Crypto at Crossroads: Fed Rate Cut Speculations Clash with 4% Treasury Baseline

Markets hold their breath as crypto braces for Fed's next move.

With Treasury yields anchoring at 4%, traders are gambling on rate cuts—but will the Fed play along?

The crypto-volatility cocktail: Mix one part monetary policy uncertainty with two parts institutional FOMO. Shaken, not stirred.

Meanwhile, traditional finance clings to its spreadsheets like a security blanket. Some things never change.

The rally in cryptocurrencies was snatched away by Friday's weak jobs report, and attacks on the Federal Reserve are reducing investors' appetite for risk.

Investors currently view the likelihood of a 25-basis-point rate cut from the Fed in September as an 80 percent chance.

Governor Adriana Kugler announced her resignation this weekend, effective 8 August, ahead of her term's scheduled conclusion next January.

The departure opens the door for President Donald TRUMP to appoint a successor who may lean towards a more accommodating stance—a role that could eventually pave the way for a new chair to take over from Jerome Powell when his term concludes next May.

A prior substitution for Kugler could potentially introduce an additional dissenting voice to the Fed's existing position of maintaining rates, thereby increasing the internal pressure on Powell.

It will be insightful to gather perspectives from other Fed members regarding the jobs report. This Wednesday and Thursday, we will be hearing insights from FOMC voters, including Susan Collins, Lisa Cook, and Alberto Musalem.

Trump is advocating for lower interest rates. Reaching that goal will necessitate navigating challenges that are more significant than those posed by Powell.

Current structural dynamics are influencing borrowing costs, and the trend is upward.

Entities are accumulating debt to finance tax reductions, defense expenditures, and advancements in artificial intelligence—resulting in an increased appetite for credit.

With the retirement of the Baby Boomers and the decoupling of China from the US, the available resources to support those loans are diminishing.

Individuals who allocate their resources are concerned about the erosion of the value of their financial assets due to the influence of a central authority driven by political motives.

With credit and liquidity shrinking, the appetite for alternative investments rests purely on how much investors want to stay invested in cryptos.

This period of extreme uncertainty about the US economy amidst Trump's trade rhetoric, which is finally showing up in inflation, will test the Fed and cryptos equally.

The question of whether a forced rate cut WOULD really boost digital assets has become prominent.

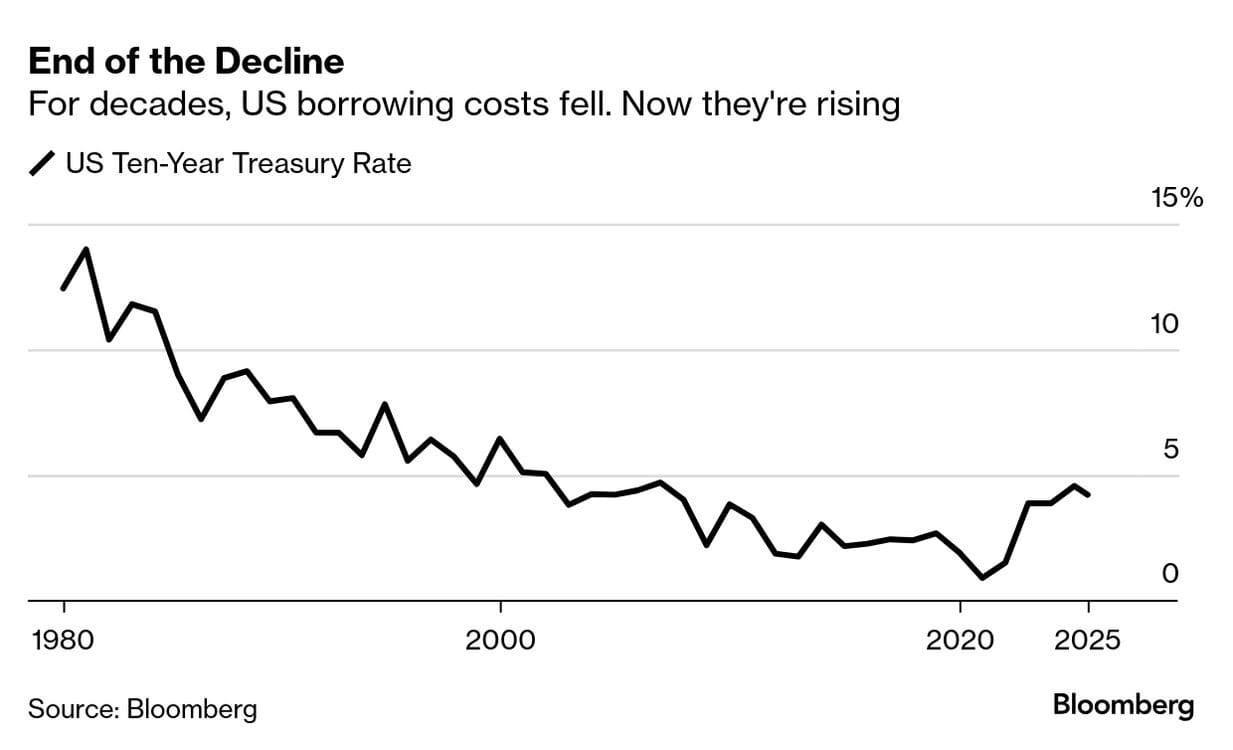

When considering all these factors collectively, it suggests a scenario where a 4 percent yield could become the standard for benchmark ten-year Treasuries.

