Bitcoin’s $112,000 Ceiling: What Comes Next After the Rejection?

Bitcoin smashes into resistance at $112,000—stalls, pulls back. The king of crypto faces its next big test.

Market Psychology at Play

Traders eye the $112k level like hawks. That number isn’t just technical—it’s psychological. Break through, and FOMO kicks in. Fail, and profit-taking takes over. Simple as that.

Where’s the Support?

All eyes drop to key support zones. If bulls hold the line, consolidation follows. If not, a deeper retrace kicks in. Nobody’s panicking—yet.

Macro Still in Charge

Institutional flows haven’t dried up. ETF approvals still rolling. The halving narrative remains intact. This isn’t a breakdown—it’s a breath.

Altcoins Feeling the Heat

When BTC stalls, alts often bleed. But selective strength emerges in DeFi and Layer 2s. Smart money rotates—doesn’t exit.

Regulatory Noise Amplifies

Politicians suddenly remember crypto exists every time ATHs hit. Expect grandstanding, proposed bills, and the usual circus—because what’s finance without a little regulatory theater?

Bottom Line: This is normal. Markets don’t go up forever without pauses. Bitcoin’s hit a wall—now it either breaks it or builds a base. Your move, bulls.

This edition of Blockhead Daily Bulletin is brought to you by SRK Haute Hologerie, a distinguished watch dealer known for their collection of extremely rare luxury timepieces. The company brings its passion of luxury watch collecting and experience in financial markets to advise, build and create word-class collections. It provides access to rare, in-demand timepieces to those that seek artistry, rarity or value within the world of Haute Horlogerie. For over two decades, SRK has been quietly advising and building collections across the globe. Whether it’s helping clients with their first timepiece or presenting them with the 250th for their collection, SRK pride itself on advising and sourcing luxury pieces utilizing the knowledge and relationships only it has.

Learn moreLosses in digital assets and related stocks have persisted since last week, with tokens and firms tied to initiatives associated with Trump's family seeing particularly steep falls. They had soared earlier because of Trump's favorable attitude toward cryptos.

World Liberty Financial, a decentralized firm related to Trump, has its $WLFI coin issued by ALT5 Sigma, a treasury business whose shares fell by 12%. The stock has seen a drop of more than 50% over the past week. The $WLFI coin fell 25% and has lost around half of its value since its Labor Day debut.

Eric Trump-led American Bitcoin, the mining firm that began trading on Wednesday, recorded a decline of up to 22%.

A Bloomberg report showed that WLFI, to allay fears, held a live event on Thursday on CoinMarketCap's website. Over 2,000 people tuned in to World Liberty's event.

Bloomberg News also reported that a representative from WLF informed them that their team is committed to creating and distributing high-quality goods like its fiat-backed stablecoin USD1, so that millions of people across the world may benefit from DeFi.

But Bitcoin remained steady on Monday, trading around $111,000 per coin following a lackluster weekend characterized by minimal price movement.

Market participants largely remained inactive following the disappointing US jobs report from Friday, which caused a temporary decline in the token before opportunistic buyers entered the scene.

According to Friday's labor report, August's employment growth was far lower than expected at 22,000, and June's numbers were revised to show a net loss of 13,000 jobs.

Even if the muted reading bolstered anticipation of a Fed rate cut, the crypto markets were not as positively affected as gold, which reached a new all-time high.

Bitcoin is generally considered a risk asset, which is in sharp contrast to gold, the classic safe-haven investment during times of uncertainty.

A paucity of activity in weekend trade volumes suggests that markets are generally cautious ahead of this week's inflation data and the September Fed policy meeting.

Current resistance is positioned around $112,000, a level where bitcoin has consistently struggled to maintain its gains. A decisive breakout above could reintroduce the record high of $124,500, reached on August 14, into consideration.

Conversely, sellers are closely monitoring the $75,000 support level. This is the identical level examined following the tariff shock implemented by TRUMP in April, which catalyzed Bitcoin's dramatic surge to new peaks.

