🚀 Bitcoin & Ethereum Surge Toward New All-Time Highs as $1B ETH Buy Spree Sparks Frenzy—ETF Inflows Ignite Market

Crypto markets roar back with vengeance as BTC and ETH eye record-breaking territory. Someone just dropped a cool billion on Ethereum—no explanation, no apologies.

ETF money floods in like Wall Street finally remembered its FOMO meds. Traders scramble while purists mutter about 'institutional contamination.'

The real mystery? Whether this rally survives contact with the next SEC statement or crypto Twitter meltdown. Place your bets—the casino never closes.

After a dull week, cryptos rebounded sharply on Monday, with Bitcoin approaching its all-time high of slightly over $123,000.

Geopolitical news is boosting the appetite for risk assets at the beginning of the week after Wall Street stocks broadly ignored macro gloom from data and Trump's tariffs last week, even as cryptos played safe. Wall Street equity futures pointed to another healthy opening on Monday, with US stocks NEAR record highs.

Domestically, calls for Fed rate cuts by governor Michelle Bowman and Trump's executive order directing agencies to reexamine guidance on allowing alternatives like cryptocurrencies and private equity into 401(k) plans have buoyed prices across the board.

Market capitalization for all cryptocurrencies reached a new record high of $4.14 trillion on Monday, driven by price rises in bitcoin and Ethereum, according to data compiled by CoinGecko.

Bitcoin prices surged by as much as 3.3 percent, reaching over $122,000 and approaching its all-time high.

Over the past week, the OG token has risen 6.6 percent after having fallen from all-time highs in the middle of July.

As last week drew to a conclusion, the OG token continued to gain momentum, helped along by a favorable executive order from Washington and three days of net inflows into spot Bitcoin exchange-traded funds. Farside Investors reports that in the previous three trading days of last week, Bitcoin ETF issuers bought $773 million worth of Bitcoin.

According to data on BitcoinTreasuries.net, bitcoin treasury companies—publicly traded organizations that specialize in cryptocurrency accumulation—have managed to amass a Bitcoin reserve worth $117 billion collectively.

The rising excitement among big investors for digital currencies is the primary factor propelling the price increases - as demand pours in from treasury companies and US spot bitcoin ETFs.

The sector also benefited from US President Donald Trump's executive order allowing cryptocurrency to be included in 401(k) funds. This order has the potential to release $9 trillion in capital for bitcoin and the broader cryptocurrency market, marking a significant advancement in the sector. However, any implementation requires a rule-making process, indicating that the potential capital inflow, if any, will be a long-term effect, not an immediate consequence.

An increase in Bitcoin acquisitions is a clear play for top investors. On Sunday, Michael Saylor suggested on X that the strategy will involve increasing its Bitcoin holdings within the $76.8 billion portfolio, remarking, “If you don’t stop buying Bitcoin, you won’t stop making money.”

If you don't stop buying Bitcoin, you won't stop making Money. pic.twitter.com/G9S2gPO1t8

— Michael Saylor (@saylor) August 10, 2025The broader market for digital assets was propelled higher by demand from institutional investors and corporate treasury buys. Notably, a mysterious buyer acquired over 270,000 ETH tokens over the last five days.

This mysterious institution accumulated another 49,533 $ETH($212M) today.

Over the past week, they have accumulated 221,166 $ETH($946.6M) from #FalconX, #GalaxyDigital, and #BitGo.https://t.co/k99BomKVq5 pic.twitter.com/u3j2LJ9M1H

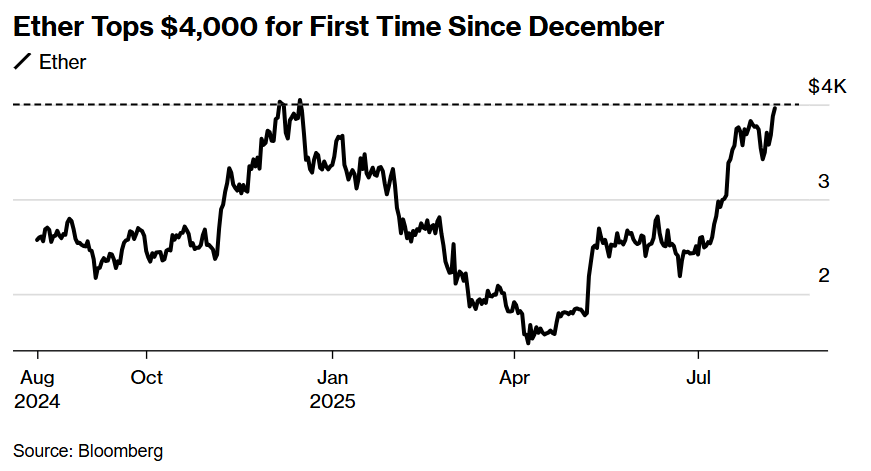

Ether surged beyond $4,300 for the first time since December 2021, after a robust weekend. On Friday, the crypto experienced an increase of up to 3.5 percent, reaching $4,013 in New York, before settling around $3,965 - it is up nearly 22 percent over the past week.

