GameStop’s $528M Bitcoin Bet Defies $18.5M Loss — Top Crypto Presale & Treasury Hedge Picks Revealed

GameStop doubles down on digital gold—holding firm with half-billion Bitcoin reserves despite paper losses.

Bold Moves, Big Numbers

While traditional portfolios bleed, GameStop's crypto treasury strategy showcases institutional conviction. The $528 million Bitcoin position stands as a defiant hedge against conventional market wisdom—proving that sometimes the biggest risks yield the strongest statements.

Presale Power Plays

Emerging projects now mirror corporate treasury strategies, leveraging crypto presales for explosive entry points. Smart money bypasses traditional VC routes, capturing ground-floor opportunities before retail even hears the buzz.

Hedging Against Hedge Funds

Corporate treasuries increasingly allocate to crypto not just for diversification—but as a middle finger to inflationary monetary policies. Because nothing says 'financial revolution' like watching bankers sweat over your blockchain balance sheet.

Final Tally: While Wall Street analysts clutch their pearls over short-term losses, forward-thinking companies stack digital assets—turning volatility into strategic advantage. After all, in a world where monetary policy resembles a casino, sometimes you gotta play the house's game better than they do.

GameStop’s latest report shows $528M in Bitcoin holdings helping offset a tough quarter. At the same time, new altcoins likeare catching attention as top presale hedge picks.

GameStop’s Bitcoin Treasury Bet Pays Off

GameStop disclosed that itsearlier this year is now worth, giving the gaming firm a much-needed cushion during a difficult quarter. The unrealized gain of $28.6 million comes as bitcoin has risen about 18% since the acquisition of 4,710 BTC.

For the quarter ending August 2, 2025, GameStop reported a, which was an improvement compared to earlier losses. Net sales dropped to $674 million as hardware and software demand slowed, but collectibles sales surged 63%.

Partnerships with publishers and exclusive merchandise played a big role in helping balance weaker console and game sales.

GameStop now holds more than half a billion dollars in Bitcoin, a MOVE that positions it alongside other listed companies adding BTC to their treasury. By using Coinbase pricing to value its reserves, the firm has set itself up as part of a growing corporate trend treating Bitcoin as a.

GME Stock Sees Mixed Reaction

Following the report,and jumped as much as 7% after hours to $25.29. The company’s market cap now sits at, with an enterprise value of $6.28 billion.

Despite this short-term boost, GameStop’s stock has been largely flat over the past year. Shares slipped by 1.38%, and short interest remains high at 67.8 million shares, about 15% of total. The company has raised $270 million through convertible bonds and exited operations in Canada and France to cut costs. At the same time, it reported $6.1 billion in liquid assets excluding its Bitcoin stack.

The key takeaway for traders:, even as traditional sales face ongoing pressure.

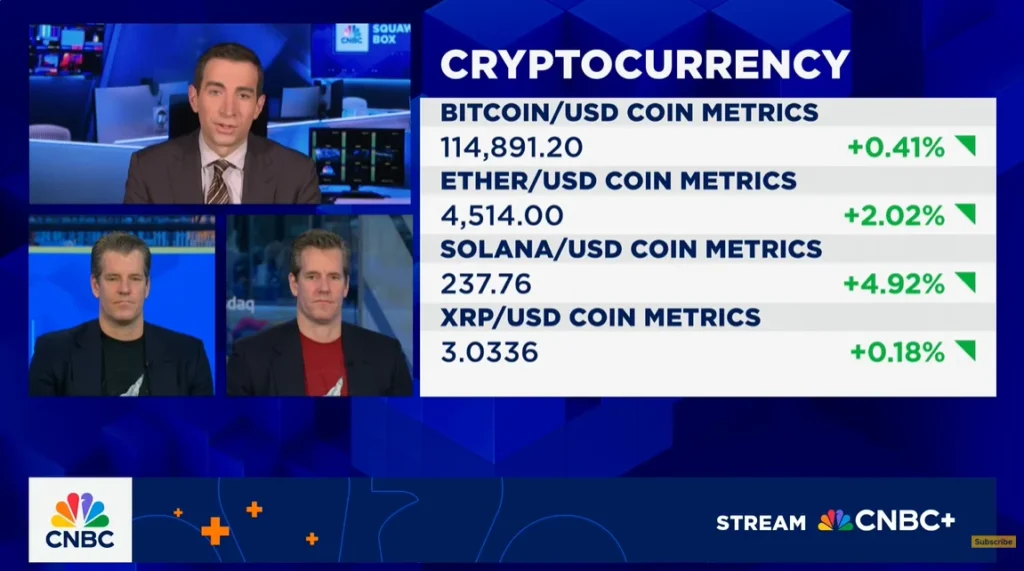

Winklevoss Twins See Bitcoin at $1M

Adding to the bullish backdrop,recently said Bitcoin could climb toin the coming years. Speaking on CNBC, the twins described Bitcoin as “modern-day gold” and argued that adoption is still in its early stages despite years of growth.

They explained that if Bitcoin disrupts Gold as a store of value, its price could easily rise tenfold from today’s levels. Cameron also highlighted Gemini’s expansion into more than 100 digital assets and collaborations with Nasdaq, while Tyler pointed out that Bitcoin’s halvings will continue to restrict supply.

The Winklevoss view aligns with others in the industry, including ARK Invest’s Cathie Wood and Coinbase CEO Brian Armstrong, both of whom have forecast million-dollar Bitcoin targets within the decade.

MAGACOIN FINANCE — Best Crypto Presale & Hedge Pick

While companies like GameStop lean on Bitcoin, new altcoins are emerging as.is one of the best presales in the market right now, with its price increasing hourly at this stage. Traders who diversify into undervalued assets like this can ride both Bitcoin’s rise and the upside of a fresh project.

It’s safe, fully audited, and preparing for listings soon. For a limited time, early buyers can claim a. This is the type of opportunity that only early adopters see — before wider exchange listings.

Final Takeaway

GameStop’s $528M Bitcoin bet shows how corporate treasuries are turning to crypto for stability. Traders looking for their own hedge can watch Bitcoin closely while also exploring new altcoins.

- Website: https://magacoinfinance.com

- X: https://x.com/magacoinfinance

- Telegram: https://t.me/magacoinfinance