LYS Labs Evolves from Data Provider to Global Automated Finance Operating System

LYS Labs launches ambitious bid to become the foundational layer for automated global finance—moving beyond data services to build the industry's first comprehensive operating system.

The Infrastructure Shift

Forget simple data analytics—LYS Labs now targets the entire automated finance stack. Their new platform handles everything from transaction processing to smart contract execution, positioning itself as the backbone for decentralized financial operations worldwide.

Automation at Scale

The system processes complex financial instruments autonomously—cutting settlement times from days to seconds while bypassing traditional intermediaries. It's designed to handle everything from simple payments to sophisticated derivatives without human intervention.

Global Integration Challenges

Making automated finance work across regulatory jurisdictions remains the ultimate test. The platform must navigate conflicting compliance requirements while maintaining its core promise of seamless cross-border operations—because nothing says 'global finance' like trying to please twenty different regulators simultaneously.

LYS Labs isn't just providing data anymore—they're building the rails for finance's automated future, whether traditional institutions are ready or not.

, the Web3 data infrastructure company building the intelligence LAYER for machine finance on Solana, today announced a series of significant milestones that underscore its rapid growth and adoption. The company is expanding its data capabilities and gearing up to introduce a new trading product on Solana, LYS Flash, aiming to optimize transaction execution.

LYS Labs recently announced its seed round with participation from Alchemy Ventures, Auros Global, and Frachtis, among others, expanded its ecosystem through integrations with, and joined theThe company has also launched new developer-facing initiatives that are already driving significant traction.

Phase 1 of LYS Development has been completed, with its ultra-low latency, structured solana data now available to the public. Additionally, its aggregated data is in testnet with a few selected partners.

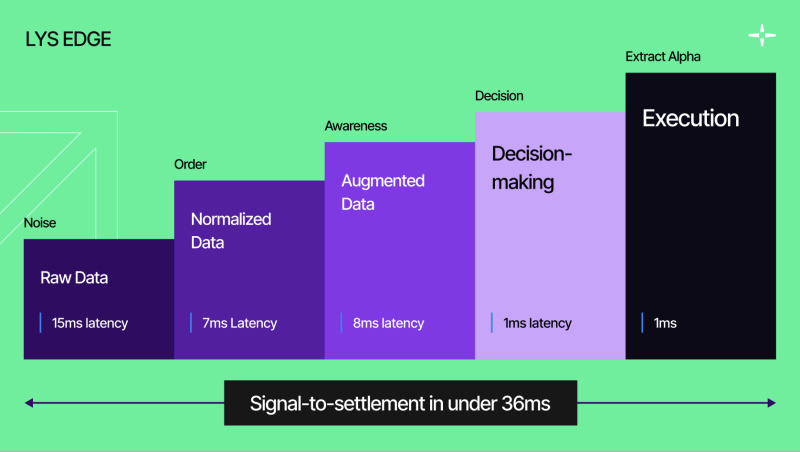

For Phase 2, LYS Labs will release a new product that complements its stack, aimed at Solana traders. Execution on Solana can be complex: every DEX has its own contract quirks, associated token account logic, and fee structures. Priority fees, bribes, and MEV protection require careful tuning to avoid failed transactions or suboptimal fills. LYS Flash smart relay engine abstracts this complexity away, enabling machines to get from signal to settlement in under 36 milliseconds.

As part of Phase 1, LYS Labs integrated with, where it now delivers structured Solana data with latency as low as 14 milliseconds. Traders and developers can access wallet flows, token insights, and liquidity events from Solana’s largest DEXes and launchpads likedirectly through the QuickNode Marketplace. This gives builders near-real-time access to event-driven data pipelines, closing the gap between analysis and execution.

LYS Labs is also joining the, a chainlink initiative focused on builders on SolanaBy collaborating with Chainlink, LYS Labs gains enhanced technical support, cryptoeconomic security, and access to new dApp integrations.

Andra Nicolau,commented: “We are very lucky to have such a great and supportive team at Chainlink Labs helping us accelerate our vision. We’ve only joined a few weeks ago, and we are already seeing massive value added through our collaboration with them. We have an exciting integration roadmap ahead and believe our synergies can change the game for their Solana efforts”.

The launch of theandhas generated strong early traction, with hundreds of developers gaining direct access to APIs, structured datasets, and community support. In its first month alone, LYS Labs recordeda strong signal of market demand for structured blockchain data on Solana. Demand for LYS Flash is also lining up.

LYS Labs co-founder,, a veteran builder who coded the original ethereum crowdsale contract in 2014 and later developed Ethstats.dev to make Ethereum’s state more transparent. Reflecting on his journey, Marian commented:

“We started off attempting to make Solana’s data usable. Given the large number of transactions per block, it is difficult for most users to access clean, useful data so we wanted to fix that as a first step. Organically, once you have near-instant alpha, the immediate thing you want to do is execute, which is why we are building LYS Flash, which can land transactions in 1ms, and users will be able to get from alpha to settlement in 36ms.”

LYS Labs’ mission is to become the. It’s stack transforms raw blockchain events into contextualized, AI-ready insights and optimizes execution, thus enabling traders, protocols, and autonomous agents to execute strategies at the speed of the chain. By delivering consistency, semantic structure, and reliability at scale, LYS Labs is laying the foundation for the next generation of programmable finance.

LYS Labs is building the operating system that powers automated global finance on Solana, featuring contextualized AI-ready insights and a smart execution engine.

Website: https://lyslabs.ai

Twitter: https://x.com/LYS_Labs

Blog: https://substack.com/@lyslabs

Press Contact: [email protected]

ContactThis article is not intended as financial advice. Educational purposes only.