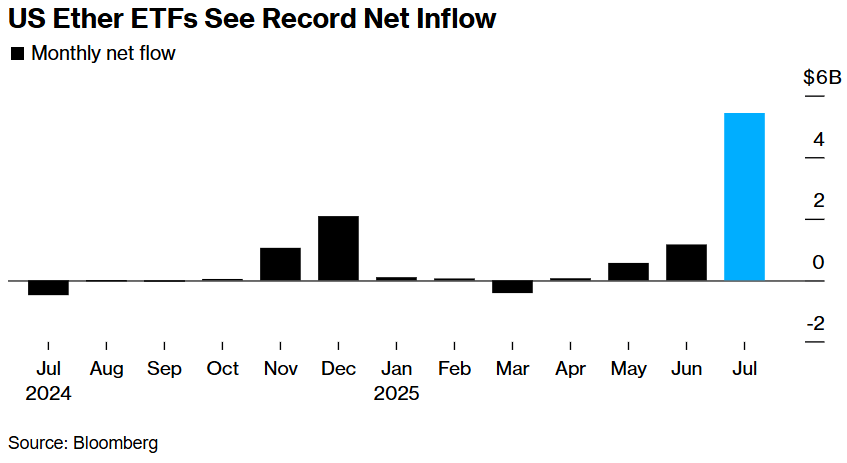

The recent uptick in Ether can be attributed to a significant influx of capital into spot exchange-traded funds, coupled with an increasing interest from corporations accumulating the token for their financial reserves. The token has surged about 190 percent since its low in April, driven by unprecedented inflows into funds that invest directly in the token.

Over $6.7 billion has been allocated to the nine US-listed Ether spot ETFs so far this year.

Crypto treasury companies, which function as a means for accumulating substantial token holdings, have acquired over $12 billion in the token, according to data from the tracking site strategicethreserve.xyz. Large purchases from Bitmine, Sharplink and The Ether Machine last week gave an uplift to ETH price into the weekend.

Over 304K $ETH was added to public treasuries recently.

In this thread, we cover recent acquisitions from established players like @BitMNR to newer ones like @TheEtherMachine.

Here’s a roundup of who's buying 👇 pic.twitter.com/VljibTy93w

The growing interest in the token is in line with a trend among institutional investors looking beyond Bitcoin for new digital assets exposure. After a prolonged period of underperformance relative to market leader Bitcoin and emerging rivals such as Solana, Ether has staged a remarkable comeback.

Still, the token remains approximately 18 percent under its peak of over $4,867 reached in November 2021, even with recent progress.

On X, US President Donald Trump's son Eric—who has investments in a number of digital asset companies—spoke about how he was pleased by the recent spike in Ether prices.

It puts a smile on my face to see ETH shorts get smoked today. Stop betting against BTC and ETH - you will be run over.

— Eric TRUMP (@EricTrump) August 8, 2025The Trump family's endeavor, World Liberty Financial, is reportedly in talks with investors to FORM a public firm to handle its WLFI coins, according to Bloomberg News.

While the current momentum is strong, ethereum co-founder Vitalik Buterin cautioned against the risk of an "overleveraged game" on a Bankless podcast, referring to Ether treasury companies accumulating ETH.

Are ETH Treasuries good for Ethereum?@VitalikButerin thinks they can be:

“ETH just being an asset that companies can have as part of their treasury is good and valuable… giving people more options is good.”

But he also issues a warning:

“If you woke me up 3 years from now… pic.twitter.com/W55oUD7Lke

However, the overall sentiment remains overwhelmingly positive. With Ethereum's robust fundamental and developer ecosystem, the asset is attracting serious money. The stage is set for a potential new all-time high in the coming weeks, providing macro factors don't kill the vibe.

That's it, for now. We're off to find out who had a $1 billion lying around to throw at ETH.