Harvard Dives Deep: $116M Bitcoin ETF Bet Marks Watershed Moment for Institutional Crypto Adoption

Wall Street's ivory tower just placed its biggest crypto bet yet.

Harvard University's $116 million plunge into a Bitcoin ETF isn't just another institutional allocation—it's a flashing neon sign that digital assets have gone mainstream. The Ivy League endowment's move signals a tectonic shift in how traditional finance views cryptocurrency exposure.

No more 'academic interest'—this is cold, hard capital deployment.

The 8-figure position turns Bitcoin's institutional narrative from 'maybe someday' to 'show me the ticker symbol.' Suddenly, every pension fund manager who dismissed crypto as 'rat poison squared' needs to explain why Harvard's risk models see something they don't.

Of course, the finance world will spin this as 'prudent diversification'—right up until their own clients start asking why their portfolios aren't keeping pace with university endowments playing the volatility casino.

A recent SEC filing has revealed that the Harvard University endowment has disclosed a significant stake in a Bitcoin exchange-traded fund (ETF). According to its Q2 2025 filings, the Harvard Management Company (HMC) reported holding 1.9 million shares of the iShares Bitcoin Trust (IBIT), an investment valued at over $116 million.

HMC's IBIT position is its fifth-largest single position, surpassing the fund's holdings in tech giants like Alphabet and NVIDIA, and is nearly on par with its investment in Meta.

A number of other prestigious academic institutions have also recently disclosed their forays into the crypto market, showcasing a collective shift in strategy.

- Brown University: Filings show Brown’s endowment holds a position of more than $13 million in BlackRock's IBIT.

- Emory University: The Georgia-based university was a comparatively early mover, being the first American university to reveal an investment in the Grayscale Bitcoin Mini Trust (BTC) in late 2024, alongside Coinbase Inc. holdings.

- University of Austin (UATX): The new Texas university has been one of the most vocal proponents of digital assets, partnering to create a dedicated $5 million Bitcoin fund as part of its endowment.

