Airdrops Aren’t Charity—They’re Warfare: 5 Make-or-Break Questions for Crypto Projects

Crypto’s favorite marketing tactic just got ruthless—are you playing to win or handing out free money like a VC’s kid at Burning Man?

The liquidity trap: Dropping tokens without a plan burns communities faster than a memecoin rug pull. See: 2023’s ’airdrop farmers’ who dumped $250M of tokens in under 72 hours.

Game theory or blind hope? Successful projects treat airdrops as smart contracts—not marketing confetti. Ethereum’s 2015 developer grant created a $400B ecosystem. Compare that to last year’s ’NFT loyalty drops’ now trading at 0.003 ETH.

The compliance timebomb: That ’decentralized’ airdrop? The SEC just labeled three of them unregistered securities offerings. Ask your lawyer before your community manager.

Real utility or token theater? Empty airdrops train users to beg for handouts—see the avalanche of ’wen token?’ tweets drowning every project’s announcements.

The mercenary math: If your airdrop budget exceeds your dev team’s runway, congratulations—you’ve invented a less efficient version of paid advertising.

Wake up: In 2025, airdrops aren’t growth hacks—they’re precision strikes. Get the strategy wrong, and you’re not acquiring users. You’re subsidizing the next degenerate trading farm.

Part 1 Recap: The Airdrop Economy

In Part 1: The Airdrop Economy, I explored how crypto projects use token airdrops to solve the critical "cold start problem" that plagues new platforms. I revealed that projects are now distributing up to 50% of their token supply to early users as a strategic method to bootstrap communities.

I examined how successful projects like Uniswap and ENS Leveraged strategic token distributions to build engaged communities and create aligned incentives between projects and users. Rather than traditional marketing approaches, I showed how these airdrops serve as a powerful mechanism for attracting initial users and creating network effects.

The Airdrop Economy: How Crypto Projects Bootstrap Communities & Solve the Cold Start ProblemWeb3 token airdrops solve the “cold start problem” by giving up to 50% of supply to early users. Learn how Uniswap, BONK, and others use strategic distributions to build communities and create aligned incentives.![]()

My key insights from Part 1 focused on:

- How airdrops function as a solution to the platform adoption challenge

- The scale of distributions (up to 50% of total supply)

- Case studies of successful implementations I analyzed (Uniswap, ENS, and others)

- The alignment of incentives between projects and early supporters through token ownership

I positioned airdrops not just as promotional tools, but as fundamental infrastructure for Web3 community building and user acquisition strategies.

Timeline Visualization

Airdrop HistoryThe Airdrop Economy: Strategic Questions Every Project Must Ask![]()

@sianliu https://dune.com/queries/5131292/8458890/

Introduction

Things have changed since the early days of airdrops. Simple token giveaways no longer work. Projects now face sell pressure and Sybil attacks. They must design better incentive structures. They need to be clear about their goals.

I’ve watched projects learn hard lessons. I don’t want to name any names. One project faced immediate sell-offs after their airdrop. One recipient dumped nearly 190,000 tokens, contributing to a price drop from $15 to under $13. Another project saw 40% of top recipients sell immediately. The price fell 39%.

But some projects got it right. ENS required governance participation during claims. This created instant community engagement. Optimism implemented multiple phases to sustain interest.

In this second part, I’ll share the strategic framework every project needs. I’ll cover the key questions about incentives. I’ll explain the ongoing battle against Sybil attacks. I’ll discuss why there’s no perfect solution.

The truth is, we’re in an evolutionary arms race. As detection improves, so do the attacks. The goal isn’t perfection. It’s making attacks unprofitable while keeping things simple for real users.

