Bitcoin Defies Gravity at $112K as Gold Shatters Records - Soars Past $3,500/oz in Historic Rally

Digital gold meets ancient gold in a spectacular showdown of store-of-value assets.

Bitcoin maintains its throne at the $112,000 level while traditional safe-haven gold achieves what many analysts called impossible—breaking through the $3,500 barrier with unstoppable momentum.

The Parallel Ascent

Two entirely different asset classes scream one unified message: institutional money seeks refuge from traditional finance's crumbling foundations. Bitcoin's algorithmic scarcity mirrors gold's physical limitations, creating a perfect storm of value preservation.

Wall Street's worst nightmare unfolds as both digital and physical stores of value outperform their carefully constructed portfolios—proving once again that yesterday's safe bets become tomorrow's nostalgic memories.

While gold celebrates its new all-time high, Bitcoin's consolidation at six figures signals neither asset shows signs of slowing down. The real question isn't which to choose, but how much of both you can accumulate before the traditional finance crowd finally catches on.

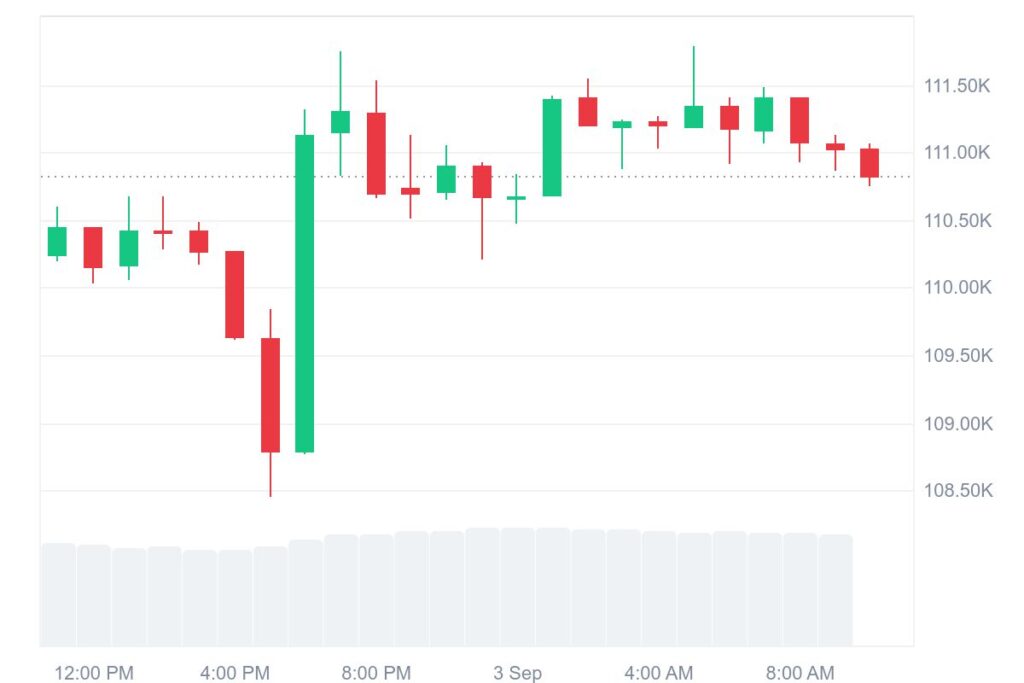

Bitcoin ($BTC), the leading cryptocurrency, is going through upside volatility when compared with gold. As the exclusive market data suggests, Bitcoin ($BTC) is moving toward the $112K mark, while gold has reached its new all-time highs above $3,500 per ounce at the start of September 2025.

In this respect, the gold’s remarkable price rally is leading toward a significant shift from the top crypto assets like bitcoin ($BTC) to the precious metal. Additionally, amid the wider political and economic uncertainties, the crypto traders are investing their funds into gold.

Gold Surges Above $3,500, Fueling Bitcoin’s Jump Toward $112K

Based on the new market statistics, Bitcoin ($BTC) is spiking toward $!12,000, parallel to gold’s surge above $3,500 per ounce. Hence, gold’s market rally is driving Bitcoin’s upward volatility. Keeping this in view, the investors are tending toward gold amid the market-wide Optimism around the precious metal.

On the other hand, despite the gradual upward trajectory, Bitcoin ($BTC) still faces the concerns of a notable dip to the psychological $100K mark. Thus, in line with the on-chain data, the increased volatility highlights the potential of robust volatility around the $112K spot. However, Gold is making waves with increasing inflows.

Gold ETF Inflows Accelerate Amid Institutional and Retail Optimism

In addition to this, the breakout above $3,500 per ounce is substantially contributing to the unprecedented gold ETF purchases. In this respect, the retail and institutional investors looking for stability are shifting from Bitcoin ($BTC) to gold. Simultaneously, the September effect is also adding to the broader changing behavior in the market.

Overall, amid the volatility witnessed by the emerging projects such as the TRUMP family-led World Liberty Financial (WLFI) and the notable altcoins like $DOGE, Bitcoin’s ($BTC) is also facing risks. Hence, despite the momentary charge toward $112K, Bitcoin ($BTC) could still plunge to $100K while gold is making new records above $3,500.