ADA Price Prediction 2025: Technical Strength and Whale Activity Signal Potential Breakout

- What Do the Technical Indicators Reveal About ADA's Current Position?

- Why Are Whales Suddenly Interested in Cardano Again?

- How Does Cardano's Development Roadmap Support Price Growth?

- Can Cardano Maintain Its Top 10 Position Through 2030?

- What Are the Key Factors Influencing ADA's Price in 2025?

- Is Now a Good Time to Invest in ADA?

- ADA Price Prediction: Frequently Asked Questions

Cardano (ADA) is showing all the classic signs of a major breakout as we head into Q4 2025. Trading comfortably above key moving averages with strong whale accumulation patterns, the cryptocurrency appears poised for significant movement. Our analysis combines technical indicators from TradingView with on-chain data showing large holder activity mirroring previous successful breakout scenarios. With the Cardano ecosystem entering its crucial Voltaire governance phase and implementing Hydra scaling solutions, fundamental developments support the bullish technical picture. This could be ADA's moment to shine - but will it deliver?

What Do the Technical Indicators Reveal About ADA's Current Position?

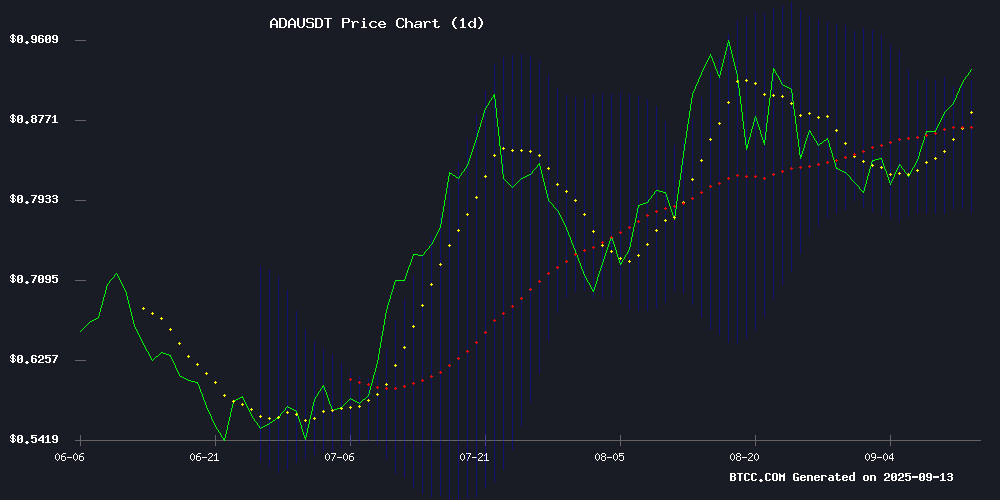

As of September 13, 2025, ADA is trading at $0.9259, comfortably above its 20-day moving average of $0.84955 according to TradingView data. The MACD indicator shows positive momentum with a reading of 0.000045, though the signal line at 0.021376 suggests we might see some consolidation before the next leg up. The price currently sits above the middle Bollinger Band at $0.84955, with the upper band providing resistance NEAR $0.91765.

In my experience watching ADA's price action over the years, this setup often precedes significant moves. The slight negative MACD histogram at -0.021332 might worry some traders, but remember - we're still in positive territory overall. It's like when your car's gas light comes on but you know you've got another 50 miles in the tank.

Why Are Whales Suddenly Interested in Cardano Again?

Santiment data reveals a fascinating trend - addresses holding 10M+ ADA increased their holdings by 1% this week to 18.79B tokens. That's not pocket change, even for crypto whales. Derivatives markets echo this sentiment, with open interest nearing its all-time high at $1.83B. We've seen over 16 whale transactions exceeding $1M each in the past month alone.

What's particularly interesting is how this mirrors Solana's accumulation pattern before its parabolic MOVE earlier this year. The similarities are striking - both in terms of technical setup and whale behavior. It's like watching a rerun of your favorite sports match, except this time you might actually profit from knowing how it ends.

How Does Cardano's Development Roadmap Support Price Growth?

Cardano enters 2025 at a pivotal moment in its development. The Basho era's Layer-2 Hydra solution promises throughput of 1,000 transactions per second per "head" - finally addressing those pesky scalability concerns that have dogged the project. Meanwhile, the upcoming Voltaire era will enhance decentralized governance, giving ADA holders real decision-making power.

From my perspective, what makes cardano unique is its academic rigor. While other projects move fast and break things (sometimes literally), Cardano's team takes the "measure twice, cut once" approach. It might not be as exciting as some newer projects, but in crypto, slow and steady often wins the race.

Can Cardano Maintain Its Top 10 Position Through 2030?

This is the billion-dollar question (literally). Cardano has maintained a top-tier market position since its 2017 launch, but the competition is fiercer than ever. The rise of presale tokens like MAGACOIN FINANCE shows the market's appetite for quick returns, while established players continue innovating.

What gives me confidence in Cardano's staying power is its real-world adoption. We're seeing serious DeFi applications and identity solutions built on Cardano, particularly in emerging markets. That's the kind of utility that sustains value long-term, beyond just speculative trading.

What Are the Key Factors Influencing ADA's Price in 2025?

| Factor | Impact | Current Status |

|---|---|---|

| Technical Indicators | Bullish | Price above 20-day MA, positive MACD |

| Whale Activity | Strong Accumulation | 1% increase in large holder balances |

| Development Progress | Positive | Hydra scaling and Voltaire governance underway |

| Market Sentiment | Improving | Open interest near ATH |

The convergence of these factors creates what I like to call a "perfect storm" scenario for ADA. When technicals, fundamentals, and market sentiment align like this, big moves often follow. Of course, in crypto, nothing's guaranteed - but the setup looks promising.

Is Now a Good Time to Invest in ADA?

This article does not constitute investment advice. That said, based on the current technical setup and fundamental developments, ADA presents an interesting opportunity. The cryptocurrency is trading above key moving averages with positive momentum, while institutional interest appears to be growing.

If you're considering ADA, think about your time horizon. Short-term traders might watch for a break above that $0.91765 resistance, while long-term holders might focus on Cardano's governance upgrades and scaling solutions. Personally, I'm keeping an eye on how the Hydra implementation progresses - successful scaling could be a real game-changer.

ADA Price Prediction: Frequently Asked Questions

What is the current price prediction for ADA in 2025?

While precise predictions are impossible, the current technical setup suggests ADA could test higher resistance levels if the bullish momentum continues. The $0.91765 level appears to be the next significant hurdle based on Bollinger Band analysis.

Why are whales accumulating ADA now?

Large holders appear to be positioning themselves ahead of Cardano's governance upgrades and scaling solutions. The accumulation pattern mirrors previous successful breakout scenarios in similar assets.

How does Cardano's development compare to competitors?

Cardano takes a more methodical, research-driven approach compared to many competitors. While this means slower feature rollouts, it often results in more stable and secure implementations.

What are the risks of investing in ADA?

Like all cryptocurrencies, ADA carries significant volatility risk. Additionally, delays in roadmap execution or failure of scaling solutions to deliver expected performance could negatively impact price.

Where can I trade ADA?

ADA is available on numerous cryptocurrency exchanges including BTCC, Binance, and Coinbase. Always conduct your own research before selecting a trading platform.