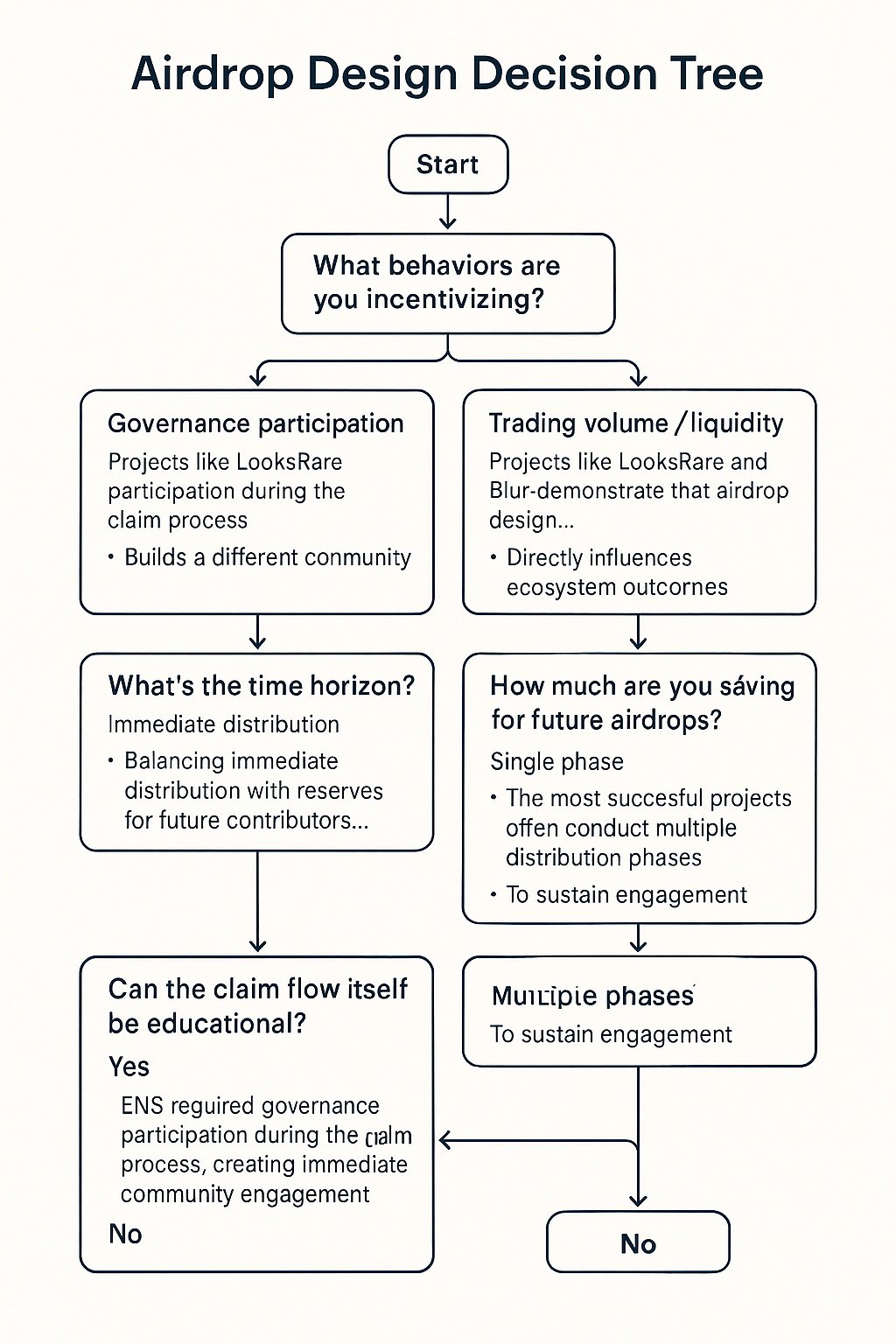

Based on these case studies and industry learnings, several key questions emerge that every project should consider before conducting an airdrop:

Listen to a16z’s "All about Airdrops" podcast episode for a DEEP dive.

The Sybil Resistance Challenge

The Problem

As airdrops grow more valuable, Sybil attacks have become a critical threat. Attackers create multiple wallets to farm rewards unfairly.

Past airdrops highlight the need for Sybil resistance. For example, Aptos launched without strict anti-Sybil measures. One recipient sold nearly 190,000 APT on Binance. This contributed to a price drop from $15 to under $13.

Exclusive: Aptos suddenly released an airdrop without strict anti-sybil attack, which led to some people getting a lot of airdrop tokens. Someone selling 189,567 APT directly on binance, resulting in the APT price from $15 to less than $13. pic.twitter.com/sE71UzRnSC

— Wu Blockchain (@WuBlockchain) October 19, 2022After zkSync’s airdrop, 40% of top recipients sold immediately. This correlated with a 39% price decline.

These cases provide educational insights on token distribution. They show why projects now implement vesting periods and qualification requirements.

Sell Pressure Impact

Nature’s Parallel and Evolution of Defense Mechanisms

As mentioned by Andrew Hall in the a16z panel discussion on airdrops, the battle against Sybil attacks mirrors Batesian mimicry in nature. In this biological phenomenon, harmless species evolve to look like dangerous ones to fool predators and survive.

The crypto ecosystem demonstrates this same pattern. Sybil attackers (mimics) create multiple fake identities to appear as legitimate users (dangerous models). These attackers attempt to deceive distribution systems (predators) into treating them as genuine participants worthy of rewards.

