Metaplanet Moonwalks Past Skeptics as Tokyo Firm Becomes Bitcoin Whale

Move over, MicroStrategy—Japan’s Metaplanet just pulled a corporate treasury power move by stacking Bitcoin like a Wall Street degen. Shares surged 20% as the firm announced its $240M BTC purchase, joining the top 0.1% of holders worldwide.

Bullish or reckless? The market’s voting with its wallet while traditional finance analysts clutch their risk management manuals. One Goldman Sachs alum quipped: ’Nothing hedges against yen weakness like a volatile crypto bet—what could go wrong?’

With this play, Metaplanet effectively turns its balance sheet into a leveraged Bitcoin ETF. Whether that’s visionary or desperate depends entirely on whether BTC hits $100K... or crashes back to $20K.

Japanese company Metaplanet is rapidly emerging as "Asia’s MicroStrategy," pursuing an aggressive Bitcoin (BTC) accumulation strategy that mirrors the approach of the well-known U.S.-based Strategy (formerly MicroStrategy).

On Monday, Metaplanet acquired an additional 1,004 BTC at an average price of JP¥15,134,304 per bitcoin ($104,180). This purchase, valued at approximately $104 million, brings Metaplanet’s total Bitcoin holdings to 7,800 BTC, currently valued at over $800 million. This acquisition follows two earlier purchases in May 2025, totaling 1,796 BTC. Metaplanet is now the 10th largest public company in terms of Bitcoin holdings, surpassing El Salvador’s national Bitcoin treasury. The company aims to hold 10,000 BTC by the end of 2025.

*Metaplanet Acquires Additional 1,004 $BTC* pic.twitter.com/r86rLc7ngh

— Metaplanet Inc. (@Metaplanet_JP) May 19, 2025Metaplanet’s Q1 FY2025 earnings report revealed strong performance, with revenues of $6 million, 88% of which was attributed to Bitcoin options trading. The company reported a BTC yield of 170% and a BTC gain of 2,996 BTC, as of May 12.

"Our results speak for themselves: we don’t set targets to feel safe—we set them to exceed them, quarter after quarter," Metaplanet said.

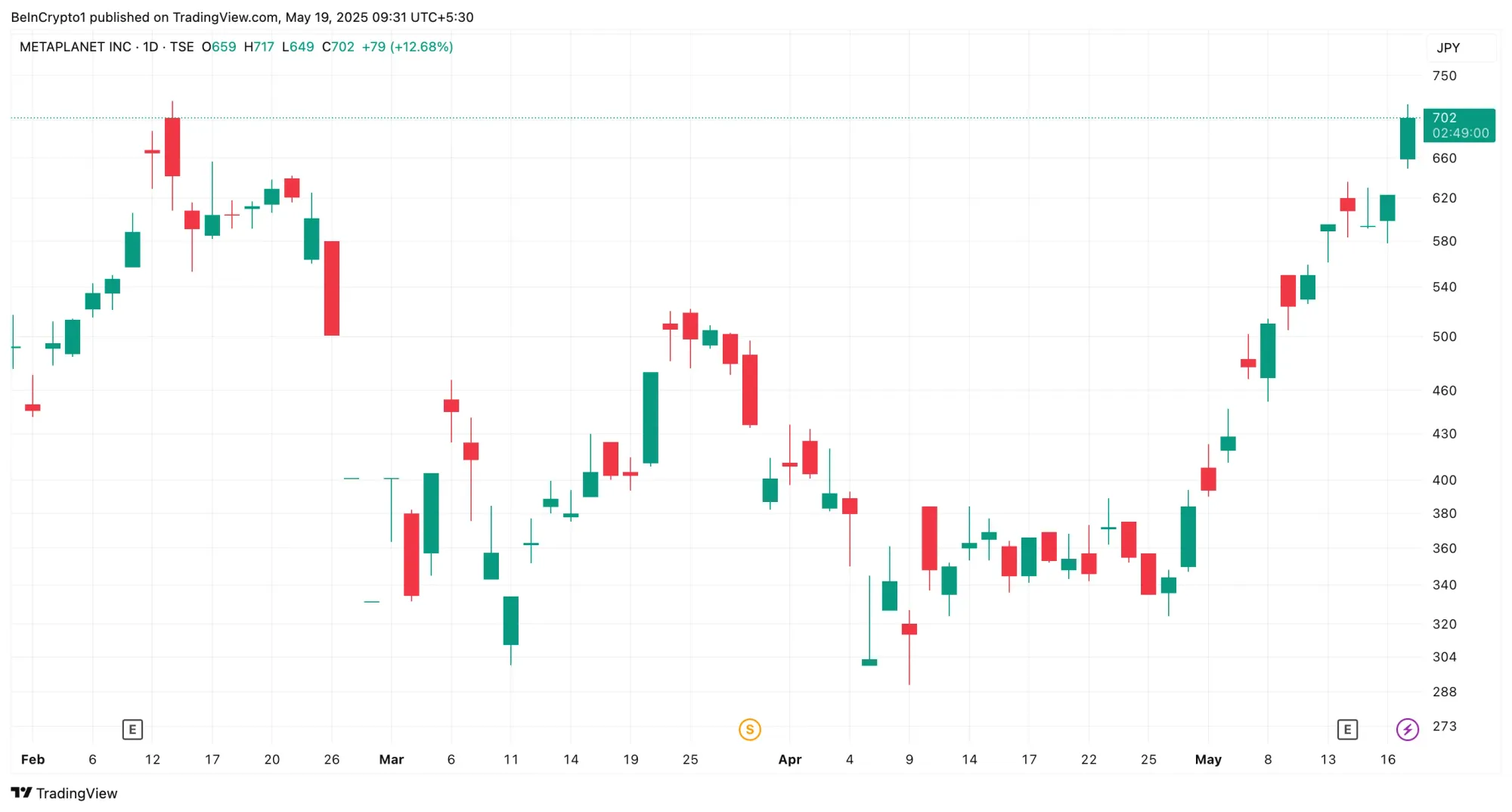

Metaplanet’s stock price (3350.T) has responded positively to these developments. Following the recent 1,004 BTC acquisition, the stock price surged to a three-month high, appreciating by 12.6%. At the time of reporting, the stock was trading at 684 yen ($4.72). Over the past month, the stock’s value has increased by 101.7%, driven by Bitcoin’s rally and Metaplanet’s Bitcoin-focused strategy. Since adopting this strategy, Metaplanet’s stock price has increased over 15-fold.

Metaplanet funds its Bitcoin purchases through the issuance of zero-coupon ordinary bonds. In May 2025, the company issued bonds worth $64.7 million. Metaplanet’s total investment in Bitcoin is approximately $712.5 million, with an average historical purchase price of 13.5 million yen per BTC, or roughly $91,343 per token.

Stay ahead of the curve. Join the Blockhead community on Telegram @blockheadco