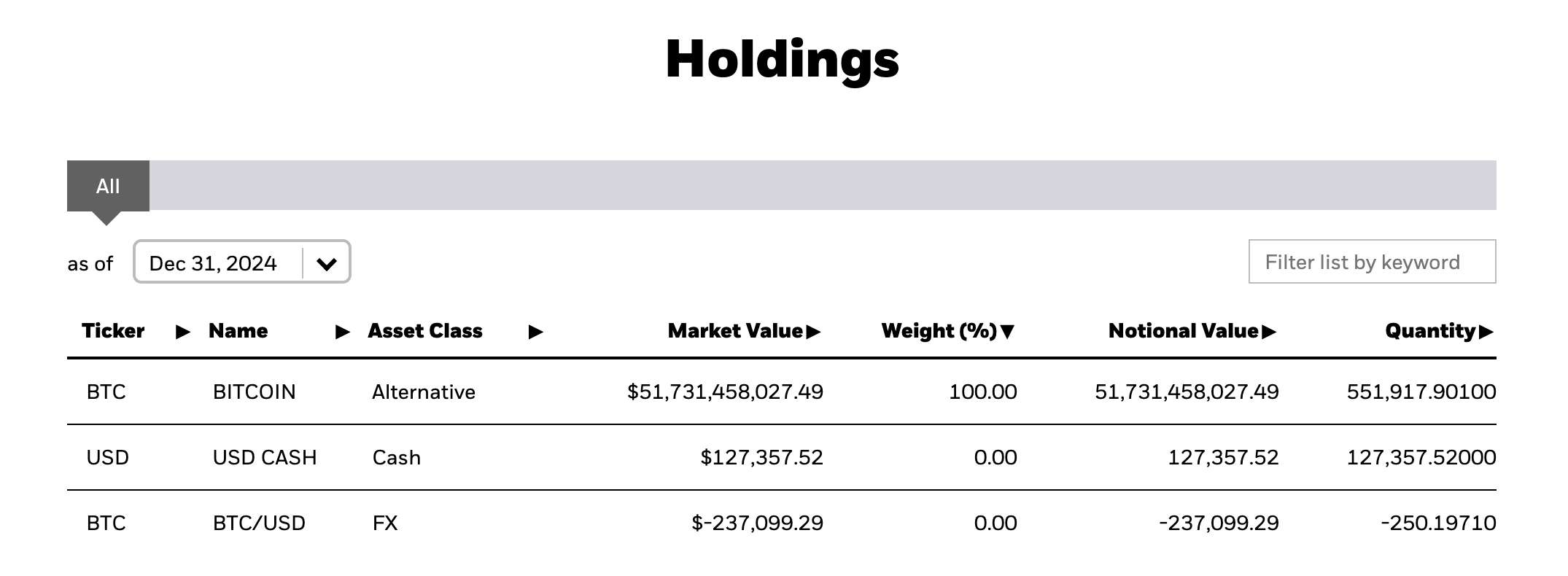

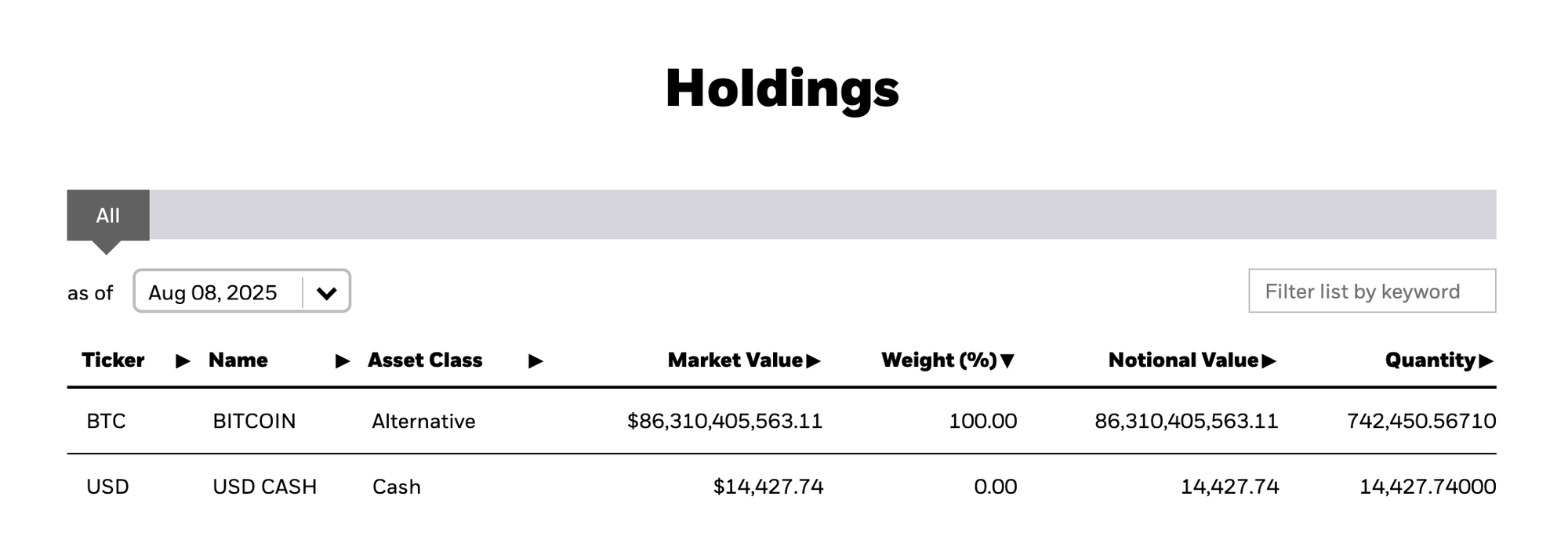

Since its launch in January 2024, BlackRock's IBIT has been growing at an unprecedented rate. Since December 2024, IBIT's AUM has grown over 34.5% from $51.7 to $86.3 billion, driven by a combination of strong institutional demand and the sustained rally in Bitcoin's price. According to popular analyst Eric Balchunas, IBIT took 374 days to cross the %80 billion AUM mark - five times faster than Vanguard's S&P 500, which took 1,814 days.