This rate is vital for determining mortgage costs and corporate bond pricing, and it aligns with the objectives outlined by Trump's team to reduce it.

Analysts indicate a greater probability of trending above that figure rather than below it.

For the largest economy globally, this signifies a challenging shift.

For over thirty years, declining borrowing costs have transformed the entire environment.

Washington has the potential to accumulate a growing level of debt while maintaining balanced financial statements.

Low-cost capital has significantly boosted the performance of the US housing, equity, and crypto markets.

The situation has shifted dramatically, with the US now confronting a scenario where interest payments exceed defense expenditures, while higher mortgage rates exert downward pressure on home values.

Examining the fluctuations of the cycle reveals a more profound rationale at play.

The cost of capital, similar to any other cost, is determined by the equilibrium between supply and demand.

An increase in the availability of savings leads to a decline in rates. Increased demand leads to a rise.

In economics literature, the cost of capital that equilibrates the availability of savings with the appetite for investment, while maintaining robust employment levels and controlling inflation, is referred to as the natural rate of interest.

For over thirty years, spanning from the early 1980s to the mid-2010s, there was a decline. Currently, it is on an upward trajectory.

That is the biggest risk for the Fed and cryptos.

For now, though, the Fed would need to look at the latest jobs figures and the economic hit from tariffs even as it navigates the price pressures.

For cryptos, a stagflation scenario seems to be a bigger risk than a significant economic slowdown or even an outright recession.

Cryptos need the boost from Fed rate cuts, and the rally so far since last year has been tied to lower rates.

However, with the prospect of long-term rates looking at a higher trajectory despite Fed cuts priced in, the path of least resistance for a boost to cryptos remains in balance.

Several leading firms on Wall Street are advising their clients to brace for a significant market downturn as equities trade NEAR record highs and collide with disappointing US economic data.

About fifteen percent is the average bet among Wall Street analysts.

The S&P 500 Index may see a temporary drop as a result of the worsening economic forecast, according to Morgan Stanley, Deutsche Bank, and Evercore.

All eyes are on the growing list of consequences for President Trump's trade war, which includes falling consumer spending, slower economic growth, higher unemployment, and the chance of further inflationary pressures.

Following the tumultuous events driven by data and tariffs on Friday, dip buyers emerged on Monday to provide support.

Due to the heightened pressure on consumer expenditure and corporate financial health stemming from recent policies, strategist Mike Wilson from Morgan Stanley anticipates a 10 percent decline this quarter.

Julian Emanuel from Evercore anticipates a sharper decline of as much as 15 percent.

Considering the current market dynamics, it is becoming increasingly clear that a modest pullback in equities is not only anticipated but perhaps even warranted, especially in light of their recent performance.

Furthermore, it's August, and one should understand the implications of this month.

Historically, the S&P 500 has shown a tendency to underperform in August and September, with an average loss of 0.7% in each of these months, contrasting with an average gain of 1.1% during other months.

All those points to pain for cryptos too.

Even as cryptos have behaved as a hedge during times of uncertainty from tariffs, macro-related downside risks suggest plenty of risks for digital assets.

Stay ahead of the curve. Click here to join the Blockhead community on Telegram today.Elsewhere

Crypto Curiosity Meets Caution: Navigating Singapore’s Digital Asset Journey SafelySingapore’s crypto revolution is here—but only those choosing regulated, trusted platforms will thrive safely.![]()

![]()

![]()

![]()

![]()

![]()

Blockcast

In this episode, we dive into the world of crypto payments with Joey Isaacson, CEO and co-founder of Joey Isaacson shares his journey from working at tech giants like Facebook and Uber to entering the crypto space through Coinbase. He discusses the challenges and opportunities in making crypto accessible to the masses, focusing on simplifying DeFi lending and the importance of user-friendly design.

Access the episode from your preferred podcast platform here.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama. Previous episodes of Blockcast can be found here, with guests like Kapil Duman (Quranium), Eric van Miltenburg (Ripple), Davide Menegaldo (Neon EVM), Jeremy Tan (Singapore parliament candidate), Alex Ryvkin (Rho), Hassan Ahmed (Coinbase), Sota Watanabe (Startale), Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

![]()

Blockhead is a media partner of Coinfest Asia 2025. Get 20% off tickets using the code at https://coinfest.asia/tickets.