Bold Bitcoin Bet: $1.42B BTC Haul Propels Obscure Strategy Past FAANG Stocks

While Wall Street hedgies twiddle thumbs waiting for ’the right entry point,’ some nameless quant shop just deployed a dump truck of institutional capital into Bitcoin—and their stock is smoking Silicon Valley’s darlings.

The numbers don’t lie:

That $1.42 billion BTC position now outperforms Meta, Apple, and Alphabet year-to-date. Guess those ’uncorrelated asset’ PowerPoint slides weren’t just consultant fluff after all.

Cynical take:

Meanwhile, three VPs at BlackRock are probably getting fired for missing this trade while obsessing over ETH ETF paperwork. The market rewards action, not 47-page compliance decks.

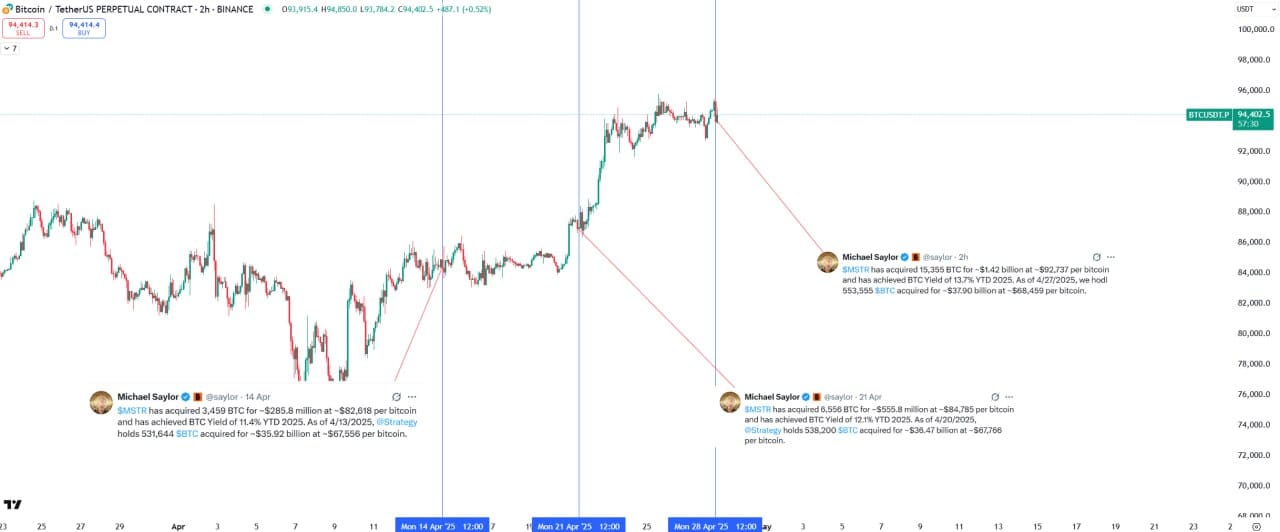

Strategy (MSTR), under the continued conviction of its chairman Michael Saylor, has further solidified its position as the leading corporate holder of Bitcoin, acquiring an additional 15,355 BTC for approximately $1.42 billion.

The purchase, executed at an average price of around $92,737 per bitcoin, was announced on April 28th. This latest acquisition brings Strategy’s total Bitcoin holdings to a staggering 553,555 BTC, acquired for roughly $37.90 billion at an average price of $68,459 per bitcoin.

When banks finally bless Bitcoin

and the experts agree it’s a good idea,

everyone will want to buy it,

no one will need to sell it,

and you won’t be able to afford it.

The company reported a year-to-date Bitcoin yield of 13.7% as of April 27, 2025, highlighting the profitability of its digital asset strategy amidst Bitcoin’s price appreciation. Currently trading around $94,725, Bitcoin has shown a modest 0.89% increase over the past 24 hours and a more significant 7.44% gain over the last week, per Coinmarketcap data.

CEO Michael Saylor, a vocal proponent of Bitcoin, has predicted the widespread adoption of Bitcoin within the traditional financial system, anticipating that banks will begin offering lending services against Bitcoin holdings. Saylor also foresees the U.S. government eventually holding Bitcoin as part of its reserves, major technology companies integrating Bitcoin into their platforms, and the seamless integration of Bitcoin into everyday devices like iPhones.

Interestingly, Strategy’s stock has significantly outperformed major tech companies and the broader market over the past three months. While MSTR has delivered a 6% return, giants like NVIDIA (-6%), the S&P 500 (-8%), Microsoft (-10%), and Google (-15%) have all experienced negative returns during the same period. This outperformance underscores investor confidence in MicroStrategy’s Bitcoin-centric strategy.

As of the latest trading data, MicroStrategy’s stock price stands at $369.25, marking a substantial increase of $80.98, or 28.09%, over the past month. This surge reflects the market’s positive reaction to both Bitcoin’s upward trajectory and Strategy’s aggressive accumulation strategy.

Stay ahead of the curve. Join the Blockhead community on Telegram @blockheadco