Just as in nature, where mimicry drives the coevolution of species, each airdrop incident pushes projects to develop more sophisticated detection mechanisms.

Projects have evolved various defense strategies to combat these attacks:

| High Economic Barriers | Extended Vesting (Avalanche) 🟧 Discourages sell pressure via locked rewards | Proof-of-Personhood (Worldcoin) 🔵 Requires biometric or strong ID systems |

| Low Economic Barriers | Governance Participation (Optimism) 🟩 Requires small effort to engage but low cost | Points Systems (Pendle) 🟦 Needs infra for tracking and anti-sybil filtering Activity-Based Rewards (Meteora) 🟨 Tracks usage patterns over time |

- 🟧 Extended Vesting – High economic lock-in, low tech

- 🟩 Governance Participation – Light touch, minimal barrier

- 🔵 Proof-of-Personhood – Technically advanced, high barrier

- 🟦 Points Systems – Behavior tracking, higher infra cost

- 🟨 Activity-based Qualification – Time-based participation rewards

The most successful projects recognize this isn’t a battle that can be permanently won, but rather an ongoing evolutionary process requiring constant refinement of their defense mechanisms.

The Ideal Solution: A Two-Part Approach

Technical Defenses

Smart projects deploy:

- Machine learning to spot suspicious patterns

- Human reviewers to verify algorithmic flags

- Onchain analytics to track wallet behavior

Economic Design

Effective projects build:

- Incentives that make attacks unprofitable

- Verification systems requiring meaningful stake

- Community-owned detection mechanisms

The Evolutionary Reality

In my opinion, perfect Sybil resistance is a myth. Like predators and mimics in nature, this is an evolutionary arms race. The goal is making attacks economically irrational while keeping the experience positive for real users. As detection methods evolve, so will mimicry tactics. It will be an endless dance of adaptation.

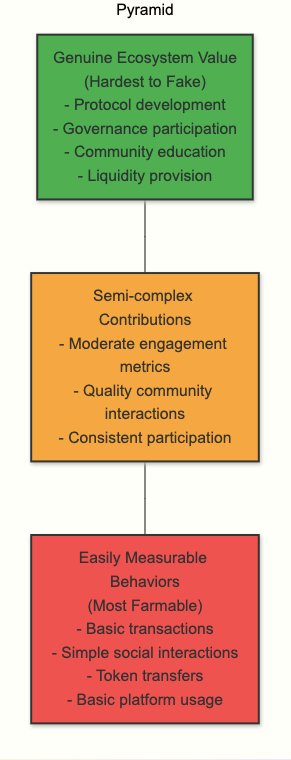

Are You Rewarding the Right Behavior?

Perhaps the most important question for any project planning an airdrop is: Are you rewarding behaviors that genuinely benefit your ecosystem?

If your criteria are easily measurable, they’re also easily copied and farmed. This creates a perpetual cat-and-mouse race between projects seeking authentic engagement and opportunistic participants.

From the projects I’ve observed, those that achieve lasting success have taken time to clearly define what constitutes valuable contributions to their ecosystem.

They have established concrete metrics around protocol development, liquidity provision, community education, or governance participation. This is done before designing their distribution mechanisms.

With these definitions established, they can then implement targeted incentives that reward genuine ecosystem participants.

As the market continues to evolve, projects that master this balance will likely see the strongest community retention and long-term growth.

In a space where ownership is increasingly distributed and community-driven, well-designed airdrops remain one of the most powerful tools for bootstrapping network effects and solving the cold start problem.

But like any powerful tool, their effectiveness ultimately depends on how thoughtfully they are wielded.

Further Reading & Listening

For those interested in learning more about innovative work in this space:

- All About Airdrops (a16z crypto podcast) - Comprehensive exploration of airdrop mechanics, challenges, and evolving best practices

- Gitcoin’s Community-Based Roadmap for Sybil Detection - Explores how GitcoinDAO is building community-centric detection processes

- World ID by Worldcoin - A digital proof-of-humanity solution for the internet

Elsewhere

Former CFTC Commissioner Mersinger to Lead US Crypto Lobby GroupThis appointment, effective June 2nd, comes at a pivotal moment as the regulatory landscape for digital assets in the United States faces a potential seismic shift.![]()

![]()

![]()

![]()

![]()

Blockcast

Rho Protocol addresses a critical gap in the crypto ecosystem. While traditional finance boasts the largest asset class in rates, the crypto market has largely overlooked its own unique and volatile interest rate dynamics, particularly perpetual funding rates. Listen to founder Alex Rvykin on our latest episode.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama. Previous episodes of Blockcast can be found here, with guests like Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.