Yield Basis Shatters Curve DAO Vote Barrier - DeFi Governance Breakthrough

Yield Basis just bulldozed through Curve's notorious governance gatekeeping—proving DAOs can actually make decisions faster than traditional finance committees schedule lunch meetings.

The Protocol That Wouldn't Quit

Curve's voting mechanism typically moves at regulatory speed—but Yield Basis cracked the code. The proposal cleared required thresholds while legacy finance was still drafting meeting agendas.

Governance Without the Gridlock

Active participation surged past historical averages as token holders bypassed usual apathy. The vote demonstrates functional decentralization beats theoretical perfection—every time.

DeFi's proving governance can work at market speed while TradFi institutions still require notarized paperwork to change the office coffee brand. Maybe that's why they're still measuring ROI in basis points while we're counting protocol revenues.

Conflicts-of-interest questions

Voting aside, critics on the Curve forum argued the facility is extractive to Curve and raised potential conflicts, since major ecosystem figures may have stakes in Yield Basis while voting in Curve. Similar concerns have been raised during past votes.

Egorov responded that a breakdown of allocations was added to the proposal and defended bringing in familiar names: “It is very natural to invite notable persons from the ecosystem as investors in such a project.”

“Small Cap Scientist” warned that “bribes” — the standard term for paying veCRV (or ve-style) voters to direct emissions — would cost CurveDAO by forcing CRV emissions toward Yield Basis. Egorov pushes back: The plan is a 7.5% stream of YB tokens to Curve, which veCRV can choose to deploy as bribes for crvUSD/stable pools. He stressed this does not mandate new CRV emissions, and adds that “cryptopools related to crypto liquidity working for Yield Basis should get no CRV inflation.”

In other words, any vote incentives WOULD be funded in YB supplied by YB, unless Curve voters opt otherwise.

There’s also a question of who will be liable should something go wrong. Egorov acknowledged the scale of the credit line is substantial. “CrvUSD supply is a bit more than 100M, and here the ask is for 60M for the start — already looks big,” he said, noting that “emergency measures” have been a hot topic of discussion with community members.

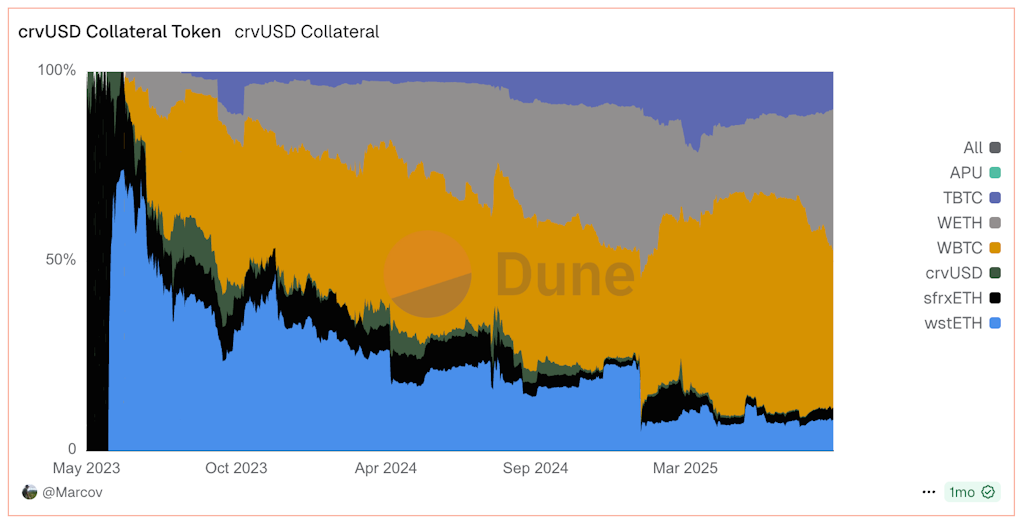

At about $113 million in circulating supply, crvUSD accounts for just under 1% of the decentralized stablecoin market (USDS/DAI, GHO, FRAX, BOLD, LUSD, USDaf).

Egorov also touted a rigorous code review process, including 6 (and soon to be 7) audits. The Curve Emergency DAO multisig provides a circuit breaker for the integrated system. But there’s a certain amount of trust involved here, in the team’s assertions: “If anything happens — of course it’d be on Yield Basis to deal with it to the highest degree possible,” Egorov said.

Does Yield Basis solve Impermanent Loss (IL)?

One of Yield Basis’ headline claims is that it “eliminates impermanent loss” for LPs — long a holy grail in DeFi. In a standard AMM, liquidity providers suffer when the price of one asset moves relative to the other: Their position ends up underexposed if the asset rallies, overexposed if it dumps. Mathematically, the LP position tracks the square root of price, meaning it underperforms a simple buy-and-hold portfolio during trends.

Yield Basis attacks this by using leverage: It borrows the other side of the pair so that an LP can post 100% BTC (or another crypto) and stay roughly 50/50 at all times. By constantly rebalancing to keep leverage NEAR 2×, the position becomes linear in price — tracking BTC itself rather than √BTC.

But critics argue this doesn’t mean users are insulated from losses. Because leverage must be actively managed, there are path-dependent costs: rebalancing trades, borrow interest, and potential slippage when prices gap. If those costs outweigh trading fees, the LP’s equity can still decline even if the BTC price ends up higher.

A pseudonymous forum critic contended the whitepaper’s calculus may overstate the effect.

“Saying IL is ‘eliminated, full stop’ feels like semantics when there’s still a scenario where LPs come out behind,” argued Anoncalc1.

Egorov countered that the claims are accurate. “Whether it removes IL is not a question,” he told Blockworks. The geometric underperformance from an AMM LP position curve is gone. The real issue is the LPs operating costs. Even on a round-trip in price, which would eliminate IL, those costs remain. The Yield Basis design sets aside a fixed share of trading fees (about half) to fund rebalancing, so the model relies on volatility generating enough volume to cover the cost. As Vasily Sumanov explained, “volatile market → more rebalancing needed, but at the same time much more fees that will cover it.”

The net result is a nuanced picture. “From a user’s perspective, the end result is the same: your equity can still go down,” Anoncalc1 insisted.

Yield Basis may technically neutralize IL, but it doesn’t make LPing risk-free. It converts that risk into a volatility budget — fees versus costs — that can still produce negative P&L in quiet markets or under extreme stress.

For DAO voters, the distinction was largely academic: The credit line proposal still passed overwhelmingly.

What’s next

With approval in hand, Yield Basis plans to deploy on Ethereum first. The project is also preparing a token launch through Kraken’s new “Launch” platform in partnership with Legion.

For Curve, the decision binds the protocol more closely to BTC routing and crvUSD activity. The question of whether Yield Basis can turn volatility into durable fee income, at scale and without incident, will soon be settled in the real world.

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.

- Empire: Crypto news and analysis to start your day.

- Forward Guidance: The intersection of crypto, macro and policy.

- The Drop: Apps, games, memes and more.

- Lightspeed: All things Solana.

- Supply Shock: Bitcoin, bitcoin, bitcoin.