As WLFI Freezes Wallets, Traders Flock To Unich’s Trustless Pre-Market

When centralized platforms pull the plug, decentralized alternatives shine—Unich's trustless pre-market just became traders' haven of choice.

The Great Migration

WLFI's sudden wallet freeze sent shockwaves through crypto circles—traders aren't just moving funds, they're abandoning the very concept of custodial control. Unich's non-custodial architecture suddenly looks less like an alternative and more like the only sane option.

Trustless by Design

No middlemen, no permission requirements, no sudden freezes. Unich's pre-market operates on pure code—if it's in the smart contract, it executes. Period. Traders get price discovery without begging for withdrawal approvals from some offshore 'foundation'.

The Irony of 'Security'

WLFI claimed the freeze was for 'user protection'—the same excuse banks used before crypto existed. Meanwhile, Unich's volume spikes 300% as traders vote with their wallets. Sometimes the safest place for your assets is where nobody can touch them but you.

Finance never changes—it just finds new ways to restrict your money while calling it innovation.

World Liberty Financial just showed crypto what happens when “decentralized” projects can freeze wallets at will. After blacklistingincluding Justin Sun’sholdings, the Trump-backed token crashedwhile investors watched helplessly. This drama pushed traders toward platforms where code, not company decisions, controls their assets – like Unich Pre-Market, where smart contracts handle everything and nobody can lock your funds.

WLFI’s Wallet Freeze Creates Trust Crisis in Crypto Trading

The whole mess started when WLFI’s compliance team decided to freeze hundreds of wallets, claiming they were protecting users from phishing attacks. Justin Sun, who droppedinto the project, found his tokens locked after moving justbetween his own wallets. He wasn’t selling, just doing what crypto holders do every day – moving funds around for security. But World Liberty Financial saw red flags and hit the freeze button.

The timing couldn’t be worse. WLFI had just launched trading aton Binance before tumbling to $within days. While the team burnedtokens trying to stop the bleeding, freezing major holders’ wallets only made things worse.

Bruno Skvorc from Polygon went public with his frustration after receiving an email that his wallet was flagged as “high risk” – after they’d already taken his money during the sale. He called it straight: “This is the new age mafia. There is no one to complain to, no one to argue with, no one to sue.”

I just got a reply from @worldlibertyfi. TLDR is, they stole my money, and because it's the @POTUS family, I can't do anything about it.

This is the new age mafia. There is no one to complain to, no one to argue with, no one to sue. It just… is. @zachxbt THIS is the scam of… pic.twitter.com/m6NP9VmHfd

What really stings is how arbitrary these freezes seem. Some wallets got blocked for being “8 hops away” from a risky address – like freezing your bank account because someone six degrees of separation from you might have done something sketchy. The crypto community noticed the hypocrisy immediately: if World Liberty Financial can freeze anyone’s tokens whenever they want, they’re no different from traditional banks.

This is exactly why traders are flocking to Unich Pre-Market, where smart contracts eliminate the middleman entirely – no compliance team can wake up and decide to freeze your assets.

Unich Pre-Market Proves Trustless Trading Works

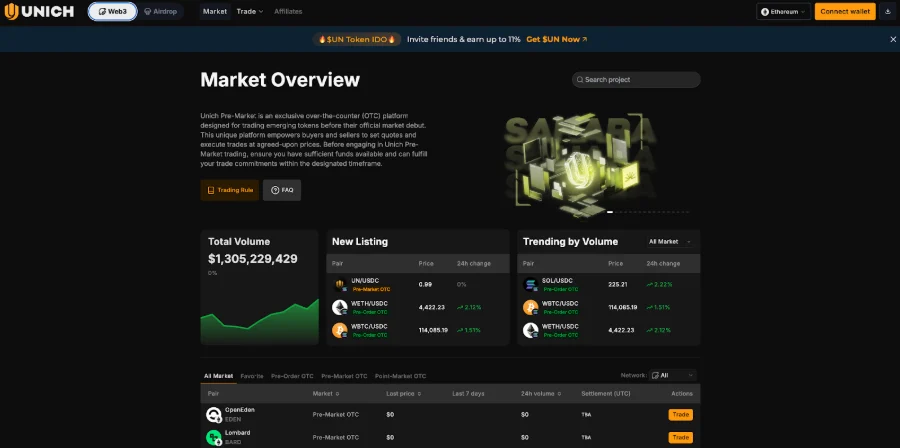

While WLFI investors begged for their tokens back, Unich Pre-Market kept processing trades the way crypto was meant to work – with zero ability to freeze anyone’s assets. The platform hitover six months by solving the exact trust problem WLFI just created.

The mechanics are refreshingly simple. When you trade pre-TGE tokens on Unich, both sides deposit funds that get held by code, not people. If someone tries to back out after token generation, the smart contract automatically compensates the other party. No compliance team making judgment calls, no sudden wallet freezes, just transparent rules enforced by blockchain.

Next Gen Pre-Market Hub for Web3 🪐

A convergence of innovative trading models – where people around the world can trade Pre TGE projects.

We’re driving innovation in DeFi and rolling it out on Unich. pic.twitter.com/O5ZyLiRjGF

What really sets Unich apart is their Cashout Order feature – traders can exit positions before TGE by transferring trades to other participants. You maintain control of your capital instead of being locked in until someone decides you’re allowed to MOVE your own money.

Ironically, WLFI itself was one of the biggest tokens on Unich Pre-Market before its TGE, generating over. This shows Unich enabled traders who saw WLFI’s potential to safely pre-buy and pre-sell the token before its TGE, without worrying about getting scammed or losing their deposits – exactly the kind of protection WLFI investors now wish they had.

🚨 NEW LISTING!$WLFI (World Liberty Financial) will be listed on #Unich Pre-Market OTC!

⏰ Trading starts: 11:00 AM, Jun 27 (UTC)

✨ Supported pairs: WLFI/USDT, WLFI/ETH

Join now 👉https://t.co/bitRX4UnLp

Based on community suggestions, we've decided to support the token… pic.twitter.com/vhNiLggyjL

Right now, Unich is offering those interested in the project a chance to join its journey through the Unich IDO, with $UN tokens starting at just. What’s notable is that $UN is already trading betweenon the Pre-Market – just below itsATH.

The 6x massive gap between IDO and Pre-Market prices also tells you everything – actual users who know the platform inside out are accumulating hard. It shows organic demand from daily users who bet the price will blast past that $0.99 once major exchanges list it.

With, early IDO participants are getting tokens at pre-public prices while the market has already shown where fair value sits.

Conclusion

WLFI’s wallet freeze controversy reveals a fundamental truth: calling something decentralized doesn’t make it so. When projects can freeze funds at will, they’re just traditional finance with extra steps. The exodus to platforms like Unich shows traders voting with their wallets for genuine trustless systems.

For those looking to be part of this shift, the ongoing Unich token sale offers a rare entry into infrastructure that’s already proven its worth – where your keys truly mean your coins, no exceptions.