Bitcoin News Today: $300K BTC Looms as Bollinger Bands Hit Extreme Levels - Analysts Declare ETH and MAGACOIN FINANCE Top Buys

Bollinger Bands scream extreme—Bitcoin's poised for a potential $300K surge as technical indicators flash their most bullish signal in years.

ETH and MAGACOIN FINANCE: The analyst picks

While Bitcoin's setup looks explosive, seasoned analysts are diverting attention to two standout altcoins. Ethereum's infrastructure dominance keeps attracting institutional flow—quietly becoming the backbone everyone uses but rarely praises. Meanwhile, MAGACOIN FINANCE rides political tailwinds with the subtlety of a meme coin but the traction of a movement. One fund manager quipped, 'It's like betting on red—but with extra zeros.'

Timing the top? Good luck with that.

Sure, everyone's a genius in a bull market—until the leverage flips. Crypto's not for the faint-hearted, but for those riding the wave, the charts are shouting louder than any skeptic.

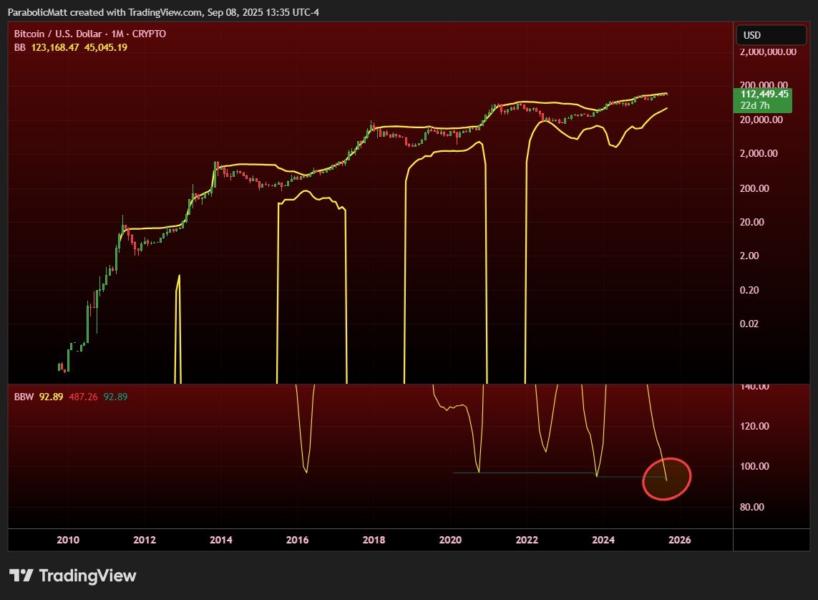

Bitcoin is entering one of the most pivotal technical phases in its history. On the, Bollinger Bands have contracted to their tightest range ever recorded, according to data shared this week by TradingView and Cointelegraph analysts. Previous periods of similar compression, such as in 2012, 2016, and 2020, all preceded massive rallies, with BTC multiplying by double- or triple-digit percentages in the following months. The current setup has prompted forecasts that Bitcoin could surge towardif the breakout mirrors earlier cycles.

This Optimism comes as Bitcoin continues to trade above, establishing firm support even amid short-term volatility. Institutional inflows into U.S.-listed Bitcoin ETFs remain positive, reinforcing the idea that large players are quietly positioning ahead of the move. Analysts argue that the combination of historical patterns, tightening supply, and favorable macro conditions provides the strongest bullish backdrop since 2020. And while Bitcoin dominates headlines, presale attention is shifting toward, a project gaining traction as one of the cycle’s most promising hidden gems.

Bitcoin’s volatility squeeze raises $300K potential

The mechanics behind this setup are straightforward yet powerful. Bollinger Bands measure volatility by plotting two standard deviations around a moving average. When they contract heavily, it indicates extreme consolidation, a precursor to sharp directional moves. With BTC’s Bands now at their narrowest point ever, traders believe a breakout is imminent.

Some analysts point toas the first upside target, followed by potential extensions towardif momentum accelerates. The bullish case is further supported by declining exchange reserves, showing that long-term holders are withdrawing BTC to cold storage rather than selling. This pattern, historically, has signaled confidence before major price expansions. On the downside, failure to hold support near $110,000 could trigger short-term dips, but many argue these WOULD simply offer accumulation opportunities in the broader bullish structure.

Presales rarely achieve the balance of credibility and cultural firepower that drives explosive adoption, but analysts say MAGACOIN FINANCE

What has really ignited momentum is the, which grants early investors. This incentive is creating urgency across Telegram and X groups, sparking competition between retail buyers and whales for allocations. Many now describe MAGACOIN FINANCE as more than a meme project – it’s being positioned as a, the kind of setup that could deliver returns reminiscent of Ethereum’s earliest days. Forecasts ofare already circulating, and analysts warn it may not stay under the radar much longer.

Ethereum adds strength to the breakout setup

Ethereum is also reinforcing the bullish case for the broader market. ETH has climbed above, driven by whale accumulation and falling exchange supply. If ETH can defend these levels and extend gains toward, it will further validate the risk-on environment for crypto assets. Analysts note that ethereum often acts as a secondary confirmation for Bitcoin’s trend, when ETH rallies in tandem, it amplifies confidence in the cycle’s strength.

Together, Bitcoin’s volatility squeeze, Ethereum’s accumulation trends, and presale momentum from MAGACOIN FINANCE are forming a trifecta that could define the next leg of the bull market. Each plays a different role: Bitcoin as the institutional anchor, Ethereum as the infrastructure powerhouse, and MAGACOIN FINANCE as the high-upside cultural play.

Risks and factors to monitor

Despite the bullish alignment, risks remain. Extreme Bollinger Band squeezes can trigger fake-outs before the true direction emerges. A short-term breakdown below $110,000 could unsettle traders even if long-term structure remains intact. Macro shocks, unexpected inflation spikes, rate hikes, or geopolitical tensions, could also curb risk appetite, slowing momentum.

For Ethereum, resistance around $4,800 will be crucial to clear convincingly. Failure there could cap upside temporarily.

Conclusion

Bitcoin’s Bollinger Bands are tighter than ever, signaling that an explosive MOVE is on the horizon. If history is any guide, BTC could push well beyond $125,000, with some models projecting as high as $300,000 in this cycle. Ethereum is showing strength of its own, building momentum toward $6,000–$9,000, while MAGACOIN FINANCE is capturing retail excitement as a presale that blends meme culture with audit-backed legitimacy and scarcity-driven design.

Together, these three represent different dimensions of opportunity, from institutional-scale security to cultural breakout potential. But what setsapart is that it is still at the ground floor, where exponential growth is possible. bitcoin and Ethereum already command trillion-dollar valuations, which limits their percentage upside. MAGACOIN FINANCE, by contrast, enters the market with scarcity, incentive-driven tokenomics, and cultural energy, giving it the unique ability to deliver the kind of outsized returns early ETH and DOGE investors once experienced. For investors looking ahead to 2025, the alignment may mark the beginning of crypto’s most powerful chapter yet.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance