Ethereum Price Prediction 2025: Bullish Signals and $6K Target as Whales Accumulate

- Why Is Ethereum Price Rising?

- Institutional Money Flooding Into ETH

- Technical Analysis: The Path to $6,000

- Ecosystem Developments Supporting Price

- Potential Risks to Consider

- Is Ethereum a Good Investment Now?

- Ethereum Price Prediction FAQ

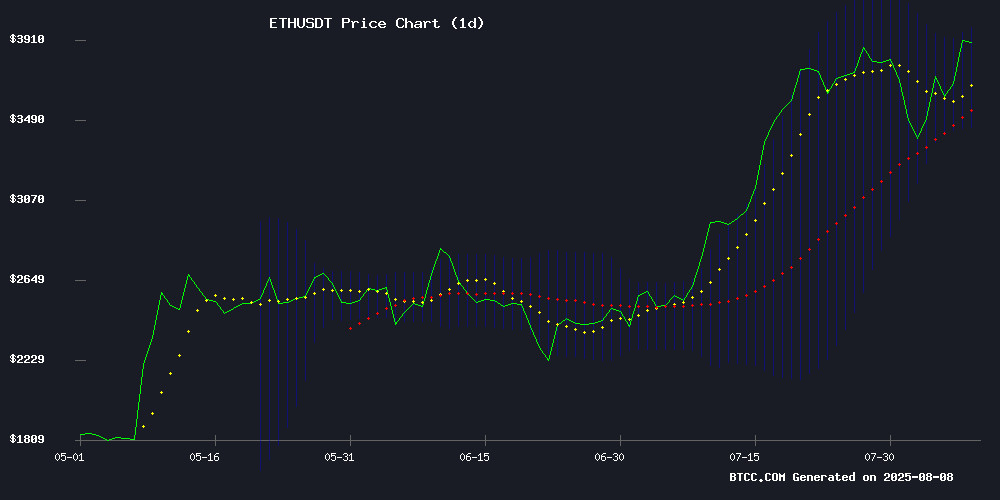

Ethereum (ETH) is showing strong bullish momentum in August 2025, trading above key technical indicators at $3,890 with institutional inflows and whale activity signaling potential for a rally to $6,000+. The cryptocurrency has rebounded 8% this week despite traditional August weakness, with on-chain metrics and Elliott Wave Theory suggesting further upside. Here's our comprehensive analysis of ETH's current position and future prospects.

Why Is Ethereum Price Rising?

ETH has been one of the best-performing large-cap assets in 2025, currently trading at $3,890.25 - well above its 20-day moving average of $3,711.78. The MACD shows positive divergence at 126.7022, while the price flirts with the upper Bollinger Band at $3,973.70. In my experience, when ETH holds above these levels during Asian trading hours, it often signals continued strength.

Institutional Money Flooding Into ETH

Corporate ETH holdings skyrocketed 127.7% in July alone to 2.7 million ETH, now representing nearly half of all ETF-held Ethereum. A mysterious whale recently accumulated $123 million worth of ETH, while daily transactions hit 1.87 million - the second-highest in Ethereum's history. As one BTCC analyst noted, "This isn't retail FOMO - it's smart money positioning for the next leg up."

Technical Analysis: The Path to $6,000

Elliott Wave projections suggest ETH could be setting up for a major move. The recent dip to $3,510 aligned perfectly with the 76.4% retracement level, and the subsequent bounce to $3,941 validated the W-v target zone. Current trading suggests we're in gray W-iii of green W-5, which could propel ETH toward $4,525 before the $6,000 target comes into play.

| Indicator | Value | Implication |

|---|---|---|

| 20-day MA | $3,711.78 | Bullish above |

| Upper Bollinger | $3,973.70 | Resistance level |

| MACD | 126.7022 | Positive momentum |

Ecosystem Developments Supporting Price

The Caldera-EigenCloud partnership integrating EigenDA V2 promises 100 MB/s throughput for rollups - addressing Ethereum's scalability challenges. Meanwhile, regulatory clarity from the U.S. GENIUS Act has boosted confidence, with ethereum processing over $50 billion in stablecoin transactions last week alone. These fundamentals suggest ETH's rally has substance beyond speculation.

Potential Risks to Consider

Not all signals are positive - ETH futures recently saw $418 million in net taker volume imbalance, the second-largest daily sell-side pressure in history. August's historical weakness (60% negative closes over past decade) also warrants caution, though 2025 has bucked seasonal trends so far.

Is Ethereum a Good Investment Now?

Based on current technicals and fundamentals, ETH appears positioned for continued growth. The combination of institutional adoption, technical strength, and ecosystem development creates a compelling case. However, as with any cryptocurrency investment, volatility remains high and positions should be sized accordingly.

Ethereum Price Prediction FAQ

What is the Ethereum price prediction for 2025?

Technical analysis suggests ETH could reach $6,000+ in 2025 based on Elliott Wave projections and current momentum. The cryptocurrency has already shown unusual strength in typically weak August markets.

Why is Ethereum price going up?

ETH is rising due to institutional inflows, whale accumulation, positive technical indicators, and strong ecosystem developments like the Caldera-EigenCloud partnership improving scalability.

Is Ethereum a good investment?

ETH shows strong fundamentals and technicals, making it an attractive investment for those comfortable with crypto volatility. However, this article does not constitute investment advice.

What is Ethereum's current price?

As of August 8, 2025, Ethereum is trading at $3,890.25 on major exchanges like BTCC, above its key 20-day moving average support.

How high can Ethereum go?

Elliott Wave Theory suggests intermediate targets around $4,525 before potential movement toward $6,000, though market conditions can change rapidly.