumpFun, most participants lose out while bots, whales, and insiders walk away with the gains. Gas wars erupt, bids are manipulated at the last minute, and access to pricing data tilts the outcome toward a select few. Because of this nightmarish environment, as widely reported earlier in January, only .04% of the platform’s users had booked more than $10,000 in profits.

On FAIR, user success would tell a different story. With encrypted transactions as the default, orders no longer leak into the mempool. Limit orders execute at intended prices, and CLOBs finally function as they were meant to, matching buyers and sellers without interference. Token launches transform into sealed-bid auctions, where every bid remains encrypted until finalization. Only then are they revealed together, delivering fair access, predictable pricing, and outcomes driven by demand rather than manipulation.

By removing the exploit window, FAIR establishes the needed basic integrity for DeFi infrastructure. Markets can operate efficiently, transparently, and equitably, and investors can finally trust that the rules of the game are the same for everyone.

Institutional-grade privacy onchain

Tokenization is widely seen as the next major wave for crypto, with market projections reaching $16 trillion by 2030, powered by traditional assets like real estate and equities moving onchain. It has become a clear race unfolding across the industry, with leading ecosystems like Ethereum and solana vying to position themselves as the preferred venues for Wall Street.

Yet for institutions, the gap between blockchain’s potential and reality has remained stubbornly wide.

The missing piece is execution privacy. Products like ETFs and index funds depend on timely, private, and tamper-proof execution. On networks where transaction details are visible in advance, rebalancing strategies and trade orders are exposed to frontrunning. The result is that institutional products that could benefit most from onchain efficiency are kept offchain to avoid exploitation.

FAIR closes this gap. By encrypting intent before consensus, it allows index strategies and structured products to rebalance securely without signaling trades ahead of time. Institutions can manage portfolios without leaking their playbooks, ensuring that strategies remain confidential until after execution. With these protections in place, the infrastructure is finally in place for ETFs, indexes, and other tokenized products to operate reliably onchain.

Scaling DeFi with Fairness

Every blockchain faces the same central question: what can you do tomorrow that you can’t do today? Every blockchain, that is, except FAIR.

Thanks to FAIR’s Proof-of-Encryption, DeFi can finally scale without the mempool transparency that has long limited the industry. By embedding encryption directly into consensus, FAIR provides the foundation for onchain privacy where users, agents, and institutions can participate with confidence.To follow FAIR’s progress, explore the latest updates on X, read deeper insights on Medium, or join the waitlist to be among the first to build on the network.

Sign Up for the FAIR Waitlist: https://www.fairchain.ai/

Follow FAIR on X: https://x.com/FAIR_blockchain

This content is sponsored and does not serve as an endorsement by Blockworks. The veracity of this content has not been verified and should not serve as financial advice. We encourage readers to conduct their own research before making financial decisions.

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.