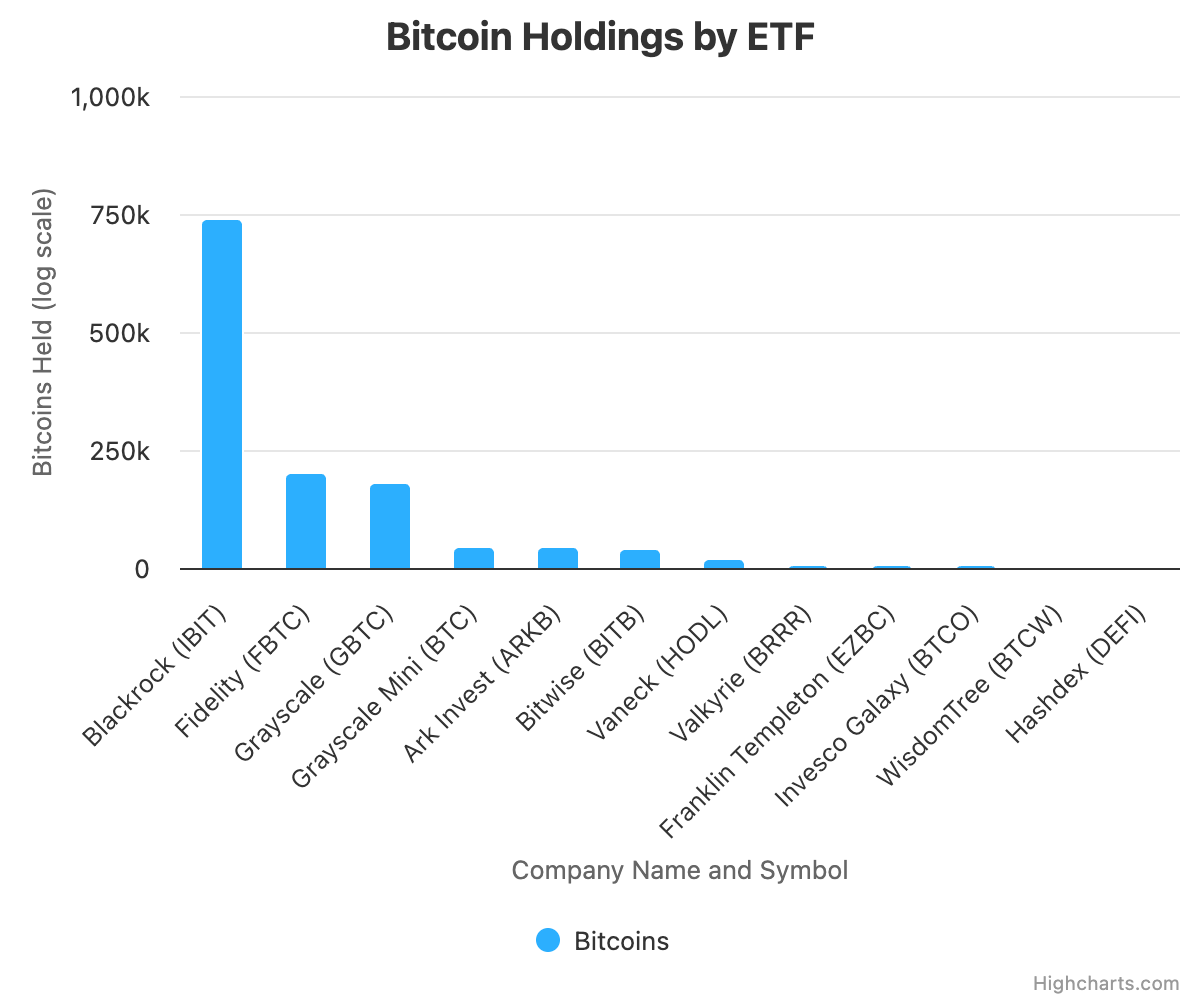

IBIT now holds a substantial portion of all bitcoin ETF assets in the U.S. and has become the second-largest holder of Bitcoin globally, only trailing the holdings of Bitcoin founder Satoshi Nakamoto. Bitcoin ETFs as a whole now hold just over 7% of the total bitcoin supply.

The latest round of 13-F filing reveals a broader trend of institutional convergence on Bitcoin ETFs, with over 1300 institutional holders of IBIT alone.

The State of Michigan pension fund, for example, has NEAR tripled its investment in Bitcoin ETFs. Earlier this year, Mubadala Investment, a sovereign wealth fund from Abu Dhabi, revealed holdings that topped over $500 million in Bitcoin-related funds as of Q1 2025, demonstrating an interest from traditionally conservative state-backed investors.

From investment banks like Goldman Sachs to hedge funds like Millennium Management and Citadel Advisors, this participation is a significant indicator of how institutions view Bitcoin as a viable, long-term asset, a fundamental change in perception for the asset class.

The accessibility and regulatory clarity provided by the new ETFs have been instrumental in opening the door for these significant institutional investments, allowing large-scale funds to gain exposure without the complexities of direct cryptocurrency ownership and custody.

Bitcoin price surged past $120,000 this morning, coming within arm's length of its previous all-time high of $123, 091. It is currently trading at $122,170, according to CoinMarketCap data.

Stay ahead of the curve with the latest industry news on Blockhead’s Telegram channel!