Bitcoin Price Prediction 2025: Why $111K Support Retest Could Spark Next Bull Run

- Is Bitcoin's Pullback to $111K Inevitable?

- Why Are Institutions Buying This Dip?

- Market Turbulence: Geopolitics Meets Leveraged Liquidations

- Is Now the Time to Buy Bitcoin?

- Bitcoin Price Prediction FAQs

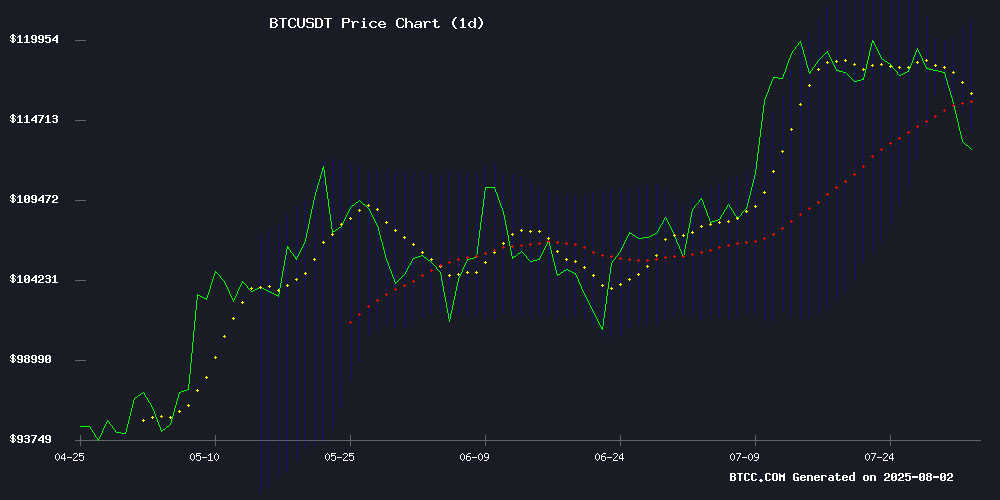

Source: BTCC

Source: BTCC

Bitcoin's recent price action has traders on edge as BTC tests critical support levels. Currently trading at $113,906, the cryptocurrency faces a crucial juncture that could determine its trajectory for the coming weeks. This analysis examines the technical indicators, market sentiment, and institutional developments shaping Bitcoin's path forward.

Is Bitcoin's Pullback to $111K Inevitable?

The charts tell a compelling story - bitcoin currently trades below its 20-day moving average ($117,732), signaling near-term bearish pressure. However, the MACD histogram (showing +2006.8) reveals bullish divergence despite negative signal lines. "This looks like healthy profit-taking after the recent run-up," notes the BTCC research team. "The $111K support level has historically triggered institutional buying waves."

Bollinger Bands paint a clear picture of the current consolidation range:

| Indicator | Value | Implication |

|---|---|---|

| Upper Band | $121,058 | Resistance Level |

| Lower Band | $114,406 | Support Level |

| Price/20MA | -3.3% | Discount to Mean |

Why Are Institutions Buying This Dip?

While retail traders panic, smart money appears to be accumulating. Japanese firm Metaplanet's recent $3.7 billion shelf registration for Bitcoin purchases made waves across markets. "This is MicroStrategy-level commitment," observed one analyst. The move comes as Bitcoin's on-chain velocity hits decade lows - not a sign of weakness, but rather maturation as institutions treat BTC as digital gold.

The IMF's recent classification of Bitcoin as a "non-produced nonfinancial asset" in global economic statistics further validates this institutional adoption. Meanwhile, over 70% of Bitcoin supply hasn't moved in a year, creating unprecedented scarcity.

Market Turbulence: Geopolitics Meets Leveraged Liquidations

Bitcoin's drop below $115K wasn't purely technical. Geopolitical tensions flared as former U.S. President Trump's nuclear submarine repositioning comments rattled markets. The resulting $200 million in long liquidations compounded existing derivative market pressures - Binance alone saw $500 million in position unwinds.

Yet beneath the surface, intriguing dynamics emerge:

- Dormant 2010-era wallets moved 250 BTC ($29.6M), sparking sell-off fears

- Lightning Network capacity grew 400% since 2020

- WBTC on Ethereum surged 34% in 2025's first half

Is Now the Time to Buy Bitcoin?

The risk/reward calculus appears favorable for dollar-cost averaging:

- Price sits at a 3.3% discount to 20-day MA

- MACD shows bullish momentum building

- 70% of long-term holders increase positions below $115K

This article does not constitute investment advice.

Bitcoin Price Prediction FAQs

Why is Bitcoin testing $111K support?

Bitcoin's pullback reflects profit-taking after its recent rally, compounded by geopolitical tensions and Leveraged liquidations. The $111K level represents a key psychological and technical support zone where institutional buyers have historically entered.

How reliable is the $111K support level?

On-chain data shows strong accumulation at this level, with 70% of long-term holders adding to positions below $115K. The July 9-14 price surge left a "unrealized gap" in the $111K-$117K range that markets may need to fill.

What's driving institutional Bitcoin adoption?

Metaplanet's $3.7B BTC purchase plan and the IMF's formal recognition of Bitcoin in global economic statistics signal growing institutional acceptance. Declining on-chain velocity suggests institutions are treating BTC as long-term reserves rather than trading vehicles.

How does geopolitical risk affect Bitcoin?

While Bitcoin initially fell alongside traditional markets during recent tensions, its long-term correlation with geopolitical events remains complex. Some view BTC as a hedge, while others see it as a risk asset during initial shock periods.

What's the significance of dormant wallets moving?

The recent movement of 250 BTC from 2010-era wallets raised sell-off concerns, but such events often prove temporary. The bigger story remains institutional accumulation offsetting any retail selling pressure.