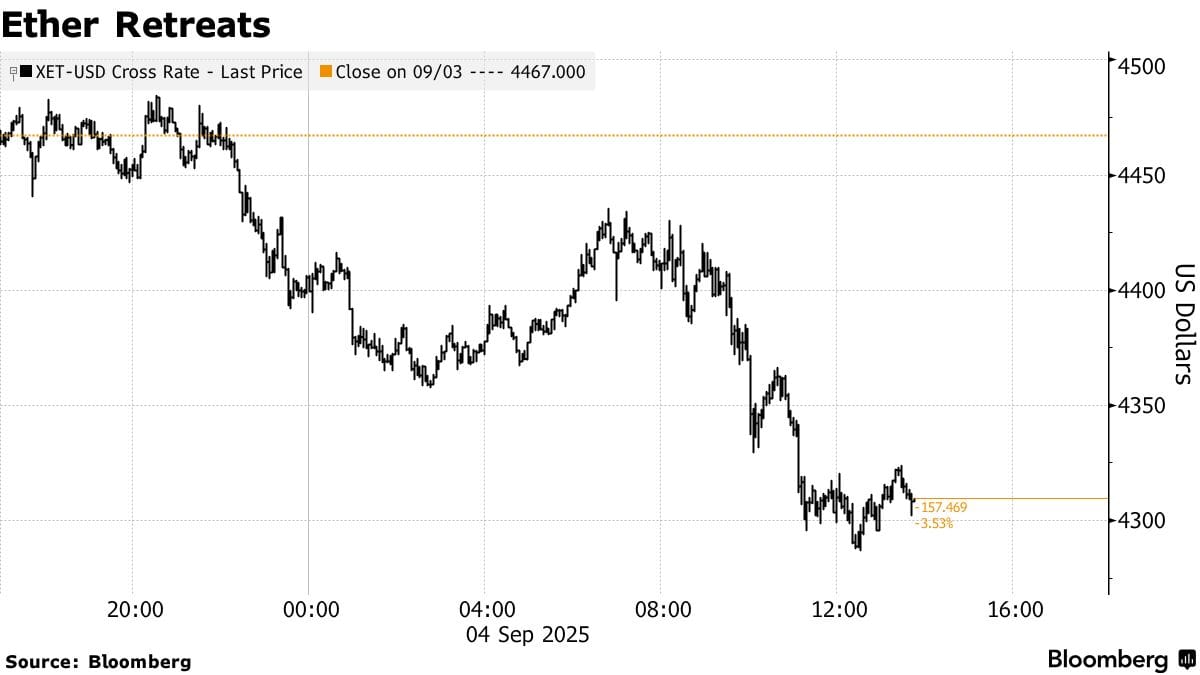

The market is characterized by consolidation now, with Bitcoin approximately 10% below its peak, whereas Ether is stable around $4,300 but still 13% away from its all-time high of $4,955 reached on August 24.

CryptoQuant analysts say recent data indicate big holders of Bitcoin have liquidated $12.7 billion in the token over the last month. Ongoing sales may exert additional downward pressure on its price in the coming weeks, as per those analysts.

Data from CryptoQuant indicates that the latest marks the most significant sell-off by large holders since July 2022, reflecting a 30-day change of 114,920 BTC, valued at approximately $12.7 billion based on the average price as of Saturday.

The seven-day daily change balance reached its highest position since March 2021 on September 3, with whales transferring over 95,000 BTC over that week.

The positive development is that the intense selling seems to have faded. The weekly balance change decreased to approximately 38,000 BTC as of September 6.

Currently, the asset is experiencing a constrained trading range, oscillating between $110,000 and $111,000 over the last three days, as the selling pressure has eased somewhat.

The long-term outlook appears significantly more robust, with Bitcoin experiencing only a 13% correction from its mid-August peak, a decline that is notably less severe compared to earlier retracements.

Additionally, there is a prevailing concern regarding potential resistance to the surge of publicly traded digital-asset treasury firms that have emerged recently, investing in a variety of tokens.

The stock prices of numerous previously underperforming companies experienced a significant increase following their strategic shift towards cryptocurrency.

On Thursday, news broke that Nasdaq, which is a major market for a lot of these companies, is requiring some token holders to have shareholder permission before they may issue stocks to buy tokens.

Michael Saylor of Strategy came up with the idea of issuing shares to the public as a way for treasury businesses to get money to buy more coins. To purchase coins without incurring any further debt, the treasury businesses have used this technique.

Many financial treasury firms saw their share prices fall, including those that hold Ether and Solana.

Sharplink Gaming, for example, had a 9.7% drop in its share price. Ether lost 3.3%. An investment in Solana's treasury business, DeFi Technologies, fell 4.6%, as solana fell 3.8%.

The prices of the underlying coins have declined alongside the share prices of the treasury firms.

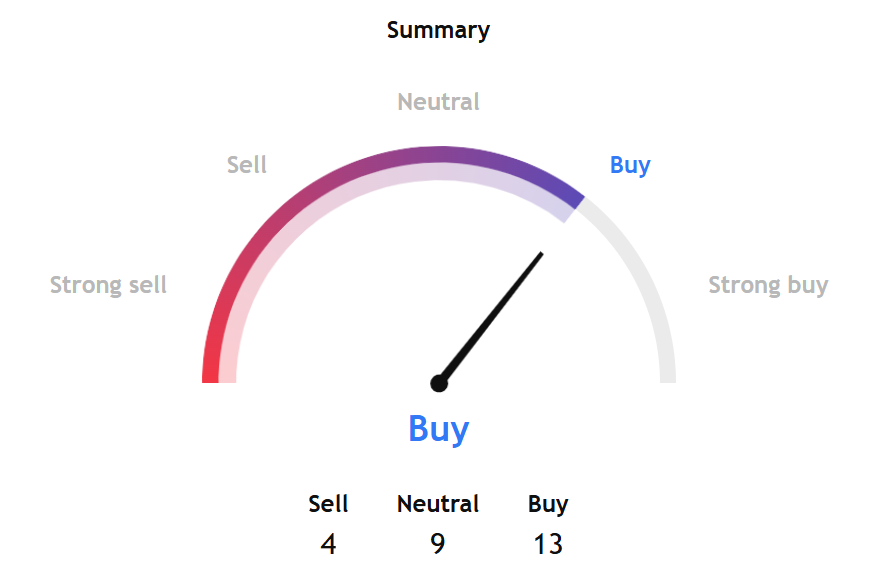

TradingView's BTCUSD technical analysis gauge gave a buy signal for the week ahead.

A sub-gauge of oscillators gave a neutral signal, while the moving averages pointed to a 'strong buy' suggestion.

Bitcoin's market cap dominance was more or less the same as last week, indicating the recent moves away from the OG token toward Ether have slowly faded.

Separately, InvestTech's Algorithmic Overall Analysis gave a positive score for Bitcoin, with low liquidity risk and medium risk to volatility in the NEAR term.

In its recommendation for a period of one to six weeks, InvestTech stated, "Bitcoin has broken through the ceiling of a short-term falling trend channel. This indicates a slower falling rate initially, or the start of a more horizontal development."

InvestTech's recommendation added, "The currency has support at points $107,700 and resistance at points $113,500. The currency is assessed as technically neutral for the short term."

Overall, beyond the near term, technical analysis shows the OG token as being positive.

Elsewhere

Obfuscation Clarity Part 1: Mixers Are GuiltyRecent convictions show that ‘non-custodial’ doesn’t mean ‘non-criminal’ when it comes to cryptocurrency mixing services. The cases of Roman Storm and the Samourai Wallet team reveal how conspiracy charges are reshaping the regulatory landscape for privacy tools in crypto.![]()

![]()

![]()

Blockcast

In this episode, the Licensed to Shill panel is joined by Blockhead DeFi writer Jon Liu to discuss the infamous Blockchain Trilemma – the challenge of balancing decentralization, security, and scalability – and why shared security might be the key to a thriving multi-chain future.

Please like and subscribe to Blockcast on your favorite podcast platforms like Spotify and Apple.